Bco 10 2009

What is the Bco 10

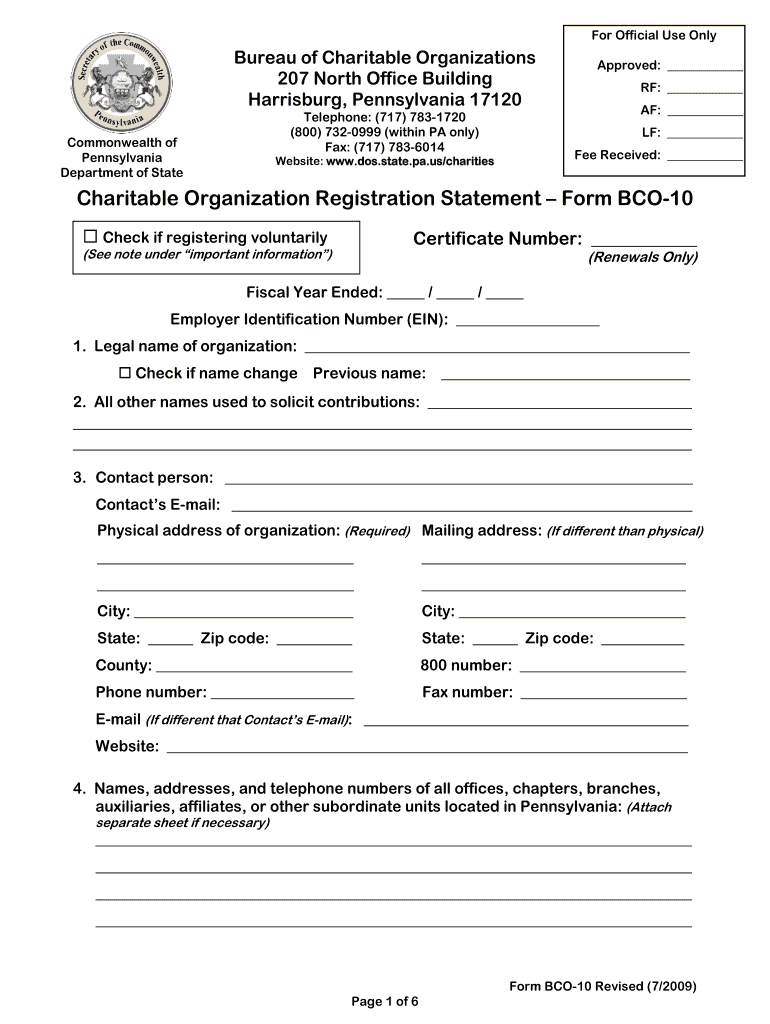

The Bco 10 is a vital form used for registering charitable organizations in Pennsylvania. This document is essential for entities that wish to operate as nonprofit organizations within the state. The Bco 10 form collects important information about the organization, including its name, purpose, and the names of its officers and board members. Understanding the Bco 10 is crucial for compliance with state laws and for maintaining the organization's tax-exempt status.

Steps to complete the Bco 10

Completing the Bco 10 form involves several key steps:

- Gather necessary information about your organization, including its mission, structure, and leadership.

- Fill out the Bco 10 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the completed form to the appropriate state agency, either online or by mail, along with any required fees.

Following these steps carefully will help ensure a smooth registration process for your charitable organization.

Legal use of the Bco 10

The legal use of the Bco 10 is governed by Pennsylvania state laws regarding nonprofit organizations. This form must be used to register any organization that intends to operate as a charity within the state. Failure to properly register can result in penalties, including fines or the inability to legally operate as a nonprofit. It is essential to adhere to all legal requirements outlined in the form and to provide accurate information to maintain compliance.

Required Documents

When completing the Bco 10, certain documents are required to support your application. These may include:

- Bylaws of the organization, detailing its governance structure.

- Articles of incorporation, if applicable.

- Tax identification number, if the organization has one.

- Financial statements or a budget, demonstrating the organization’s financial viability.

Having these documents ready will facilitate the completion and submission of the Bco 10 form.

Form Submission Methods

The Bco 10 form can be submitted through various methods, depending on your preference and the requirements of the state. These methods include:

- Online submission through the Pennsylvania Department of State's website.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at designated state offices, if available.

Choosing the right submission method can help ensure timely processing of your application.

Eligibility Criteria

To be eligible to file the Bco 10 form, organizations must meet specific criteria set forth by Pennsylvania law. These criteria typically include:

- Operating primarily for charitable purposes, such as education, health, or social services.

- Having a defined governance structure, including a board of directors.

- Complying with all local, state, and federal regulations applicable to nonprofit organizations.

Understanding these eligibility criteria is essential for organizations seeking to register as charitable entities in Pennsylvania.

Quick guide on how to complete bco 10 form

Handle Bco 10 wherever, whenever

Your routine business operations may need additional focus when managing state-specific business documents. Reclaim your work hours and reduce the costs associated with paper-based processes using airSlate SignNow. airSlate SignNow provides you with a vast array of pre-uploaded business documents, including Bco 10, which you can utilize and share with your business associates. Administer your Bco 10 smoothly with robust editing and eSignature features and dispatch it directly to your recipients.

Steps to obtain Bco 10 in just a few clicks:

- Select a form pertinent to your state.

- Click on Learn More to view the document and ensure its accuracy.

- Hit Get Form to start using it.

- Bco 10 will instantly appear in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s advanced editing features to complete or amend the form.

- Locate the Sign option to create your personal signature and eSign your document.

- When ready, click Done, save changes, and access your document.

- Share the form via email or text, or use a link-to-fill method with your associates or permit them to download the document.

airSlate SignNow greatly simplifies your management of Bco 10 and enables you to find important documents in one place. A comprehensive library of forms is organized and tailored to address essential business operations needed for your organization. The sophisticated editor minimizes the chance of mistakes, allowing you to effortlessly correct errors and review your documents on any device before sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

Find and fill out the correct bco 10 form

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

Create this form in 5 minutes!

How to create an eSignature for the bco 10 form

How to create an eSignature for your Bco 10 Form online

How to create an electronic signature for your Bco 10 Form in Chrome

How to make an eSignature for putting it on the Bco 10 Form in Gmail

How to generate an electronic signature for the Bco 10 Form from your mobile device

How to create an electronic signature for the Bco 10 Form on iOS devices

How to generate an electronic signature for the Bco 10 Form on Android

People also ask

-

What is pa bco 10 and how does it enhance my document signing experience?

Pa bco 10 is a feature offered by airSlate SignNow that streamlines the document signing process. This tool allows users to send, sign, and manage documents efficiently, ensuring a smooth experience for both senders and recipients. With pa bco 10, you can reduce turnaround time signNowly.

-

How does airSlate SignNow's pa bco 10 pricing compare to other e-signature solutions?

AirSlate SignNow provides competitive pricing for the pa bco 10 solution, making it a cost-effective choice for businesses of all sizes. Unlike other platforms, our pricing plans are transparent with no hidden fees, allowing users to select the best fit for their needs. By choosing pa bco 10, you ensure affordability paired with high-quality service.

-

What key features does the pa bco 10 solution offer?

The pa bco 10 solution includes features like customizable templates, real-time tracking, and advanced security measures. These tools are designed to simplify the e-signature process and increase productivity for businesses. By incorporating these features, airSlate SignNow empowers users to manage document workflows seamlessly.

-

Can I integrate pa bco 10 with other software platforms?

Yes, airSlate SignNow's pa bco 10 can easily integrate with many popular software platforms like Salesforce, Google Workspace, and Microsoft 365. This versatility allows for a customized workflow that suits your business needs. Integrating pa bco 10 with your existing tools can enhance productivity and streamline processes.

-

What benefits can I expect from using pa bco 10 for my business?

By utilizing pa bco 10, businesses can expect improved efficiency, reduced paperwork, and shorter turnaround times for document signing. This solution fosters better collaboration among teams and customers alike, ensuring that everyone stays on the same page. Additionally, pa bco 10 enhances security and compliance standards for your document management.

-

Is pa bco 10 suitable for businesses of all sizes?

Absolutely! Pa bco 10 is designed to cater to businesses of all sizes, from startups to large enterprises. Its flexible pricing plans and robust features make it an ideal choice for any organization looking to improve their document processes. With pa bco 10, everyone can benefit from efficient e-signature solutions.

-

How does airSlate SignNow ensure the security of documents signed with pa bco 10?

AirSlate SignNow prioritizes the security of documents signed with pa bco 10 by employing encryption technologies and secure cloud storage. Our platform is compliant with major standards such as GDPR and eIDAS, ensuring that your documents are safe and legally binding. Trusting pa bco 10 for your e-signature needs means you can have peace of mind regarding document security.

Get more for Bco 10

Find out other Bco 10

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document