Ifta Fuel Tax Preparation 2019

What is the IFTA Fuel Tax Preparation?

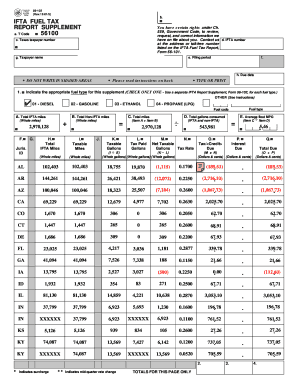

The IFTA Fuel Tax Preparation involves the process of calculating and reporting fuel taxes for commercial vehicles operating in multiple jurisdictions. The International Fuel Tax Agreement (IFTA) simplifies the reporting of fuel use by interstate carriers, allowing them to file a single quarterly fuel tax report instead of separate reports for each state. This preparation ensures compliance with state regulations and helps avoid penalties associated with fuel tax discrepancies.

Steps to Complete the IFTA Fuel Tax Preparation

Completing the IFTA Fuel Tax Preparation involves several key steps:

- Gather necessary documents: Collect all fuel purchase receipts, mileage logs, and any other relevant records for the reporting period.

- Calculate fuel usage: Determine the total gallons of fuel purchased and used in each jurisdiction where the vehicle operated.

- Record mileage: Document the total miles driven in each state or province to accurately report fuel consumption.

- Complete the IFTA report: Fill out the IFTA Fuel Tax Report Supplement, ensuring all calculations are accurate and reflect the gathered data.

- Review and submit: Double-check the report for errors and submit it to the appropriate state agency by the deadline.

Legal Use of the IFTA Fuel Tax Preparation

The IFTA Fuel Tax Preparation must adhere to specific legal requirements to be considered valid. Electronic submissions are acceptable, provided they comply with regulations set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Ensuring that all signatures are properly executed and that the report is filed within the designated time frame is crucial for legal compliance.

Required Documents for IFTA Fuel Tax Preparation

To successfully prepare the IFTA Fuel Tax Report, certain documents are essential:

- Fuel purchase receipts

- Mileage logs detailing the distance traveled in each jurisdiction

- Previous IFTA reports for reference

- Any additional state-specific forms that may be required

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IFTA Fuel Tax Report is vital for compliance. Typically, the reports are due quarterly, with specific deadlines falling on the last day of the month following the quarter's end. For example, reports for the first quarter are due by April 30, while those for the second quarter are due by July 31. Staying informed about these dates helps avoid late fees and penalties.

Form Submission Methods

The IFTA Fuel Tax Report can be submitted through various methods, including:

- Online submission: Many states offer electronic filing options that streamline the process.

- Mail: Paper forms can be mailed to the appropriate state agency.

- In-person: Some jurisdictions allow for direct submission at designated offices.

Quick guide on how to complete ifta fuel tax preparation

Effortlessly Complete Ifta Fuel Tax Preparation on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, update, and electronically sign your documents quickly without delays. Manage Ifta Fuel Tax Preparation on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Update and Electronically Sign Ifta Fuel Tax Preparation with Ease

- Obtain Ifta Fuel Tax Preparation and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require you to print new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ifta Fuel Tax Preparation and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta fuel tax preparation

Create this form in 5 minutes!

How to create an eSignature for the ifta fuel tax preparation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IFTA fuel tax report supplement?

The IFTA fuel tax report supplement is a document that provides additional details and calculations related to fuel taxes for commercial vehicles operating across state lines. This supplement helps ensure accurate reporting and compliance with state regulations, making it essential for trucking companies.

-

How does airSlate SignNow facilitate the IFTA fuel tax report supplement process?

airSlate SignNow streamlines the preparation and submission of the IFTA fuel tax report supplement by allowing users to easily fill out, sign, and send documents electronically. This not only saves time but also reduces errors associated with manual paperwork.

-

Is there a cost to use airSlate SignNow for IFTA fuel tax report supplement preparation?

Yes, airSlate SignNow offers various pricing plans tailored to accommodate businesses of different sizes. These plans are designed to provide a cost-effective solution for preparing and managing the IFTA fuel tax report supplement, ensuring that every business can find a plan that suits their needs.

-

What features does airSlate SignNow offer for managing the IFTA fuel tax report supplement?

Key features of airSlate SignNow include document eSigning, template creation for the IFTA fuel tax report supplement, and secure cloud storage. These features help streamline workflows and ensure that documents are processed quickly and efficiently.

-

Can airSlate SignNow integrate with other software for IFTA fuel tax report supplements?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and logistics platforms, making it easier to import data required for the IFTA fuel tax report supplement. This integration enhances productivity by minimizing manual data entry.

-

What benefits can businesses expect from using airSlate SignNow for IFTA fuel tax report supplements?

Businesses can benefit from increased accuracy, reduced turnaround time, and improved compliance when using airSlate SignNow for their IFTA fuel tax report supplements. The electronic signing feature also enhances the convenience of document management.

-

Is airSlate SignNow user-friendly for preparing the IFTA fuel tax report supplement?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to create and manage the IFTA fuel tax report supplement. The intuitive interface allows users to navigate the platform without extensive training.

Get more for Ifta Fuel Tax Preparation

- Uconn verification enrollment form

- Child care all states form

- Pharmacy technician certificate training program pima medical form

- Behavioral health discharge form

- Ethnicity hispaniclatino non hispaniclatino form

- 2019 20 student athlete health insurance idaho state athletics form

- Integrated home mail order pharmacy intro and form integrated home mail order pharmacy intro and form

- Metromac anesthesiology form

Find out other Ifta Fuel Tax Preparation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors