2022 Form 1120 W Worksheet Estimated Tax for Corporations 2022-2026

What is the 2018 Form 1120 W Worksheet Estimated Tax For Corporations

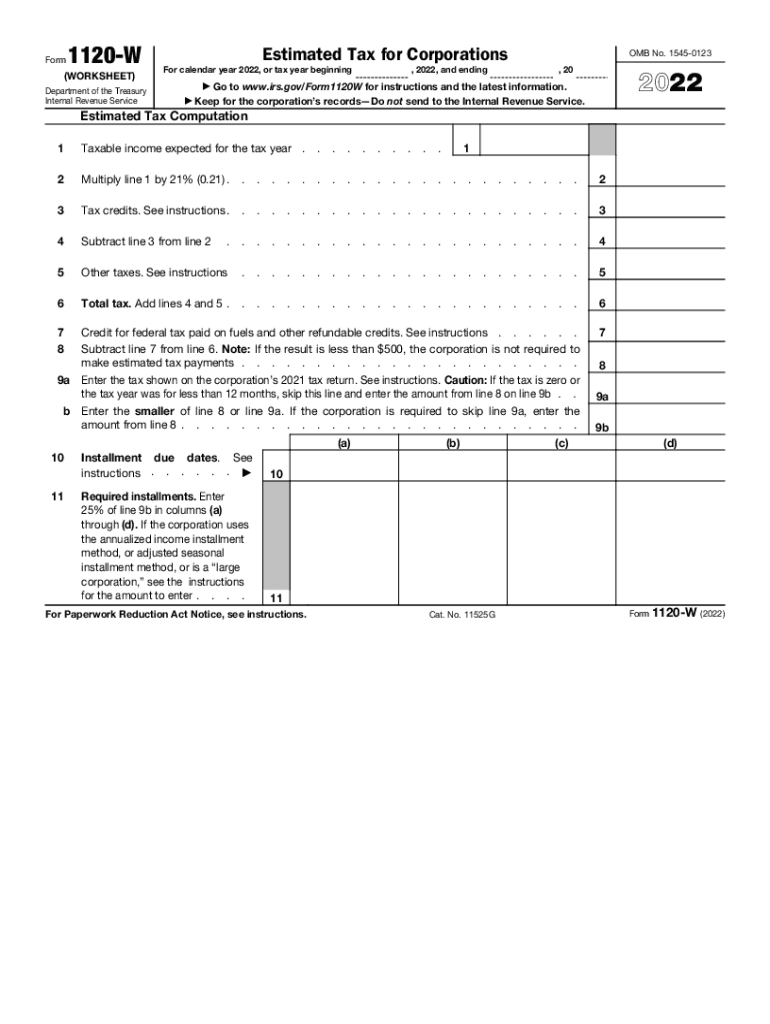

The 2018 Form 1120 W Worksheet is a crucial document used by corporations in the United States to calculate their estimated tax payments. This form is specifically designed for corporations that expect to owe tax of five hundred dollars or more when they file their return. The worksheet helps businesses determine their estimated tax liability based on their expected taxable income for the year. By accurately completing this form, corporations can ensure they meet their tax obligations and avoid potential penalties.

Steps to Complete the 2018 Form 1120 W Worksheet Estimated Tax For Corporations

Completing the 2018 Form 1120 W Worksheet involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements and expense reports, to estimate your taxable income.

- Calculate Taxable Income: Determine your corporation's expected taxable income for the year. This figure is essential for accurate calculations.

- Determine Tax Rate: Identify the applicable corporate tax rate based on your taxable income level. The tax rate can vary depending on the income bracket.

- Complete the Worksheet: Fill out the Form 1120 W Worksheet by following the provided instructions. Ensure all calculations are accurate.

- Review and Submit: Double-check your entries for accuracy before submitting the form. Keep a copy for your records.

Legal Use of the 2018 Form 1120 W Worksheet Estimated Tax For Corporations

The 2018 Form 1120 W Worksheet is legally binding when completed and submitted according to IRS guidelines. It is essential for corporations to use this form to report estimated tax payments accurately. Failure to file or underpayment can result in penalties and interest charges. By adhering to the legal requirements associated with this form, corporations can maintain compliance and avoid complications with the IRS.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines related to the 2018 Form 1120 W Worksheet. Generally, the estimated tax payments are due quarterly. The deadlines for these payments are:

- First payment: April 15, 2018

- Second payment: June 15, 2018

- Third payment: September 15, 2018

- Fourth payment: December 15, 2018

It is important for corporations to meet these deadlines to avoid penalties for late payments.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 2018 Form 1120 W Worksheet. These guidelines include instructions on how to calculate estimated tax payments, the importance of accurate reporting, and the implications of underpayment. Corporations should refer to the official IRS documentation for detailed instructions and updates regarding any changes in tax laws that may affect their filings.

Penalties for Non-Compliance

Non-compliance with the requirements of the 2018 Form 1120 W Worksheet can lead to significant penalties. Corporations that fail to file the form or underreport their estimated tax payments may face fines, interest on unpaid taxes, and potential audits. It is crucial for businesses to stay informed about their tax obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete 2022 form 1120 w worksheet estimated tax for corporations

Execute 2022 Form 1120 W Worksheet Estimated Tax For Corporations seamlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers a superb eco-conscious substitute for traditional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the resources you require to generate, modify, and eSign your documents swiftly without delays. Manage 2022 Form 1120 W Worksheet Estimated Tax For Corporations on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign 2022 Form 1120 W Worksheet Estimated Tax For Corporations effortlessly

- Locate 2022 Form 1120 W Worksheet Estimated Tax For Corporations and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign 2022 Form 1120 W Worksheet Estimated Tax For Corporations and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1120 w worksheet estimated tax for corporations

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 1120 w worksheet estimated tax for corporations

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1120 w 2024 form and how does airSlate SignNow simplify its submission?

The 1120 w 2024 form is used by corporations to report their income and tax liabilities. airSlate SignNow simplifies this process by allowing businesses to easily eSign and send the form securely, ensuring timely submissions and compliance with IRS regulations.

-

How can I integrate airSlate SignNow with my accounting software for 1120 w 2024?

airSlate SignNow offers seamless integrations with popular accounting software, enabling users to automate the filling and signing of the 1120 w 2024 form. This integration helps streamline the document workflow, reducing manual input and increasing efficiency for your business.

-

What are the pricing options for using airSlate SignNow for the 1120 w 2024 process?

airSlate SignNow provides flexible pricing plans tailored to meet different business needs. Each plan allows for the eSigning and submission of the 1120 w 2024 form, ensuring that companies can find a cost-effective solution that fits their budget.

-

What features does airSlate SignNow offer for managing 1120 w 2024 documents?

With airSlate SignNow, users benefit from features like document templates, eSignature tracking, and customizable workflows for the 1120 w 2024. These tools ensure that businesses can efficiently manage their tax documentation while maintaining compliance.

-

How does airSlate SignNow enhance security for the 1120 w 2024 form?

Security is a priority at airSlate SignNow, especially for sensitive documents like the 1120 w 2024 form. The platform utilizes advanced encryption and secure storage to protect your documents from unauthorized access and ensure your data remains confidential.

-

Can I access my signed 1120 w 2024 documents anytime with airSlate SignNow?

Yes, airSlate SignNow allows easy access to all signed documents, including the 1120 w 2024 forms, anytime and anywhere. This accessibility helps businesses stay organized and prepared for future tax reporting needs.

-

What benefits does airSlate SignNow provide for businesses filing the 1120 w 2024?

Using airSlate SignNow for the 1120 w 2024 brings numerous benefits, including time savings, reduced paperwork, and improved accuracy in documentation. By providing a streamlined workflow for eSigning and submission, businesses can focus more on their core operations.

Get more for 2022 Form 1120 W Worksheet Estimated Tax For Corporations

- Sale of a business package delaware form

- Legal documents for the guardian of a minor package delaware form

- New state resident package delaware form

- Delaware health care directive form

- Commercial property sales package delaware form

- Delaware advance directive form

- General partnership package delaware form

- Contract for deed package delaware form

Find out other 2022 Form 1120 W Worksheet Estimated Tax For Corporations

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment