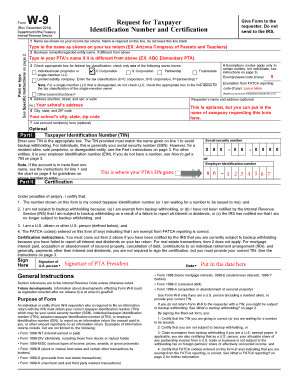

501c3 W9 Example Form

What is the 501c3 W-9 Example

The 501c3 W-9 example refers to the specific format of the W-9 form used by organizations classified under section 501(c)(3) of the Internal Revenue Code. This form is essential for non-profit organizations as it provides necessary taxpayer identification information to entities that are required to report payments made to the organization. It ensures that the non-profit is recognized as tax-exempt and allows donors to make tax-deductible contributions. The W-9 form collects details such as the organization’s name, address, and Employer Identification Number (EIN).

Steps to Complete the 501c3 W-9 Example

Completing the 501c3 W-9 example involves several straightforward steps:

- Begin by entering the legal name of the organization as registered with the IRS.

- Provide the organization’s business name if it differs from the legal name.

- Fill in the address where the organization is located, including city, state, and ZIP code.

- Include the Employer Identification Number (EIN), which is necessary for tax reporting.

- Indicate the type of entity by checking the appropriate box for a non-profit organization.

- Sign and date the form, certifying that the information provided is accurate.

Legal Use of the 501c3 W-9 Example

The legal use of the 501c3 W-9 example is crucial for compliance with IRS regulations. Non-profit organizations must ensure that the information on the W-9 is accurate and up to date. This form serves as a declaration of the organization’s tax-exempt status and is often requested by donors and grantors to verify eligibility for tax-deductible contributions. Failure to provide a correct W-9 can lead to withholding of payments and potential penalties from the IRS.

Key Elements of the 501c3 W-9 Example

Several key elements must be included in the 501c3 W-9 example to ensure its validity:

- Legal Name: The official name of the non-profit as recognized by the IRS.

- Business Name: Any other name under which the organization operates.

- Address: The complete mailing address of the organization.

- Employer Identification Number (EIN): A unique number assigned by the IRS for tax purposes.

- Entity Type: A checkbox indicating that the organization is a 501(c)(3) non-profit.

Examples of Using the 501c3 W-9 Example

Organizations typically use the 501c3 W-9 example in various scenarios:

- When applying for grants, funders often request a W-9 to confirm the organization’s tax status.

- Donors may require the W-9 to ensure their contributions are tax-deductible.

- Vendors providing services to the non-profit may ask for a W-9 to process payments correctly.

How to Obtain the 501c3 W-9 Example

Obtaining the 501c3 W-9 example is a straightforward process. Organizations can download the W-9 form directly from the IRS website. It is advisable to ensure that the version used is the most current one. Non-profits can also consult their accountants or tax professionals for assistance in completing the form accurately. Additionally, many non-profit associations provide templates specifically designed for 501(c)(3) organizations, which can be a helpful resource.

Quick guide on how to complete 501c3 w9 example

Easily Prepare 501c3 W9 Example on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle 501c3 W9 Example on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign 501c3 W9 Example Effortlessly

- Locate 501c3 W9 Example and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to missing or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 501c3 W9 Example and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 501c3 w9 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 501c3 W9 example?

A 501c3 W9 example is a specific template or format that nonprofit organizations use to fill out the IRS Form W-9. This form is essential for providing taxpayer information to other entities and demonstrates the organization's tax-exempt status. Utilizing a clear 501c3 W9 example ensures compliance and streamlines the documentation process.

-

How can airSlate SignNow assist with completing a 501c3 W9?

airSlate SignNow offers tools that simplify the process of completing a 501c3 W9. Our platform allows users to easily upload pre-existing templates or create new documents, ensuring that all required information is accurately included. This reduces errors and provides a seamless way to manage tax documentation for nonprofits.

-

Is there a cost associated with using airSlate SignNow for 501c3 W9 forms?

Yes, airSlate SignNow offers several pricing plans tailored to various business needs, including those of nonprofit organizations. These plans provide access to essential features for eSigning and document management, allowing users to effectively handle 501c3 W9 examples at a reasonable cost. Be sure to check our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing 501c3 W9 documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, collaboration tools, and cloud storage. These capabilities make it easy to create, distribute, and manage your 501c3 W9 examples effectively. Users can track document status and ensure all parties have completed the signing process.

-

Can I integrate airSlate SignNow with other software for managing 501c3 W9 forms?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing document management workflows. By integrating with platforms like Google Drive, Salesforce, and Zapier, users can automate processes related to their 501c3 W9 examples. This connectivity saves time and improves efficiency in handling nonprofit documentation.

-

What are the benefits of using airSlate SignNow for 501c3 organizations?

Using airSlate SignNow offers numerous benefits for 501c3 organizations, including improved efficiency, time savings, and enhanced compliance. With easy-to-use templates and straightforward eSigning capabilities, nonprofits can manage their 501c3 W9 examples quickly and securely. This ultimately helps organizations focus on their missions rather than paperwork.

-

How do I get started with airSlate SignNow for my 501c3 W9 needs?

Getting started with airSlate SignNow is simple. Visit our website, choose a pricing plan that suits your nonprofit, and sign up for an account. Once registered, you can easily access templates, create your 501c3 W9 example, and start sending documents for eSignature.

Get more for 501c3 W9 Example

- 5 940 pr form free to edit download ampamp printcocodoc

- 2021 form or 18 wc

- Wwwirsgovinstructionsi1099gigeneral instructions for certain information irs tax forms

- Form or 65 v oregon partnership return of income payment voucher 150 101 066

- Irs form 3921 kruze consulting

- 2022 form 1120 w worksheet estimated tax for corporations

- Fillable online see general information 2 fax email print

- Federal form 1041 t allocation of estimated tax payments

Find out other 501c3 W9 Example

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast