Ebf 1 Form

What is the EBF 1 Form

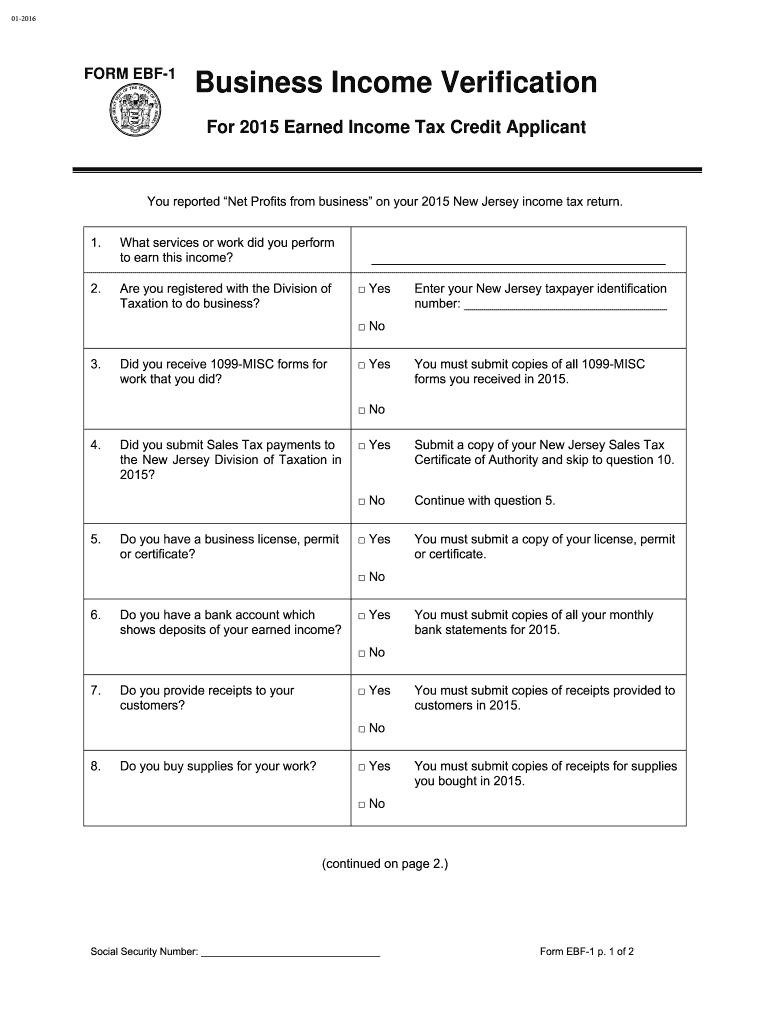

The EBF 1 form is a specific document used in various administrative processes, particularly in the context of employment and benefits. This form serves as a crucial tool for individuals and organizations to provide necessary information for compliance with regulatory requirements. Understanding the purpose and function of the EBF 1 form is essential for accurate completion and submission.

How to Use the EBF 1 Form

Using the EBF 1 form involves several key steps to ensure that all required information is accurately captured. First, gather all necessary documents and information that pertain to the form's requirements. Next, carefully fill out each section of the form, ensuring that all entries are clear and legible. Once completed, review the form for accuracy before submitting it through the appropriate channels, whether online or by mail.

Steps to Complete the EBF 1 Form

Completing the EBF 1 form requires a methodical approach to ensure compliance and accuracy. Follow these steps:

- Review the form’s instructions thoroughly to understand the requirements.

- Collect all necessary information, such as personal identification and relevant employment details.

- Fill out the form carefully, ensuring that all fields are completed as required.

- Double-check your entries for any errors or omissions.

- Submit the completed form according to the specified submission methods.

Legal Use of the EBF 1 Form

The EBF 1 form must be used in accordance with applicable laws and regulations. It is essential to understand the legal implications of submitting this form, as inaccuracies or incomplete information may lead to penalties or compliance issues. Ensuring that the form is filled out correctly and submitted on time is vital for maintaining legal standing.

Key Elements of the EBF 1 Form

The EBF 1 form contains several key elements that must be accurately completed. These elements typically include:

- Personal identification information, such as name and address.

- Details regarding employment or benefits being applied for.

- Signature and date to validate the information provided.

Each of these components plays a critical role in the form's overall validity and acceptance by relevant authorities.

Form Submission Methods

The EBF 1 form can typically be submitted through various methods, including:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate office.

- In-person submission at specified locations.

Choosing the correct submission method is important for ensuring that the form is received and processed in a timely manner.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the EBF 1 form can result in significant penalties. These may include fines, delays in processing, or other legal repercussions. It is crucial to adhere to all guidelines and deadlines to avoid these potential issues.

Quick guide on how to complete ebf 1 2015 form

Effortlessly complete Ebf 1 Form on any device

The management of documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and electronically sign your documents promptly without interruptions. Manage Ebf 1 Form on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-centric workflow today.

How to modify and electronically sign Ebf 1 Form with ease

- Obtain Ebf 1 Form and click on Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review all information carefully and click the Done button to preserve your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ebf 1 Form to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the ebf 1 2015 form

How to make an eSignature for the Ebf 1 2015 Form in the online mode

How to make an eSignature for the Ebf 1 2015 Form in Google Chrome

How to generate an eSignature for putting it on the Ebf 1 2015 Form in Gmail

How to create an electronic signature for the Ebf 1 2015 Form straight from your mobile device

How to make an electronic signature for the Ebf 1 2015 Form on iOS devices

How to make an eSignature for the Ebf 1 2015 Form on Android devices

People also ask

-

What is the Ebf 1 Form in airSlate SignNow?

The Ebf 1 Form in airSlate SignNow is a specific document template designed to facilitate electronic signatures for various business needs. This form streamlines the signing process, making it easier for users to complete necessary paperwork quickly and efficiently. By using the Ebf 1 Form, businesses can enhance their operational workflows and improve overall productivity.

-

How much does it cost to use the Ebf 1 Form with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to the Ebf 1 Form. The cost varies depending on the features you choose and the number of users in your organization. For the most accurate pricing, check our website or contact our sales team for personalized solutions.

-

What features are included with the Ebf 1 Form on airSlate SignNow?

The Ebf 1 Form on airSlate SignNow includes essential features such as customizable fields, secure electronic signatures, and automated workflows. Users can easily edit the form to fit their specific needs and ensure compliance with legal standards. Additionally, real-time tracking allows you to monitor the signing process efficiently.

-

Can the Ebf 1 Form be integrated with other software?

Yes, the Ebf 1 Form can be seamlessly integrated with various third-party applications and systems through airSlate SignNow’s API. This integration enables businesses to enhance their existing workflows by connecting the Ebf 1 Form with CRM systems, project management tools, and other software. Enjoy a streamlined process that fits within your business ecosystem.

-

What are the benefits of using the Ebf 1 Form in airSlate SignNow?

Using the Ebf 1 Form within airSlate SignNow offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. The user-friendly interface allows anyone in your organization to easily create and manage forms. Furthermore, the Ebf 1 Form enhances security and compliance, ensuring that your documents are handled correctly.

-

Is the Ebf 1 Form legally binding?

Yes, the Ebf 1 Form created and signed through airSlate SignNow is legally binding in accordance with eSignature laws, such as the ESIGN Act and UETA. This means that documents signed electronically carry the same weight as traditional handwritten signatures. You can trust that your agreements made via the Ebf 1 Form are valid and enforceable.

-

How can I customize the Ebf 1 Form in airSlate SignNow?

Customizing the Ebf 1 Form in airSlate SignNow is straightforward and user-friendly. You can add, remove, or modify fields based on your specific requirements, ensuring that the form meets your business needs. Additionally, you can incorporate your branding elements, such as logos and colors, to maintain consistency across all your documents.

Get more for Ebf 1 Form

- Law office service request moving hydro one form

- Weekly reading log pdf form

- City of clewiston building department form

- Kansas disability form

- Chase tenant security deposit account form

- Audiomarkt form

- Aa meeting format printable

- M500 reporting of jobz tax benefits for tax year revenue state mn form

Find out other Ebf 1 Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy