4th Quarter Payroll Tax Booklet the City of Newark, New Ci Newark Nj Form

What is the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

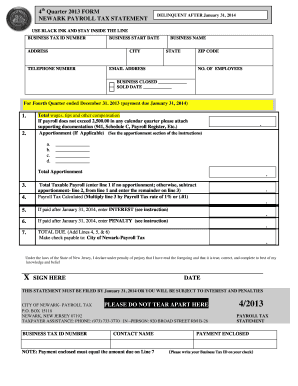

The 4th Quarter Payroll Tax Booklet for the City of Newark, New Jersey, is a vital document for employers and businesses operating within the city. This booklet includes essential information regarding payroll tax obligations, including tax rates, reporting requirements, and deadlines for the fourth quarter of the tax year. It serves as a comprehensive guide to ensure compliance with local tax regulations, helping businesses accurately calculate and remit payroll taxes to the city.

How to use the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

Using the 4th Quarter Payroll Tax Booklet involves several key steps. First, review the booklet thoroughly to understand the specific tax rates and requirements applicable to your business. Next, gather all necessary payroll data for the fourth quarter, including employee wages and hours worked. Utilize the provided forms within the booklet to report payroll tax information accurately. Ensure that all calculations are correct to avoid potential penalties.

Steps to complete the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

Completing the 4th Quarter Payroll Tax Booklet requires careful attention to detail. Follow these steps:

- Gather all payroll records for the fourth quarter.

- Calculate total wages paid to employees during this period.

- Determine the applicable tax rates as outlined in the booklet.

- Fill out the required forms accurately, ensuring all calculations are correct.

- Review the completed forms for any errors or omissions.

- Submit the forms by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 4th Quarter Payroll Tax Booklet are crucial for compliance. Typically, employers must submit their payroll tax reports by January 31 of the following year. It is essential to mark this date on your calendar and ensure all necessary documentation is prepared in advance to avoid late submissions and associated penalties.

Legal use of the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

The legal use of the 4th Quarter Payroll Tax Booklet is governed by local tax laws and regulations. Employers must utilize this booklet to ensure compliance with payroll tax obligations. Proper completion and submission of the forms within the booklet are necessary for the legal standing of your payroll tax filings. Failure to adhere to these guidelines may result in penalties or legal consequences.

Key elements of the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

Key elements of the 4th Quarter Payroll Tax Booklet include:

- Tax rate information for the fourth quarter.

- Instructions for completing payroll tax forms.

- Important deadlines for submission.

- Contact information for local tax authorities.

- Guidance on common compliance issues.

Quick guide on how to complete 4th quarter payroll tax booklet the city of newark new ci newark nj

Effortlessly Prepare 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj with Ease

- Obtain 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4th quarter payroll tax booklet the city of newark new ci newark nj

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

The 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj is an essential document for businesses to report payroll tax information for the final quarter of the year. It outlines important deadlines, tax rates, and filing requirements specific to Newark, ensuring compliance with local regulations.

-

How can I obtain the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

You can easily obtain the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj through the official city website or by visiting the local tax office. Additionally, airSlate SignNow offers solutions to upload and eSign your completed booklet efficiently.

-

What features does airSlate SignNow offer for the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

airSlate SignNow provides features that allow businesses to easily prepare, send, and eSign the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj. With a user-friendly interface and document tracking, you can ensure that all signatures and approvals are captured quickly.

-

Are there any benefits to using airSlate SignNow for the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

Yes, using airSlate SignNow for the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj offers benefits such as increased efficiency, reduced paper usage, and improved compliance tracking. This solution simplifies the document management process, allowing businesses to focus on their core activities.

-

What is the pricing for the airSlate SignNow service for managing the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

airSlate SignNow offers competitive pricing plans based on the features and number of users. For managing the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj, you can choose a plan that fits your business size and needs while benefiting from a cost-effective solution.

-

Can airSlate SignNow integrate with accounting software for the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easy to handle the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj. This integration helps streamline the entire payroll process, ensuring accurate reporting and compliance.

-

What types of businesses can benefit from the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

All businesses operating in Newark, regardless of size, should utilize the 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj. Whether you're a small business or a large corporation, this document is crucial for accurate payroll tax reporting and compliance with local laws.

Get more for 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

Find out other 4th Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney