Sa102 Form

What is the SA102 Form

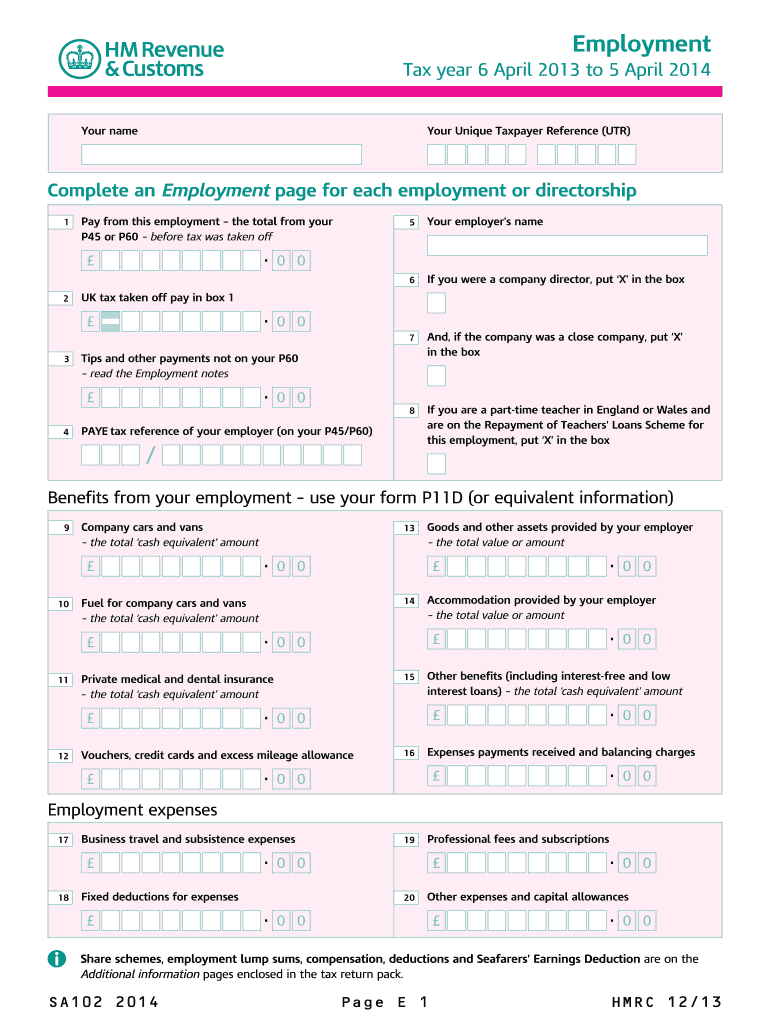

The SA102 form is a supplementary page used in the United Kingdom for reporting employment income on a tax return. It is particularly relevant for individuals who have received income from employment during the tax year. This form is essential for accurately calculating taxable income and ensuring compliance with tax regulations. The SA102 form collects various details, including the name of the employer, the total income earned, and any tax deducted at source. This information is crucial for the HM Revenue and Customs (HMRC) to assess an individual's tax liability.

How to Use the SA102 Form

To effectively use the SA102 form, individuals should first gather all necessary documentation related to their employment income. This includes payslips, P60s, and any other relevant financial statements. Once the required information is collected, users can begin filling out the form by providing details such as the employer's name, the total income received, and any tax that has been withheld. It is important to ensure that all entries are accurate to avoid potential issues with HMRC.

Steps to Complete the SA102 Form

Completing the SA102 form involves several key steps:

- Gather all relevant employment documents, including payslips and P60s.

- Enter your personal details, including your name and National Insurance number.

- Provide the name and address of your employer.

- Report your total income from employment during the tax year.

- Include any tax deducted from your earnings.

- Review the form for accuracy before submission.

Following these steps ensures that the form is completed correctly and submitted on time.

Legal Use of the SA102 Form

The SA102 form is legally recognized for reporting employment income in the UK tax system. It must be filled out accurately to meet tax obligations. Failure to provide correct information can lead to penalties or legal repercussions. The form is designed to comply with the regulations set forth by HMRC, ensuring that all reported income is accounted for in the national tax framework. Properly using the SA102 form helps maintain transparency and accountability in personal tax matters.

Filing Deadlines / Important Dates

Filing deadlines for the SA102 form align with the overall tax return deadlines set by HMRC. Typically, individuals must submit their tax returns, including any supplementary pages like the SA102, by January 31st following the end of the tax year. For example, for the tax year ending on April 5, submissions must be completed by January 31 of the following year. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with tax regulations.

Who Issues the Form

The SA102 form is issued by HM Revenue and Customs (HMRC), the UK government agency responsible for tax collection and administration. Individuals can obtain the form directly from the HMRC website or through official tax documentation received during the tax year. HMRC provides guidance on how to complete the form and the necessary steps for submission, ensuring that taxpayers have access to the resources needed for accurate reporting.

Quick guide on how to complete employment 2014 use the sa1022013 supplementary pages to record your employment details when filing a tax return for the tax

Prepare Sa102 Form effortlessly on any gadget

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Sa102 Form on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Sa102 Form with ease

- Obtain Sa102 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Sa102 Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

On joining my previous employer I was given a joining bonus in 2013 and had to return it in 2014 because I left that employer before completing my services for an year. As that bonus is no longer technically a part of my earning, how can I file my tax return for the financial year 2013-14?

I am wondering if you are asking about seeking a refund of income tax on the joining bonus which you returned to your employer. Please check your Form 16 for 2013-14 to see if your joining bonus has been included in your taxable salary by your employer. If yes, I do not think you will be able to seek a refund from the Income Tax Department since there is nothing in the law governing income tax which allows reduction in taxable income when joining bonus is returned to the employer.Of course, you can reduce your salary figure (to the extent of joining bonus) in your tax return and seek a refund. If your employer has included the joining bonus in your Form 16, the income figure in your tax return will be in conflict with the salary figure submitted to the Income Tax Department by your employer (through the quarterly return). Your return (and the refund request) could be rejected by the department as being incorrect. You can consult a tax lawyer to check if there is any case law which supports your case.I know a case in Chennai in which an employee returned his joining bonus and filed his tax return with a refund request. The Income Tax Department rejected his request. The employee went on appeal and the case is pending.

Create this form in 5 minutes!

How to create an eSignature for the employment 2014 use the sa1022013 supplementary pages to record your employment details when filing a tax return for the tax

How to create an electronic signature for the Employment 2014 Use The Sa1022013 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax in the online mode

How to generate an electronic signature for the Employment 2014 Use The Sa1022013 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax in Google Chrome

How to generate an electronic signature for putting it on the Employment 2014 Use The Sa1022013 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax in Gmail

How to make an eSignature for the Employment 2014 Use The Sa1022013 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax from your mobile device

How to generate an eSignature for the Employment 2014 Use The Sa1022013 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax on iOS

How to make an eSignature for the Employment 2014 Use The Sa1022013 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax on Android devices

People also ask

-

What is the sa102 form 2020, and who needs it?

The sa102 form 2020 is used by self-employed individuals to report their income and expenses to HM Revenue and Customs (HMRC). If you’re a sole trader or in a partnership, you will need to complete this form as part of your self-assessment tax return.

-

How can airSlate SignNow help with submitting the sa102 form 2020?

With airSlate SignNow, you can easily send and eSign your sa102 form 2020, ensuring a hassle-free submission process. Our platform allows you to securely sign documents electronically, reducing the time it takes to handle paperwork and compliance.

-

What pricing plans does airSlate SignNow offer for users needing the sa102 form 2020?

airSlate SignNow offers several pricing plans designed to cater to different business needs. Each plan provides access to features that simplify document management, including the ability to handle the sa102 form 2020 efficiently and cost-effectively.

-

Are there any specific features of airSlate SignNow that assist with the sa102 form 2020?

Yes, airSlate SignNow includes features such as document templates, customizable workflows, and real-time tracking. These tools streamline the process of filling out and managing the sa102 form 2020, enhancing productivity and accuracy.

-

Can I integrate airSlate SignNow with other accounting software for the sa102 form 2020?

Absolutely! airSlate SignNow integrates with a variety of accounting software to facilitate the completion of the sa102 form 2020. This integration allows for seamless data transfer between platforms, making document management even easier for self-employed users.

-

What are the benefits of using airSlate SignNow for the sa102 form 2020?

Using airSlate SignNow for the sa102 form 2020 simplifies the entire process by offering electronic signatures and secure document storage. This means you can manage your forms anytime and anywhere, reducing the risks associated with traditional paper-based methods.

-

Is airSlate SignNow secure for handling sensitive information on the sa102 form 2020?

Yes, airSlate SignNow employs advanced security protocols to ensure that all documents, including the sa102 form 2020, are protected. Our platform features encryption, secure cloud storage, and compliant data handling to safeguard your sensitive information.

Get more for Sa102 Form

Find out other Sa102 Form

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later