Texas Dne 1a Form

What is the Texas Dne 1a

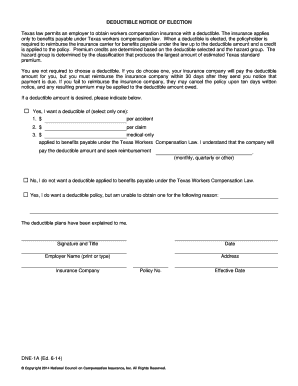

The Texas Dne 1a form, officially known as the Texas Dne 1a deductible election form, is a crucial document used by taxpayers in Texas to make specific tax elections. This form allows individuals and businesses to elect certain deductions that can significantly impact their tax liabilities. Understanding the purpose and implications of the Dne 1a is essential for ensuring compliance with state tax regulations and maximizing potential tax benefits.

How to Use the Texas Dne 1a

Using the Texas Dne 1a involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your tax identification number and details about your income and deductions. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set forth by the Texas Comptroller's office.

Steps to Complete the Texas Dne 1a

Completing the Texas Dne 1a requires careful attention to detail. Follow these steps for successful completion:

- Begin by downloading the form from the official Texas Comptroller's website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the specific deductions you are electing by following the instructions provided on the form.

- Review your entries for accuracy, ensuring all required fields are filled.

- Submit the form electronically using a secure eSignature solution, or print and mail it to the appropriate address.

Legal Use of the Texas Dne 1a

The Texas Dne 1a must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to guidelines set forth by the Texas Comptroller and ensuring that all information provided is truthful and accurate. Failure to comply with these regulations can result in penalties or disqualification from receiving the elected deductions. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of using this form.

Required Documents

When completing the Texas Dne 1a, certain documents may be required to support your claims. These documents can include:

- Proof of income, such as W-2 forms or 1099 statements.

- Receipts or records of expenses related to the deductions you are electing.

- Any prior tax returns that may be relevant to your current election.

Having these documents ready will facilitate a smoother completion process and help ensure that your form is accepted without issues.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Texas Dne 1a. Typically, the form must be submitted by the tax return due date for the year in which the deductions are being elected. Failing to meet this deadline can result in the inability to claim the desired deductions. Always check the Texas Comptroller's website for the most current deadlines and any updates that may affect your filing.

Quick guide on how to complete texas dne 1a

Effortlessly Prepare Texas Dne 1a on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly without any hold-ups. Manage Texas Dne 1a on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Texas Dne 1a with Ease

- Locate Texas Dne 1a and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal standing as a traditional wet ink signature.

- Review the details and then click the Done button to save your updates.

- Select your preferred method to send your form, either through email, text message (SMS), or an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from the device of your choice. Modify and eSign Texas Dne 1a to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas dne 1a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of dne 1a on document signing?

The dne 1a feature enhances the security and efficiency of document signing by ensuring compliance with industry standards. This allows users to send and eSign documents confidently, knowing that their data is protected. With dne 1a, businesses can streamline their workflows and reduce the risk of errors.

-

How does airSlate SignNow's pricing structure accommodate the use of dne 1a?

airSlate SignNow offers a competitive pricing structure that includes access to the dne 1a feature in various plans. Whether you’re a small business or a large enterprise, you can find a plan that suits your budget while providing essential document signing functionalities. This flexibility ensures you get the best value for integrating dne 1a into your operations.

-

What are the key features of dne 1a in airSlate SignNow?

The dne 1a feature includes advanced security protocols, seamless integrations, and user-friendly interfaces, making it easy to manage document workflows. You'll benefit from automated notifications and customizable templates that enhance the eSigning process. Overall, dne 1a signNowly improves the way businesses handle document transactions.

-

Can I integrate dne 1a with other software applications?

Yes, airSlate SignNow's dne 1a feature is designed to integrate smoothly with numerous software applications, including CRM and project management tools. This compatibility allows you to enhance your document management processes and create a more streamlined workflow. With these integrations, businesses can maximize the utility of dne 1a across their operations.

-

What benefits does using dne 1a provide for my business?

Using dne 1a can enhance your business’s efficiency by speeding up the document signing process and reducing paper waste. The feature also supports remote work by enabling secure, electronic signatures from any device. As a result, businesses can experience improved cash flow and faster contract turnaround times.

-

Is there customer support available for users of dne 1a?

Absolutely! airSlate SignNow offers robust customer support for all users utilizing the dne 1a feature. Whether you need assistance with setup, troubleshooting, or any other inquiries, our support team is ready to help. This ensures you can maximize the benefits of dne 1a without any disruptions.

-

How does the security of dne 1a compare to traditional signing methods?

The security of dne 1a far exceeds that of traditional signing methods, incorporating encryption, authentication, and tracking features. Unlike paper documents, which can be lost or tampered with, dne 1a provides a secure and verifiable trail of all actions taken on the document. This added layer of security instills confidence in users when eSigning important documents.

Get more for Texas Dne 1a

- Non taxable transaction certificates nttcforms ampamp publications taxation and revenue new mexiconon taxable transaction

- Fillable online understanding your forms w 2 wage ampampamp

- Pdf instructions for form ct 54 taxnygov

- Form ct 3 abc fill and sign printable template onlineus legal forms

- It 558 form

- Form it 196 new york resident nonresident and part yearform it 196 new york resident nonresident and part yearit 196 form 2019

- Schedule sb form 1 fill online printable pdffiller

- F120 115 000 statewide payee registration and w 9 f120 115 000 statewide payee registration and w 9 form

Find out other Texas Dne 1a

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template