Federal Form 1041 T Allocation of Estimated Tax Payments 2021

What is the Federal Form 1041 T Allocation Of Estimated Tax Payments

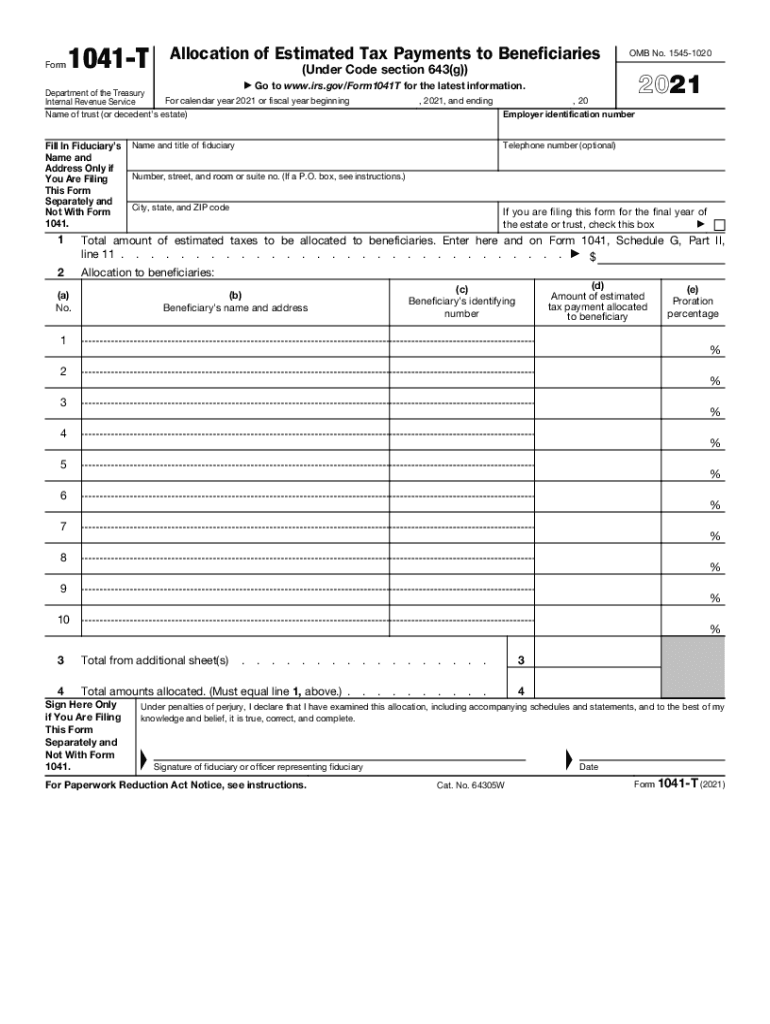

The Federal Form 1041 T is specifically designed for estates and trusts to allocate estimated tax payments among beneficiaries. This form allows fiduciaries to distribute the tax burden based on the income received by beneficiaries, ensuring that each party pays their fair share. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Federal Form 1041 T Allocation Of Estimated Tax Payments

To effectively use the Federal Form 1041 T, fiduciaries must first determine the total estimated tax payments made on behalf of the estate or trust. Next, they should identify the beneficiaries and the amounts each received. The form requires inputting these details to allocate the payments correctly. This process ensures that the tax obligations are proportionately shared, reflecting each beneficiary's income from the estate or trust.

Steps to complete the Federal Form 1041 T Allocation Of Estimated Tax Payments

Completing the Federal Form 1041 T involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Calculate the total estimated tax payments made for the tax year.

- Identify each beneficiary and the income they received from the estate or trust.

- Fill out the form by detailing the allocation of estimated tax payments based on the income distribution.

- Review the completed form for accuracy before submission.

Key elements of the Federal Form 1041 T Allocation Of Estimated Tax Payments

Several key elements are essential when dealing with the Federal Form 1041 T. These include:

- Beneficiary Information: Names and taxpayer identification numbers of all beneficiaries.

- Income Allocation: Detailed breakdown of income received by each beneficiary.

- Estimated Tax Payments: Total amount of estimated tax payments made on behalf of the estate or trust.

- Signature: The fiduciary must sign the form to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Federal Form 1041 T. It is essential to adhere to these guidelines to ensure compliance and avoid penalties. Key points include understanding the filing deadlines, ensuring accurate beneficiary allocations, and maintaining proper records of all transactions related to the estate or trust.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Form 1041 T typically align with the annual tax return deadlines for estates and trusts. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the due date is April fifteenth. It is crucial to be aware of these dates to avoid late filing penalties.

Quick guide on how to complete federal form 1041 t allocation of estimated tax payments

Prepare Federal Form 1041 T Allocation Of Estimated Tax Payments effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Federal Form 1041 T Allocation Of Estimated Tax Payments on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Federal Form 1041 T Allocation Of Estimated Tax Payments with ease

- Locate Federal Form 1041 T Allocation Of Estimated Tax Payments and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Federal Form 1041 T Allocation Of Estimated Tax Payments while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 1041 t allocation of estimated tax payments

Create this form in 5 minutes!

How to create an eSignature for the federal form 1041 t allocation of estimated tax payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 1041 t?

airSlate SignNow is a powerful electronic signature platform that simplifies the process of sending and eSigning documents, including forms related to 1041 t. It helps users efficiently manage their tax documents, ensuring compliance and accuracy while saving time and resources.

-

How much does airSlate SignNow cost for managing 1041 t documents?

airSlate SignNow offers competitive pricing plans to fit different needs, including those for handling 1041 t documents. You can select from various packages that provide access to essential features, making it a cost-effective solution for businesses seeking to streamline their document signing process.

-

What features does airSlate SignNow provide for 1041 t eSigning?

airSlate SignNow provides a range of features tailored for eSigning 1041 t documents, including templates, real-time tracking, and audit trails. These features ensure that every step of the signing process is transparent and compliant with regulatory standards.

-

Can I integrate airSlate SignNow with other software for processing 1041 t?

Yes, airSlate SignNow offers seamless integrations with various third-party applications that can enhance your workflow for processing 1041 t. These integrations allow you to connect with CRMs, cloud storage solutions, and more, ensuring a smooth document management experience.

-

What are the benefits of using airSlate SignNow for 1041 t documentation?

Using airSlate SignNow for 1041 t documentation provides numerous benefits, including improved efficiency, reduced manual errors, and enhanced collaboration. By streamlining the signing process, businesses can focus more on their core operations rather than getting bogged down by paperwork.

-

Is airSlate SignNow secure for handling sensitive 1041 t information?

Absolutely! airSlate SignNow employs robust security measures, such as encryption and secure storage, to protect sensitive 1041 t information. This enhances the confidence of your clients when sharing important documents, ensuring compliance with federal regulations.

-

How easy is it to use airSlate SignNow for eSigning 1041 t forms?

airSlate SignNow is designed with user-friendliness in mind, providing an intuitive interface for eSigning 1041 t forms. Users can easily upload, edit, and send documents for signature without any technical hurdles, making it accessible for everyone.

Get more for Federal Form 1041 T Allocation Of Estimated Tax Payments

- Employment interview package delaware form

- Employment employee personnel file package delaware form

- Assignment of mortgage package delaware form

- Assignment of lease package delaware form

- Delaware purchase agreement form

- Satisfaction cancellation or release of mortgage package delaware form

- Premarital agreements package delaware form

- Painting contractor package delaware form

Find out other Federal Form 1041 T Allocation Of Estimated Tax Payments

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form