Form 2ta

What is the Form 2ta?

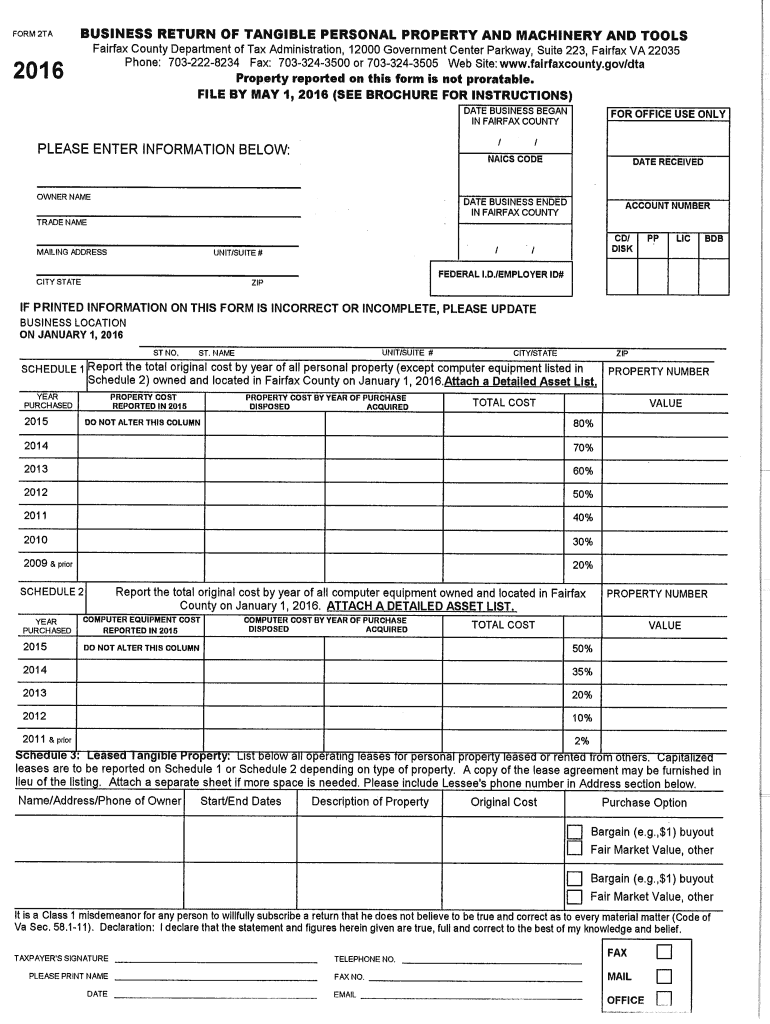

The Form 2ta, known as the Business Return of Tangible Personal Property, is a critical document used in Fairfax County for reporting business personal property. This form is essential for businesses to comply with local tax regulations. It captures details about the tangible personal property owned by a business, which may include equipment, furniture, and other physical assets. Accurate completion of this form ensures that businesses are correctly assessed for personal property tax obligations.

Steps to complete the Form 2ta

Completing the Form 2ta involves several key steps that ensure accuracy and compliance. Begin by gathering all necessary information regarding your business's tangible personal property. This includes a detailed list of assets, their purchase dates, and their estimated values. Next, fill out the form by entering the required information in each section, ensuring that all details are accurate. Double-check your entries for any errors or omissions. Finally, sign the form and prepare it for submission by the designated deadline.

Legal use of the Form 2ta

The Form 2ta serves a legal purpose in the assessment of business personal property taxes. By submitting this form, businesses declare their assets to the local tax authority, which is necessary for the fair taxation of personal property. It is important to understand that providing false information on this form can lead to penalties, including fines or legal action. Therefore, it is crucial to ensure that all information reported is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2ta are critical for compliance with local tax laws. Typically, the form must be submitted annually by a specific date, usually in early March. It is essential for businesses to stay informed about these deadlines to avoid late fees or penalties. Keeping a calendar with important dates related to the filing of the Form 2ta can help ensure timely submission and compliance with tax regulations.

Required Documents

When completing the Form 2ta, certain documents may be required to support the information provided. These documents can include purchase receipts, invoices, and any previous tax assessments related to personal property. Having these documents readily available will facilitate the accurate completion of the form and provide necessary evidence if requested by the tax authority.

Form Submission Methods

The Form 2ta can be submitted through various methods to accommodate different business needs. Businesses may choose to file the form online through the Fairfax County tax portal, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Each method has its own guidelines, so it is important to follow the instructions provided for the chosen submission method.

Penalties for Non-Compliance

Failure to submit the Form 2ta on time or providing inaccurate information can result in significant penalties. Businesses may face fines, interest on unpaid taxes, or additional assessments. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. It is advisable for businesses to consult with tax professionals if they have questions about their obligations regarding the Form 2ta.

Quick guide on how to complete form 2ta business return of tangible fairfaxcounty

Complete Form 2ta seamlessly on any device

Online document management has grown increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and safely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 2ta on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest method to alter and electronically sign Form 2ta effortlessly

- Obtain Form 2ta and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 2ta to guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the form 2ta business return of tangible fairfaxcounty

How to make an electronic signature for your Form 2ta Business Return Of Tangible Fairfaxcounty online

How to make an eSignature for your Form 2ta Business Return Of Tangible Fairfaxcounty in Chrome

How to make an electronic signature for signing the Form 2ta Business Return Of Tangible Fairfaxcounty in Gmail

How to make an electronic signature for the Form 2ta Business Return Of Tangible Fairfaxcounty from your smartphone

How to make an eSignature for the Form 2ta Business Return Of Tangible Fairfaxcounty on iOS

How to generate an eSignature for the Form 2ta Business Return Of Tangible Fairfaxcounty on Android OS

People also ask

-

What is the Fairfax County business return of tangible personal property?

The Fairfax County business return of tangible personal property is a tax form that businesses in Fairfax County must submit to report their tangible personal property assets. This includes items like equipment and furniture. Completing this return accurately is essential for compliance with local tax laws.

-

How does airSlate SignNow help with the Fairfax County business return of tangible personal property?

airSlate SignNow simplifies the process of signing and submitting documents related to the Fairfax County business return of tangible personal property. Our platform allows businesses to easily eSign documents securely and efficiently, ensuring that all necessary forms are completed correctly and on time.

-

Is there a cost associated with using airSlate SignNow for the Fairfax County business return of tangible personal property?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective, allowing businesses to manage their documents, including the Fairfax County business return of tangible personal property, without breaking the bank.

-

What features does airSlate SignNow offer for managing the Fairfax County business return of tangible personal property?

airSlate SignNow offers features such as easy document creation, eSigning, secure storage, and collaborative tools specifically for documents like the Fairfax County business return of tangible personal property. These features make managing your tax returns more streamlined and efficient.

-

Can I integrate airSlate SignNow with other software for the Fairfax County business return of tangible personal property?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow. This allows users to link their documents related to the Fairfax County business return of tangible personal property with accounting or management software for better efficiency.

-

What are the benefits of using airSlate SignNow for document handling?

Using airSlate SignNow for document handling, including the Fairfax County business return of tangible personal property, offers numerous benefits such as enhanced security, easy record-keeping, and improved turnaround times. This ensures that your business remains compliant while also saving you time and effort.

-

How secure is airSlate SignNow for submitting the Fairfax County business return of tangible personal property?

airSlate SignNow prioritizes security, employing advanced encryption technology to protect your documents, including those related to the Fairfax County business return of tangible personal property. You can trust that your sensitive data will remain confidential and secure throughout the process.

Get more for Form 2ta

- Annual escrow account disclosure statement format

- Student loan form

- Patriot act form 369196329

- What is the constitution by anita kim venegas form

- Irs depreciation tables form

- Achieving success the crucial role of goal setting in form

- Kaba lock service request form kaba lock service request

- Heartwarming handmade gifts for local veterans form

Find out other Form 2ta

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement