Instructions for Form it 112 R New York State Resident Tax 2022

Understanding the IT 230 Form

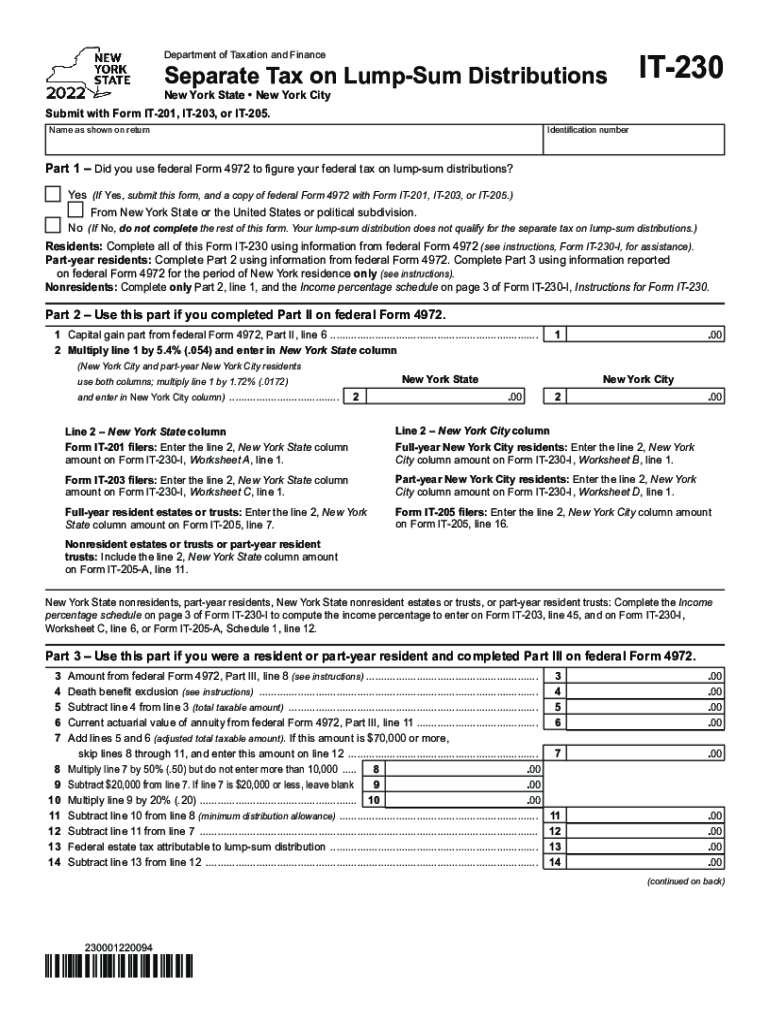

The IT 230 form is a crucial document for New York taxpayers, particularly those dealing with lump-sum distributions or separate distributions from retirement plans. This form allows taxpayers to report these distributions accurately, ensuring compliance with state tax regulations. The IT 230 form is specifically designed to calculate the tax implications of these distributions, providing clarity on how they affect overall tax liability.

Steps to Complete the IT 230 Form

Filling out the IT 230 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your lump-sum or separate distributions. This includes details from your retirement plan and any prior tax returns that may affect your current filing. Next, follow these steps:

- Enter personal information, including your name, address, and Social Security number.

- Detail the amounts received from the retirement plan, specifying whether they are lump-sum or separate distributions.

- Calculate the taxable amount based on the instructions provided on the form.

- Review all entries for accuracy before submitting.

Legal Use of the IT 230 Form

The IT 230 form is legally binding when completed accurately and submitted on time. It complies with New York State tax laws, ensuring that taxpayers report their retirement distributions correctly. Proper use of the form helps avoid potential penalties and ensures that taxpayers fulfill their obligations under state tax regulations.

Filing Deadlines for the IT 230 Form

Timely filing of the IT 230 form is essential to avoid penalties. Typically, the form must be submitted by the same deadline as your annual tax return. It is advisable to check the New York State Department of Taxation and Finance for specific dates each tax year, as they may vary. Filing early can help ensure that any issues are addressed promptly.

Required Documents for the IT 230 Form

To complete the IT 230 form accurately, certain documents are required. These include:

- Statements from your retirement plan detailing the distributions received.

- Previous tax returns, which may provide context for your current tax situation.

- Any relevant documentation regarding deductions or credits that may apply.

Examples of Using the IT 230 Form

Understanding how to use the IT 230 form can be enhanced through practical examples. For instance, if a taxpayer receives a lump-sum distribution of $50,000 from a retirement account, they must report this amount on the IT 230 form. The form will guide them in determining the taxable portion and how it impacts their overall tax liability. Similarly, separate distributions received throughout the year must also be reported, allowing for accurate tax calculations.

Quick guide on how to complete instructions for form it 112 r new york state resident tax

Complete Instructions For Form IT 112 R New York State Resident Tax effortlessly on any gadget

Web-based document management has gained popularity among businesses and individuals alike. It offers a superb environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents rapidly without interruptions. Manage Instructions For Form IT 112 R New York State Resident Tax on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to modify and eSign Instructions For Form IT 112 R New York State Resident Tax with ease

- Obtain Instructions For Form IT 112 R New York State Resident Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes just seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form IT 112 R New York State Resident Tax and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 112 r new york state resident tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 112 r new york state resident tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 230 form and why is it important?

The IT 230 form is a crucial tax document used for various tax purposes. It helps businesses and individuals ensure compliance with tax regulations, making it essential for accurate reporting and potential deductions. Understanding this form can save you time and prevent errors during tax season.

-

How can airSlate SignNow help with the IT 230 form?

With airSlate SignNow, you can easily send and eSign the IT 230 form, streamlining your document workflow. Our platform allows for quick collaboration and secure storage, ensuring that your tax documents are managed efficiently. Simplifying the signing process can save you valuable time during tax filing.

-

Are there any costs associated with using airSlate SignNow for the IT 230 form?

airSlate SignNow offers a cost-effective solution for handling the IT 230 form, with various pricing plans to fit different business needs. You can choose the plan that best suits your volume of document management. This flexibility ensures you only pay for what you use, making it a budget-friendly option.

-

What features does airSlate SignNow offer for managing the IT 230 form?

Our platform provides features like template creation, collaborative editing, and secure cloud storage specifically for the IT 230 form. You can track the signing process in real-time and access your documents from anywhere, ensuring you have the necessary information at your fingertips. These features enhance your overall document management experience.

-

Can I integrate airSlate SignNow with other tools for processing the IT 230 form?

Yes, airSlate SignNow seamlessly integrates with various business tools commonly used for processing the IT 230 form, including CRM systems and accounting software. This integration enables you to automate workflows and reduce manual data entry. By connecting your favorite apps, you create a more streamlined document management system.

-

What are the benefits of using airSlate SignNow for the IT 230 form compared to traditional methods?

Using airSlate SignNow for the IT 230 form offers numerous benefits over traditional methods, such as increased efficiency and security. You eliminate the need for physical paperwork, reduce the chances of errors, and expedite the signing process. This digital approach helps you focus on what truly matters—growing your business.

-

Is airSlate SignNow easy to use for filing the IT 230 form?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy to prepare and eSign the IT 230 form. Our intuitive interface allows users of all skill levels to navigate the platform efficiently, ensuring a smooth experience from document creation to final signature.

Get more for Instructions For Form IT 112 R New York State Resident Tax

- Sc fee workers compensation form

- Hearing workers compensation 497325729 form

- Notice check bad 497325730 form

- South carolina property search form

- Mutual wills containing last will and testaments for man and woman living together not married with no children south carolina form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children south form

- Mutual wills or last will and testaments for man and woman living together not married with minor children south carolina form

- Non marital cohabitation living together agreement south carolina form

Find out other Instructions For Form IT 112 R New York State Resident Tax

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed