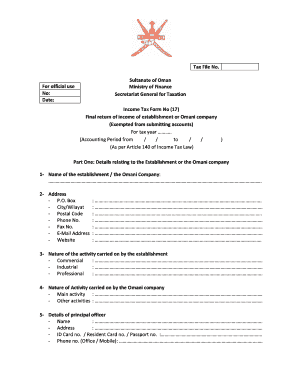

Tax Form 17

What is the Tax Form 17

The Tax Form 17 is a specific document used for reporting tax information to the Internal Revenue Service (IRS) in the United States. This form is typically utilized by individuals or businesses to report various types of income, deductions, or credits. Understanding the purpose of this form is essential for accurate tax reporting and compliance with federal regulations.

How to use the Tax Form 17

Using the Tax Form 17 involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, review it for any errors before submitting it to the IRS. It is crucial to keep a copy of the completed form for personal records.

Steps to complete the Tax Form 17

Completing the Tax Form 17 can be streamlined by following these steps:

- Gather all relevant financial documents.

- Fill in personal information, including name, address, and Social Security number.

- Report all income sources accurately.

- Include any applicable deductions or credits.

- Review the form for accuracy.

- Sign and date the form before submission.

Legal use of the Tax Form 17

The legal use of the Tax Form 17 is governed by IRS regulations. To be considered valid, the form must be filled out truthfully and submitted by the specified deadlines. Any discrepancies or inaccuracies can lead to penalties or audits. Therefore, it is important to understand the legal implications of the information provided on the form and to ensure compliance with all applicable tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form 17 can vary depending on the type of taxpayer and the specific tax year. Generally, individual taxpayers must submit their forms by April 15 of the following year. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Required Documents

To complete the Tax Form 17, several documents are typically required. These may include:

- W-2 forms from employers for reported income.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Proof of any tax credits claimed.

Having these documents on hand will facilitate a smoother filing process and help ensure accuracy in reporting.

Who Issues the Form

The Tax Form 17 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides the form and any accompanying instructions, ensuring that taxpayers have the necessary resources to complete their tax filings accurately.

Quick guide on how to complete tax form 17

Prepare Tax Form 17 effortlessly on any device

The management of online documents has gained immense popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Form 17 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Tax Form 17 seamlessly

- Locate Tax Form 17 and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Tax Form 17 and guarantee exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form 17

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Form 17 and why is it important?

Tax Form 17 is a crucial document used for reporting certain types of financial transactions to tax authorities. It's important because accurate filing can prevent penalties and ensure compliance with tax regulations. Using airSlate SignNow to prepare and eSign Tax Form 17 simplifies the process and enhances accuracy.

-

Can I eSign Tax Form 17 using airSlate SignNow?

Yes, you can easily eSign Tax Form 17 with airSlate SignNow. Our platform provides a simple and secure way to sign and send documents digitally, ensuring you can complete your filing processes quickly and efficiently. The eSigning feature makes it convenient for users to handle important tax documents from anywhere.

-

What are the pricing options for using airSlate SignNow for Tax Form 17?

airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose from free trials or subscription models, ensuring that you find an option suitable for handling Tax Form 17 and other document needs. Our cost-effective solutions make it easy to manage your documents without breaking the bank.

-

How does airSlate SignNow help in managing Tax Form 17 effectively?

airSlate SignNow streamlines the management of Tax Form 17 by providing templates, automated workflows, and secure storage. These features help in organizing your documents efficiently, ensuring that you can access and manage your tax forms easily. This can save you signNow time and reduce the risk of errors.

-

What features does airSlate SignNow offer specifically for Tax Form 17?

airSlate SignNow offers features like customizable templates and multi-party signing, which are particularly useful for handling Tax Form 17. These tools enhance collaboration and ensure that all parties involved can complete the document seamlessly. Additionally, our audit trail helps track changes and signatory actions for compliance.

-

Is airSlate SignNow compliant with tax regulations for Tax Form 17?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, making it a trustworthy solution for handling Tax Form 17. Our platform adheres to industry standards for security and data protection, ensuring that your sensitive information remains safe. This compliance gives users peace of mind while managing their tax documents.

-

Can I integrate airSlate SignNow with other applications for Tax Form 17 management?

Absolutely! airSlate SignNow offers integration capabilities with a variety of applications, allowing seamless management of Tax Form 17 alongside your other business processes. This integration can improve efficiency and ensure that all your document needs are met in one place, simplifying overall workflow.

Get more for Tax Form 17

- You are aware form

- Conduct and you should carefully consider the legal consequences of such wrongful conduct form

- Damages be assessed against you if you do not relent in this malicious retaliatory conduct form

- The express warranties above are exclusive of all others form

- Merchantability and otherwise are excluded form

- 7 day notice to pay rent or lease terminates residential form

- 7 day notice to pay rentor lease terminates non residential form

- Office building net lease dated as of march 24 secgov form

Find out other Tax Form 17

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online