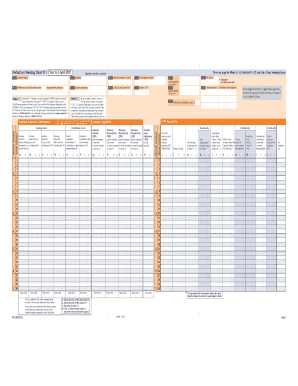

P11 Deductions Working Sheet Form

What is the P11 Deductions Working Sheet

The P11 deductions working sheet is a crucial document used primarily for calculating and reporting employee deductions in the United States. This form helps employers track various deductions such as federal income tax, Social Security, and Medicare contributions. It is essential for ensuring compliance with tax regulations and for accurately reporting employee earnings and deductions to the Internal Revenue Service (IRS).

How to use the P11 Deductions Working Sheet

Using the P11 deductions working sheet involves several steps to ensure accuracy in reporting. First, gather all necessary employee information, including names, Social Security numbers, and pay rates. Next, input the relevant data into the form, ensuring that all deductions are calculated based on current tax rates and regulations. Finally, review the completed sheet for accuracy before submitting it to the appropriate tax authorities.

Steps to complete the P11 Deductions Working Sheet

Completing the P11 deductions working sheet requires careful attention to detail. Follow these steps:

- Collect employee information, including personal and financial details.

- Determine applicable tax rates and deductions for each employee.

- Fill in the P11 deductions working sheet with accurate data.

- Double-check calculations to ensure compliance with IRS guidelines.

- Submit the completed form to the appropriate tax authority.

Key elements of the P11 Deductions Working Sheet

Several key elements are essential when filling out the P11 deductions working sheet. These include:

- Employee Information: Full name, Social Security number, and address.

- Income Details: Gross pay, bonuses, and other earnings.

- Deductions: Federal income tax, state tax, Social Security, and Medicare.

- Net Pay Calculation: Total earnings minus total deductions.

Legal use of the P11 Deductions Working Sheet

The P11 deductions working sheet must be completed in accordance with federal and state tax laws. It serves as an official record of employee deductions and is subject to audit by tax authorities. To ensure legal compliance, employers should maintain accurate records and submit the form by established deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the P11 deductions working sheet vary based on the specific tax year and the employer's reporting schedule. It is crucial for employers to be aware of these deadlines to avoid penalties. Generally, the form should be submitted annually, with specific dates outlined by the IRS for each tax year.

Quick guide on how to complete p11 deductions working sheet

Effortlessly Prepare P11 Deductions Working Sheet on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle P11 Deductions Working Sheet on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Edit and eSign P11 Deductions Working Sheet Seamlessly

- Acquire P11 Deductions Working Sheet and tap on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign P11 Deductions Working Sheet and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p11 deductions working sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the p11 deductions working sheet used for?

The p11 deductions working sheet is a crucial tool for employers to accurately calculate employees' deductions for tax purposes. It helps in organizing and summarizing various deductions, ensuring compliance with HMRC requirements. By utilizing this sheet, businesses can simplify their payroll processes and minimize errors.

-

How can airSlate SignNow assist with the p11 deductions working sheet?

airSlate SignNow provides an easy-to-use platform that allows businesses to manage and eSign the p11 deductions working sheet effortlessly. With our solution, you can upload, share, and securely sign your documents online, streamlining your payroll documentation. This not only saves time but also enhances collaboration among team members.

-

Is there a cost associated with using airSlate SignNow for the p11 deductions working sheet?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business sizes. Each plan includes features that support the handling of important documents, including the p11 deductions working sheet. Evaluate our pricing options to find the best fit for your organization's needs while ensuring compliance and efficiency.

-

What features does airSlate SignNow provide for managing the p11 deductions working sheet?

Our platform includes features such as customizable templates, real-time tracking, and secure electronic signatures that are ideal for managing the p11 deductions working sheet. You can also integrate with popular accounting tools to seamlessly import and export necessary data. These features enhance accuracy and simplify the deduction process.

-

Can I integrate airSlate SignNow with other accounting software for the p11 deductions working sheet?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll software, allowing for smooth data exchange related to your p11 deductions working sheet. This integration helps eliminate manual data entry and reduces the likelihood of errors, facilitating a more efficient workflow.

-

How does airSlate SignNow ensure the security of the p11 deductions working sheet?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption technologies to protect all documents, including the p11 deductions working sheet, during storage and transmission. We also comply with industry standards and regulations to ensure the confidentiality of your sensitive data.

-

What are the benefits of using airSlate SignNow for the p11 deductions working sheet?

Using airSlate SignNow for your p11 deductions working sheet brings numerous benefits, such as improved efficiency, reduced turnaround times, and enhanced accuracy in your payroll processes. Additionally, by digitizing your documentation, you can reduce the reliance on physical paperwork, making your operations more eco-friendly.

Get more for P11 Deductions Working Sheet

- State of michigan form tr 34 2007

- Dps for drug receipt 2010 form

- Minnesota cr h homestead form

- Financial worksheet form

- Mo dnr 780 1097 2007 form

- Kansas application for concealed carry handgun license 2013 form

- Norton correctional facility 2009 form

- Favn report form rabies antibody titer for export animals 2010

Find out other P11 Deductions Working Sheet

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free