720 Llet Form

What is the 720 Llet Form

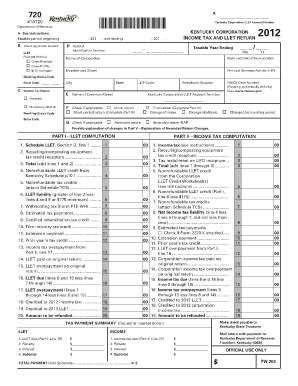

The 720 Llet Form is a specific document used in the United States for reporting certain financial information. This form is essential for individuals and businesses that need to disclose specific transactions or financial activities to the relevant authorities. Understanding the purpose and requirements of the 720 Llet Form is crucial for compliance with U.S. regulations.

How to use the 720 Llet Form

Using the 720 Llet Form involves several steps to ensure proper completion and submission. First, gather all necessary information and documentation that pertains to the financial activities you are reporting. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submitting it through the designated channels, whether online or by mail.

Steps to complete the 720 Llet Form

Completing the 720 Llet Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents and information.

- Download the form from the official source or access it through a digital platform.

- Fill in your personal or business information as required.

- Provide accurate details about the financial transactions you are reporting.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the 720 Llet Form

The legal use of the 720 Llet Form is governed by specific regulations that ensure its validity. To be legally binding, the form must be completed accurately and submitted in accordance with the relevant laws. This includes adhering to deadlines and providing truthful information. Failure to comply with these regulations can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the 720 Llet Form are crucial for compliance. It is important to be aware of the specific dates by which the form must be submitted to avoid penalties. These dates may vary depending on the type of financial activity being reported. Keeping track of these deadlines ensures that you remain compliant with U.S. regulations.

Required Documents

To complete the 720 Llet Form, certain documents are typically required. These may include:

- Financial statements related to the transactions being reported.

- Identification documents for individuals or businesses involved.

- Any supporting documentation that verifies the information provided in the form.

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete 720 llet form

Complete 720 Llet Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage 720 Llet Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign 720 Llet Form without difficulty

- Find 720 Llet Form and then click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign 720 Llet Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 720 llet form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 720 Llet Form?

The 720 Llet Form is a digital document designed for efficient completion and signing within the airSlate SignNow platform. It simplifies the process of collecting necessary information for tax purposes and streamlines signature requests, ensuring compliance and accuracy. With airSlate SignNow, you can easily create and manage the 720 Llet Form online.

-

How much does it cost to use the 720 Llet Form with airSlate SignNow?

The pricing for using the 720 Llet Form through airSlate SignNow is competitive and designed to fit various budgets. airSlate SignNow offers flexible subscription plans that can be tailored to your usage needs, ensuring you only pay for what you need. Visit our pricing page to find the best plan for your organization.

-

What features does the 720 Llet Form offer?

The 720 Llet Form includes features such as customizable fields, eSignature options, and advanced templating tools. These features enhance user experience by allowing businesses to tailor the form according to their specific requirements, making the completion and signing process seamless. Additionally, real-time notifications and audit trails ensure compliance and track changes effectively.

-

What are the benefits of using the 720 Llet Form on airSlate SignNow?

Using the 720 Llet Form on airSlate SignNow provides numerous benefits, including enhanced efficiency in document handling and reduced turnaround times. Businesses can securely collect signatures and share forms digitally, eliminating the need for paper, which is both cost-effective and environmentally friendly. This automation helps to streamline workflows and improve overall productivity.

-

Can I integrate the 720 Llet Form with other applications?

Yes, the 720 Llet Form can be integrated with various applications and software using airSlate SignNow's robust API. This allows users to incorporate eSigning directly into their existing systems, enhancing overall functionality. Integration with popular CRMs and cloud storage services also makes accessing and managing your forms more convenient.

-

Is the 720 Llet Form secure?

Absolutely! The 720 Llet Form on airSlate SignNow is designed with high-security standards to protect your sensitive information. Features such as data encryption, secure servers, and compliance with legal regulations ensure that your documents are safe from unauthorized access while maintaining integrity throughout the signing process.

-

How can I get started with the 720 Llet Form on airSlate SignNow?

Getting started with the 720 Llet Form on airSlate SignNow is easy! Simply sign up for an account on our website, create your form, and explore the intuitive interface to customize it. Our platform also offers tutorials and customer support to guide you through the process seamlessly.

Get more for 720 Llet Form

Find out other 720 Llet Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors