Form 4891 2019

What is the Form 4891

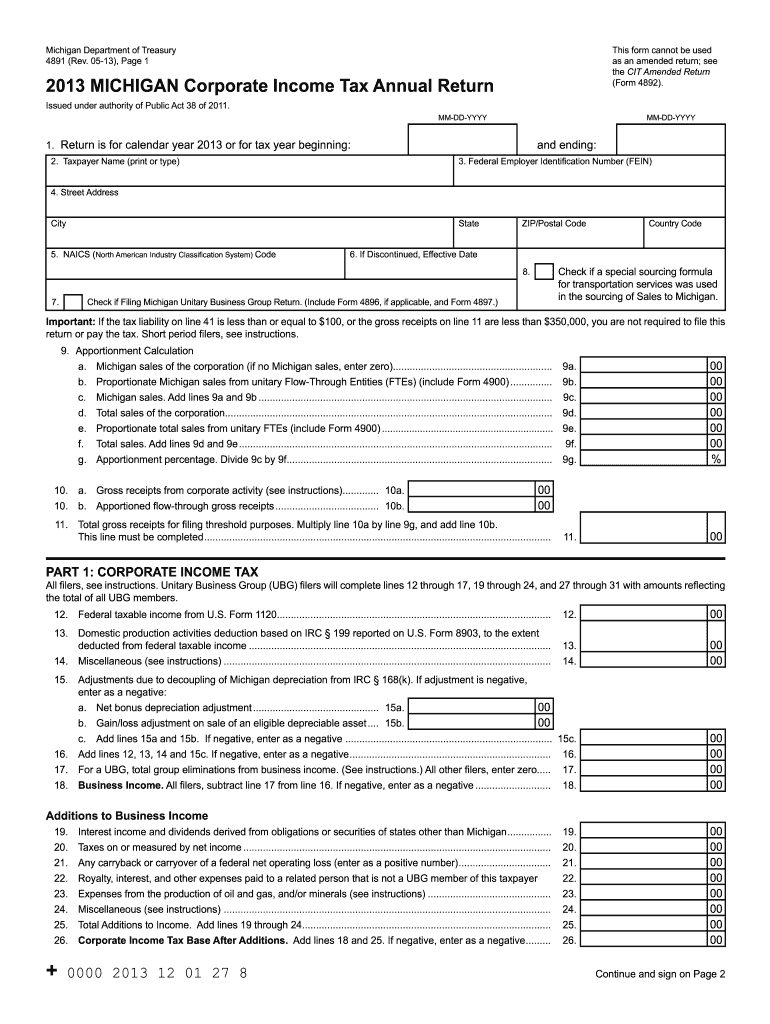

The Form 4891 is a specific document used in the United States for reporting certain tax-related information. It is typically associated with various tax obligations and is essential for ensuring compliance with federal tax regulations. Understanding the purpose and requirements of this form is crucial for individuals and businesses alike, as it helps facilitate accurate reporting and timely submissions to the Internal Revenue Service (IRS).

How to use the Form 4891

Using the Form 4891 involves several steps to ensure proper completion and submission. First, gather all necessary information, including personal identification details and any relevant financial data. Next, carefully fill out the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority. It is important to retain a copy for your records, as this may be needed for future reference or audits.

Steps to complete the Form 4891

Completing the Form 4891 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather required documents, such as W-2s, 1099s, or other income statements.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details regarding your income and deductions as applicable.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to certify the information provided.

- Submit the form either electronically or via mail, depending on IRS guidelines.

Legal use of the Form 4891

The legal use of the Form 4891 is governed by IRS regulations, which outline the requirements for valid submissions. To ensure the form is legally binding, it must be completed accurately and submitted within the designated deadlines. Additionally, electronic signatures may be used if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Understanding these legal frameworks is essential for maintaining compliance and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4891 are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15 for most individuals. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. It is advisable to check the IRS website or consult a tax professional for the most accurate and up-to-date information regarding filing dates.

Required Documents

To complete the Form 4891 accurately, certain documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of deductions, such as receipts or invoices.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete 2013 form 4891

Complete Form 4891 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Form 4891 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 4891 with ease

- Locate Form 4891 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 4891 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 4891

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 4891

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 4891 and how does it relate to airSlate SignNow?

Form 4891 is a crucial document used in various business transactions. With airSlate SignNow, you can easily create, send, and eSign Form 4891, ensuring that all parties can complete the necessary steps efficiently and securely.

-

How can airSlate SignNow streamline the process of completing Form 4891?

airSlate SignNow simplifies the completion of Form 4891 by providing a user-friendly platform for electronic signatures and document management. This allows you to quickly assemble the form, send it for signatures, and track its progress in real-time, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 4891?

Yes, there is a pricing model associated with airSlate SignNow. However, the platform offers flexible plans that cater to different business needs, making it a cost-effective solution for managing and eSigning important documents like Form 4891.

-

What features does airSlate SignNow offer for managing Form 4891?

airSlate SignNow comes equipped with robust features like customizable workflows, document templates, and audit trails specifically designed for forms like Form 4891. These tools enhance efficiency, ensure compliance, and facilitate a seamless signing experience.

-

Can I integrate airSlate SignNow with other applications for Form 4891?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRMs and cloud storage services. This capability allows businesses to streamline their workflows when managing Form 4891, making the process even more efficient.

-

How secure is the signing process for Form 4891 on airSlate SignNow?

The security of your documents, including Form 4891, is a top priority for airSlate SignNow. The platform utilizes advanced encryption protocols and strict compliance measures to protect your data, ensuring that all electronic signatures are secure and legally binding.

-

What benefits do businesses gain from using airSlate SignNow for Form 4891?

Businesses that utilize airSlate SignNow for Form 4891 enjoy increased efficiency, reduced turnaround time for signatures, and improved document management. This solution enhances collaboration, making it easier for stakeholders to execute documents without the constraints of traditional processes.

Get more for Form 4891

Find out other Form 4891

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors