5 940 Pr Form to Edit, Download & PrintCocoDoc 2021

Understanding the FUTA Tax and Form 940

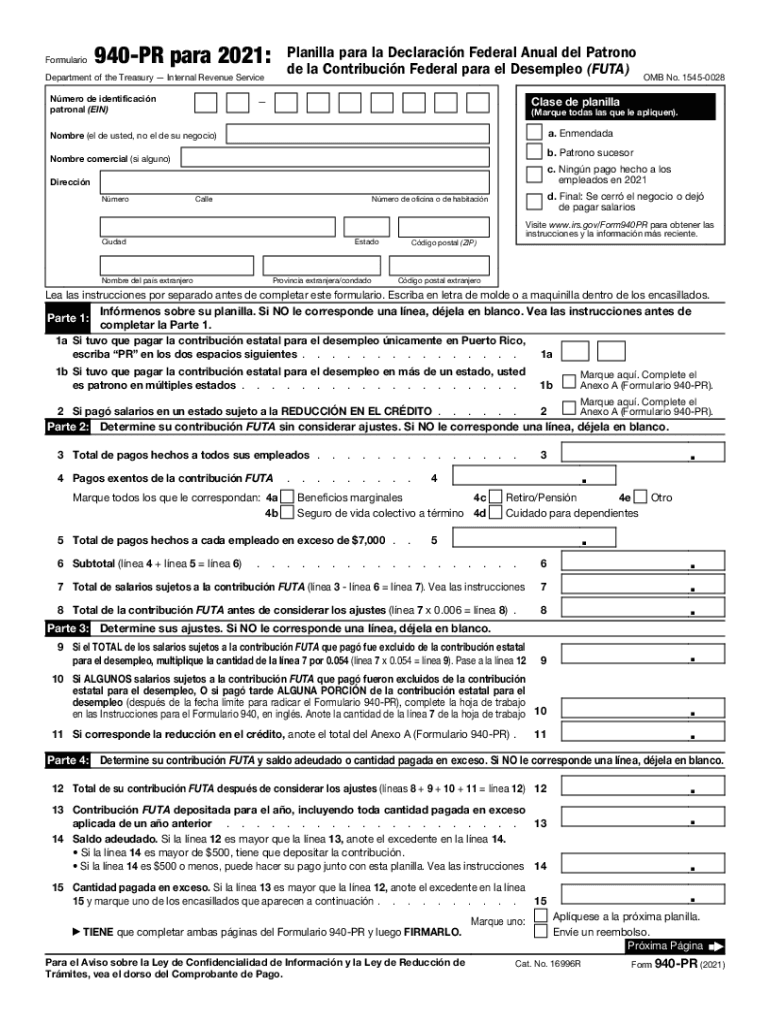

The Federal Unemployment Tax Act (FUTA) tax is a federal tax that employers pay to fund unemployment compensation. Employers use IRS Form 940 to report and pay this tax annually. The FUTA tax rate is typically six percent on the first seven thousand dollars of each employee's wages. However, most employers receive a credit of up to five point four percent when they pay state unemployment taxes, resulting in an effective rate of zero point six percent. Understanding this tax is essential for compliance and accurate reporting.

Steps to Complete IRS Form 940

Completing IRS Form 940 requires careful attention to detail. Here is a step-by-step guide to help you through the process:

- Gather necessary information, including your business details and employee wage records.

- Determine your total FUTA tax liability by calculating your taxable wages for the year.

- Complete the form by filling in all required fields, ensuring accuracy in your calculations.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the deadline, either electronically or via mail.

Filing Deadlines for Form 940

IRS Form 940 must be filed annually, with the deadline typically falling on January 31 of the following year. If you deposited all FUTA taxes when due, you may have until February 10 to file. It is crucial to adhere to these deadlines to avoid penalties and interest on late payments. Keeping track of these dates ensures compliance with federal regulations.

Penalties for Non-Compliance with FUTA Tax Regulations

Failure to comply with FUTA tax regulations can result in significant penalties. If you do not file Form 940 on time, the IRS may impose a penalty of five percent of the unpaid tax amount for each month the return is late. Additionally, failing to pay the tax owed can lead to further penalties and interest charges. Understanding these consequences emphasizes the importance of timely and accurate filing.

IRS Guidelines for FUTA Tax Reporting

The IRS provides specific guidelines for employers regarding FUTA tax reporting. Employers must report wages paid to employees and calculate the FUTA tax owed based on those wages. It's essential to maintain accurate records of employee wages and state unemployment taxes paid, as these records may be required for verification during audits. Familiarizing yourself with IRS guidelines ensures compliance and helps avoid potential issues.

Digital vs. Paper Version of Form 940

Employers have the option to file IRS Form 940 either digitally or on paper. Filing electronically is often more efficient, as it reduces the risk of errors and provides immediate confirmation of submission. On the other hand, paper filing may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensuring accuracy and compliance with submission guidelines is paramount.

Quick guide on how to complete 5 940 pr form free to edit download ampamp printcocodoc

Effortlessly Prepare 5 940 Pr Form To Edit, Download & PrintCocoDoc on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Handle 5 940 Pr Form To Edit, Download & PrintCocoDoc on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related workflow today.

Editing and eSigning 5 940 Pr Form To Edit, Download & PrintCocoDoc Made Easy

- Obtain 5 940 Pr Form To Edit, Download & PrintCocoDoc and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign 5 940 Pr Form To Edit, Download & PrintCocoDoc and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5 940 pr form free to edit download ampamp printcocodoc

Create this form in 5 minutes!

How to create an eSignature for the 5 940 pr form free to edit download ampamp printcocodoc

The way to make an e-signature for a PDF document in the online mode

The way to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the futa tax and how does it affect employers?

The futa tax is a federal tax that employers must pay to fund unemployment benefits. It affects employers by requiring them to contribute a percentage of their payroll to the federal unemployment system. Understanding the futa tax is crucial for compliance and financial planning.

-

How can airSlate SignNow help with managing futa tax documents?

airSlate SignNow provides a seamless way to eSign and manage documents related to the futa tax. With our solution, businesses can easily create, share, and store essential forms, ensuring that all pertinent information is organized and easily accessible. This streamlines the process of submitting necessary documentation to tax authorities.

-

What are the pricing plans for airSlate SignNow when dealing with futa tax filings?

airSlate SignNow offers various pricing plans tailored to different business needs, making it affordable for those managing futa tax filings. Our plans include features like eSigning and document management that enhance efficiency at a competitive price. Be sure to check our website for the latest pricing information and special offers.

-

Are there integrations available with other software for managing futa tax?

Yes, airSlate SignNow provides integrations with popular accounting and payroll software, which can help streamline the management of futa tax. By integrating with your existing systems, you can automate processes and reduce errors in document handling related to tax filings. This enhances productivity and compliance for your business.

-

What features make airSlate SignNow a good choice for handling futa tax documentation?

airSlate SignNow offers robust features like customizable templates, secure cloud storage, and advanced eSigning capabilities to help manage futa tax documentation efficiently. These tools simplify the process of preparing, signing, and storing important tax documents. With an intuitive user interface, even those new to eSigning can easily navigate the system.

-

How secure is airSlate SignNow for handling sensitive futa tax information?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive futa tax information. We implement industry-standard encryption and comply with regulations to keep your documents safe. You can trust that your data is protected while using our platform for eSigning and document management.

-

What are the benefits of using airSlate SignNow for small businesses dealing with futa tax?

For small businesses navigating futa tax, airSlate SignNow offers an affordable and user-friendly solution. The ability to eSign documents quickly can save time and reduce paperwork, allowing business owners to focus on growth. Furthermore, our platform enhances compliance and organization by ensuring that all tax-related documents are stored securely and easily retrievable.

Get more for 5 940 Pr Form To Edit, Download & PrintCocoDoc

- Final order for appointment of co guardians of the person and property delaware form

- Final order for appointment of guardians of the person delaware form

- Notice guardian form

- Notice of petition for appointment of guardians of the person delaware form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497302419 form

- Delaware annual statement 497302420 form

- Notices resolutions simple stock ledger and certificate delaware form

- Minutes organizational meeting form

Find out other 5 940 Pr Form To Edit, Download & PrintCocoDoc

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple