Penalty Form 2019

What is the Penalty Form

The Penalty Form is a specific document used to report penalties imposed by various regulatory bodies, often related to tax compliance or other legal obligations. This form serves as an official record of penalties assessed against individuals or businesses and is crucial for maintaining accurate financial and legal records. Understanding the purpose and implications of the Penalty Form is essential for anyone who may face penalties, ensuring they are aware of their rights and responsibilities.

Steps to complete the Penalty Form

Completing the Penalty Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details and any relevant financial records. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form completely, providing accurate and truthful information. Once completed, review the form for any errors or omissions before submitting it. This careful approach helps to avoid delays or complications in processing.

Legal use of the Penalty Form

The legal use of the Penalty Form is governed by various regulations that dictate how penalties are assessed and reported. It is important to ensure that the form is filled out in accordance with state and federal laws. Compliance with these regulations not only validates the form but also protects the rights of the individual or business involved. Understanding the legal framework surrounding the Penalty Form can help prevent potential disputes and ensure that penalties are handled appropriately.

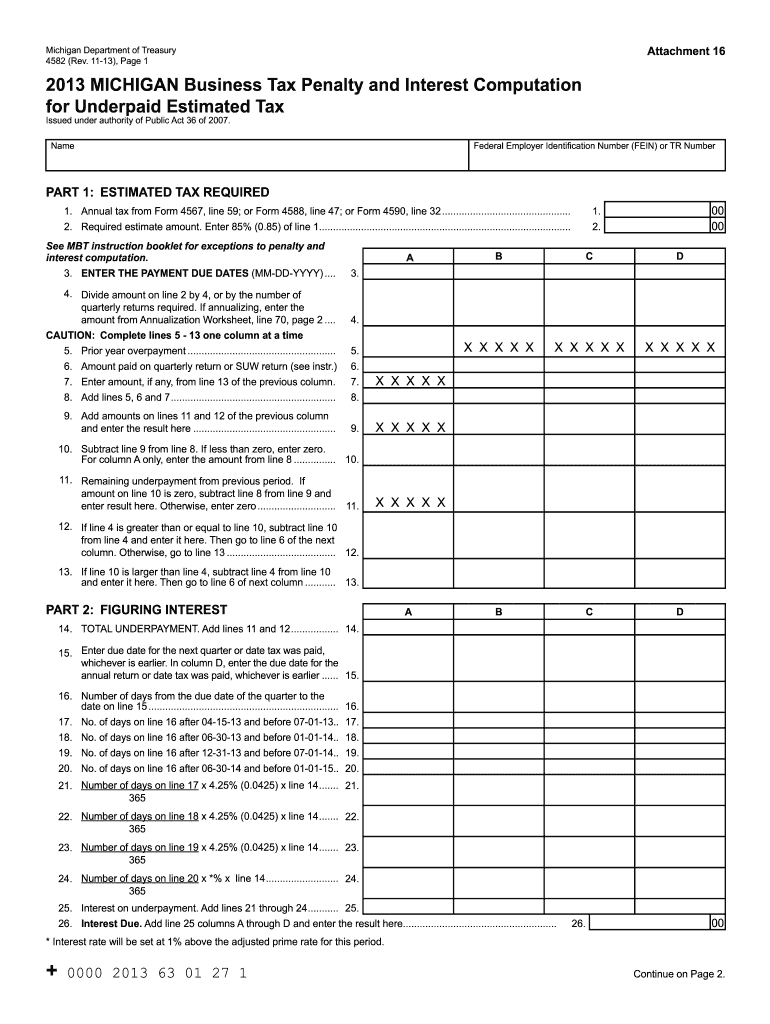

Key elements of the Penalty Form

Several key elements are essential for the Penalty Form to be considered complete and valid. These include the identification of the individual or business subject to the penalty, a detailed description of the penalty being imposed, and the specific legal basis for the penalty. Additionally, the form should include any relevant dates, such as when the penalty was assessed and the deadline for payment. Ensuring that all these elements are present helps to maintain the integrity of the form and supports its legal standing.

Form Submission Methods

The Penalty Form can typically be submitted through various methods, including online submission, mailing, or in-person delivery. Each method has its own requirements and processing times. Online submission is often the fastest and most efficient way to file, while mailing may require additional time for processing. In-person submissions can provide immediate confirmation but may not be practical for everyone. Understanding the available submission methods can help streamline the filing process and ensure timely compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Penalty Form are critical to avoid additional penalties or legal complications. These deadlines can vary based on the type of penalty and the issuing authority. It is essential to be aware of these dates and plan accordingly to ensure timely submission. Keeping a calendar of important dates related to the Penalty Form can help individuals and businesses stay organized and compliant with their obligations.

Who Issues the Form

The Penalty Form is typically issued by governmental agencies or regulatory bodies responsible for enforcing compliance with laws and regulations. This may include the Internal Revenue Service (IRS) for tax-related penalties or state agencies for other regulatory matters. Understanding which authority issues the form is important for determining the specific requirements and implications of the penalties being reported.

Quick guide on how to complete penalty form 2013

Prepare Penalty Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and electronically sign your documents swiftly without delays. Manage Penalty Form on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

The simplest way to modify and electronically sign Penalty Form without hassle

- Obtain Penalty Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Penalty Form and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct penalty form 2013

Create this form in 5 minutes!

How to create an eSignature for the penalty form 2013

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a Penalty Form in airSlate SignNow?

A Penalty Form in airSlate SignNow is a digital document designed to collect necessary information for penalty assessments. It streamlines the process of submitting details electronically, ensuring that users can send and eSign documents quickly. Utilizing a Penalty Form helps businesses maintain compliance and handle penalties with efficiency.

-

How does airSlate SignNow help in managing Penalty Forms?

airSlate SignNow simplifies the management of Penalty Forms by providing a user-friendly platform where documents can be created, customized, and shared easily. The solution allows real-time tracking and secure eSigning, which enhances overall productivity. Additionally, automated workflows reduce the time spent on processing these forms.

-

Is there a cost associated with using Penalty Forms on airSlate SignNow?

Yes, there are costs associated with using the Penalty Form feature on airSlate SignNow, but the pricing is designed to be cost-effective for businesses of all sizes. Different plans are available based on the features needed, allowing you to choose one that matches your budget and requirements. Explore our pricing page for more detailed information.

-

Can I integrate Penalty Forms with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software systems, allowing you to incorporate Penalty Forms into your existing workflows. Whether you use CRM, project management, or payment systems, these integrations help streamline your document processes. Check our integrations page to find compatible applications.

-

What benefits do Penalty Forms provide using airSlate SignNow?

Using Penalty Forms with airSlate SignNow provides numerous benefits, including enhanced accuracy, faster processing times, and improved compliance. E-signing eliminates the need for paper, making the process eco-friendly while reducing administrative overhead. Businesses can handle penalties more effectively with well-organized and easily accessible forms.

-

Are Penalty Forms customizable in airSlate SignNow?

Yes, Penalty Forms in airSlate SignNow are highly customizable to meet the specific needs of your organization. You can edit text fields, add company branding, and adjust layouts to create a form that fits your requirements. This customization ensures that your forms capture all relevant details needed for penalty assessments.

-

What security measures are in place for Penalty Forms?

airSlate SignNow employs robust security measures to protect all documents, including Penalty Forms. With advanced encryption and two-factor authentication, your sensitive information is kept safe. Additionally, all data is stored in secure, compliant environments, giving you peace of mind when handling important documents.

Get more for Penalty Form

- Videography confirmation agreement work for hire pdf ppva form

- Tipers answer key form

- Dizziness handicap inventory printable form

- I a t s e annuity fund withdrawal form

- Sample letter requesting iep evaluation form

- Bmv 5721 form

- Lab equipment activity answer key part b form

- Warren township small claims court indy gov form

Find out other Penalty Form

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement