Form W 3 PR Uncle Fed's Tax*Board the Online Resource

What is the Form W-3 PR Uncle Fed's Tax*Board The Online Resource

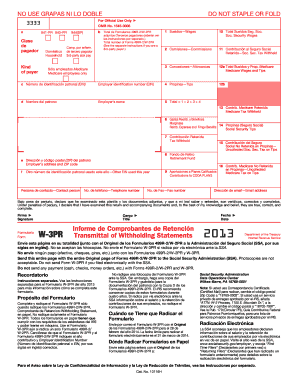

The Form W-3 PR is a crucial document for employers in Puerto Rico, serving as a summary of all W-2 forms issued to employees during the tax year. This form is submitted to the Uncle Fed's Tax*Board and is essential for reporting wages, tips, and other compensation. It ensures that the correct amounts are reported to the Internal Revenue Service (IRS) and helps maintain compliance with federal tax regulations. Understanding this form is vital for businesses operating in Puerto Rico, as it simplifies the reporting process and aids in accurate tax filings.

Steps to complete the Form W-3 PR Uncle Fed's Tax*Board The Online Resource

Completing the Form W-3 PR involves several key steps to ensure accuracy and compliance. First, gather all relevant employee information, including names, Social Security numbers, and total earnings from W-2 forms. Next, accurately fill out the form, ensuring that the totals match the combined figures from all W-2 forms issued. It is important to double-check all entries for errors, as inaccuracies can lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference. Keeping a copy for your records is advisable for future reference.

Legal use of the Form W-3 PR Uncle Fed's Tax*Board The Online Resource

The legal use of the Form W-3 PR is essential for employers to fulfill their tax obligations. This form must be filed annually, and it must accurately reflect the total wages paid to employees. Compliance with IRS regulations ensures that the form is recognized as legally binding. Employers should also be aware of the deadlines for submission to avoid any potential penalties. Utilizing a reliable platform for eSigning and submitting this form can enhance security and ensure that all legal requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-3 PR are critical to avoid late fees and penalties. Typically, the form must be submitted by the end of January following the tax year. Employers should mark their calendars and ensure that all necessary documentation is prepared ahead of time. Staying informed about any changes in deadlines or requirements from the IRS is also important, as these can affect compliance and reporting obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form W-3 PR can be submitted through various methods, offering flexibility to employers. It can be filed online through the IRS e-File system, which is often the fastest and most efficient option. Alternatively, employers can mail the completed form to the Uncle Fed's Tax*Board. In-person submissions may also be possible, depending on local regulations. Each method has its own advantages, and employers should choose the one that best suits their operational needs while ensuring compliance with submission guidelines.

Key elements of the Form W-3 PR Uncle Fed's Tax*Board The Online Resource

Key elements of the Form W-3 PR include the employer's identification information, total wages paid, and the number of W-2 forms submitted. It is essential to include accurate totals for each category to ensure that the form is processed correctly. Additionally, the form requires the signature of the employer or an authorized representative, affirming the accuracy of the reported information. Understanding these key components is vital for successful completion and submission of the form.

Quick guide on how to complete form w 3 pr uncle feds taxboard the online resource

Prepare Form W 3 PR Uncle Fed's Tax*Board The Online Resource effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Form W 3 PR Uncle Fed's Tax*Board The Online Resource on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Form W 3 PR Uncle Fed's Tax*Board The Online Resource effortlessly

- Locate Form W 3 PR Uncle Fed's Tax*Board The Online Resource and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form W 3 PR Uncle Fed's Tax*Board The Online Resource and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 3 pr uncle feds taxboard the online resource

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 3 PR Uncle Fed's Tax*Board The Online Resource?

Form W 3 PR Uncle Fed's Tax*Board The Online Resource is a streamlined digital tool that helps users manage and submit Form W-3PR, an important document for reporting Puerto Rico's income tax withholdings. It is designed to simplify tax filing for businesses and individuals alike.

-

How does airSlate SignNow assist with completing Form W 3 PR Uncle Fed's Tax*Board The Online Resource?

airSlate SignNow offers an intuitive interface that guides users through the steps of completing Form W 3 PR Uncle Fed's Tax*Board The Online Resource. With built-in templates and easy eSigning capabilities, users can quickly fill out and submit their forms with confidence.

-

What features come with the Form W 3 PR Uncle Fed's Tax*Board The Online Resource?

The Form W 3 PR Uncle Fed's Tax*Board The Online Resource includes features such as customizable templates, eSignature functionality, document tracking, and secure storage. These features ensure users can complete their filings efficiently and securely.

-

Is there a cost associated with using Form W 3 PR Uncle Fed's Tax*Board The Online Resource?

Yes, there is a subscription fee associated with accessing Form W 3 PR Uncle Fed's Tax*Board The Online Resource through airSlate SignNow. However, the service is cost-effective and saves time compared to traditional filing methods.

-

Can I integrate Form W 3 PR Uncle Fed's Tax*Board The Online Resource with my current systems?

Yes, airSlate SignNow allows seamless integrations with various business software and applications, making it easy to incorporate Form W 3 PR Uncle Fed's Tax*Board The Online Resource into your existing workflows. This interoperability enhances productivity and efficiency.

-

What are the benefits of using airSlate SignNow for Form W 3 PR Uncle Fed's Tax*Board The Online Resource?

Using airSlate SignNow for Form W 3 PR Uncle Fed's Tax*Board The Online Resource offers many benefits, including enhanced document security, reduced paper usage, and improved collaboration among team members. It streamlines the entire filing process.

-

Is support available for users of Form W 3 PR Uncle Fed's Tax*Board The Online Resource?

Absolutely! airSlate SignNow provides dedicated customer support for all users of Form W 3 PR Uncle Fed's Tax*Board The Online Resource. Users can access resources, FAQs, and direct assistance whenever needed.

Get more for Form W 3 PR Uncle Fed's Tax*Board The Online Resource

- Modelo sc 733 form

- Joining letter after medical leave for govt employees form

- Business tax organizer form

- Florida surety bonds form

- Lessee information form oregon lottery oregonlottery

- National lifeguard service theory 100 question assignment lifelink ca form

- Rev 614form ab1 alcoholic beverages excise retur

- Hotelmotel excise tax form ampamp instructions

Find out other Form W 3 PR Uncle Fed's Tax*Board The Online Resource

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement