Irs Form 8879 for

What is the IRS Form 8879 For

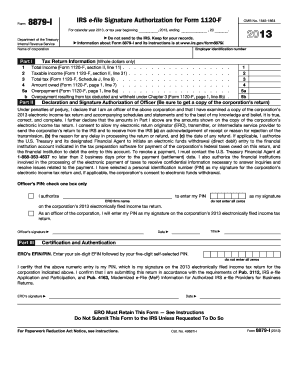

The IRS Form 8879, also known as the IRS e-file Signature Authorization, is a crucial document that allows taxpayers to authorize an electronic return originator (ERO) to file their tax returns electronically. This form is particularly important for individuals who use tax professionals to prepare and submit their returns. By signing Form 8879, taxpayers provide consent for their tax preparers to file their returns on their behalf, ensuring compliance with IRS regulations.

How to Use the IRS Form 8879 For

Using the IRS Form 8879 involves a straightforward process. Taxpayers should first complete their tax return with the assistance of their tax preparer. Once the return is ready for submission, the preparer will generate Form 8879. Taxpayers can then review the details on the form to ensure accuracy. After confirming that the information is correct, they can sign the form electronically or manually, depending on the method chosen by the tax preparer. This signed form must then be returned to the ERO, who will use it to submit the tax return electronically to the IRS.

Steps to Complete the IRS Form 8879 For

Completing the IRS Form 8879 involves several key steps:

- Gather necessary information, including your Social Security number and the details of your tax return.

- Work with your tax preparer to finalize your tax return.

- Review the completed Form 8879 to ensure all information is accurate.

- Sign the form, either electronically or by hand, as per your tax preparer's instructions.

- Return the signed form to your ERO for electronic filing.

Legal Use of the IRS Form 8879 For

The IRS Form 8879 is legally binding when properly executed. It serves as a signature authorization that allows the ERO to file your tax return electronically. To ensure its legal validity, the form must be signed by the taxpayer and must include accurate information corresponding to the tax return. Compliance with IRS guidelines is essential, as any discrepancies may result in delays or issues with the electronic filing process.

Key Elements of the IRS Form 8879 For

Several key elements are essential to the IRS Form 8879:

- Taxpayer Information: Includes the taxpayer's name, Social Security number, and filing status.

- Tax Preparer Information: Details about the ERO, including their name and identification number.

- Signature Section: Where the taxpayer signs to authorize the electronic filing.

- Return Information: Summary of the tax return being filed, including amounts and credits.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8879 align with the overall tax return deadlines. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that their Form 8879 is signed and returned to their ERO by the tax filing deadline to avoid penalties and ensure timely submission of their tax returns.

Quick guide on how to complete irs form 8879 for

Complete Irs Form 8879 For effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without delays. Manage Irs Form 8879 For on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven activity today.

The easiest way to edit and eSign Irs Form 8879 For effortlessly

- Find Irs Form 8879 For and click Get Form to begin.

- Use the features we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Irs Form 8879 For and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8879 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8879 used for?

IRS Form 8879 is used to authorize e-filing of tax returns. It serves as an electronic signature for taxpayers, allowing tax preparers to submit returns on their behalf. Understanding IRS Form 8879 for your tax filing can simplify the e-filing process and ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with IRS Form 8879?

AirSlate SignNow makes it easy to prepare, send, and eSign IRS Form 8879 within minutes. The platform supports seamless document management, ensuring that you can handle your e-filing requirements efficiently. Using airSlate SignNow eliminates the hassle of manual submissions while keeping your documents secure.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8879?

Yes, there is a subscription cost for using airSlate SignNow, but it is competitively priced to fit a range of budgets. The pricing includes access to features for sending and signing IRS Form 8879 securely online. Investing in airSlate SignNow can save you time and enhance your efficiency during tax season.

-

What features does airSlate SignNow offer for managing IRS Form 8879?

AirSlate SignNow provides features like document templates, secure eSignatures, and workflow automation for IRS Form 8879. You can easily create and customize forms, track their status, and manage your signing process from any device. These features streamline the e-filing process and ensure timely submission.

-

Can I integrate airSlate SignNow with other accounting software for IRS Form 8879?

Absolutely! AirSlate SignNow offers integrations with various accounting software and applications. You can synchronize your data and automate workflows while handling IRS Form 8879, allowing for a seamless experience and enhanced productivity.

-

Is airSlate SignNow compliant with e-signature regulations for IRS Form 8879?

Yes, airSlate SignNow complies with all e-signature regulations, including those set forth by the IRS for Form 8879. The platform adheres to the ESIGN Act and UETA, ensuring that your electronically signed documents hold the same legal weight as traditional signatures. You can trust airSlate SignNow for secure and compliant e-signatures.

-

How does airSlate SignNow enhance the security of IRS Form 8879?

AirSlate SignNow prioritizes security through encryption and secure cloud storage for documents like IRS Form 8879. All sensitive data is protected, ensuring that your information remains confidential throughout the e-signing process. This robust security framework allows you to eFile your tax documents with peace of mind.

Get more for Irs Form 8879 For

- Important guidelines for preparing your complaint montana form

- Notice of option for recording montana form

- Montana victims form

- Mt rape form

- Montana order protection form

- Montana documents form

- Essential legal life documents for baby boomers montana form

- Essential legal life documents for newlyweds montana form

Find out other Irs Form 8879 For

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist