Irs Depreciation Tables 2023-2026

What is the IRS Depreciation Tables

The IRS depreciation tables provide essential guidelines for taxpayers to calculate depreciation on various types of property. These tables outline the useful life of assets and the corresponding depreciation methods, including straight-line and declining balance methods. Understanding these tables is crucial for accurately reporting depreciation on tax returns, particularly for businesses and individuals who own significant assets.

How to Use the IRS Depreciation Tables

To effectively use the IRS depreciation tables, taxpayers should first identify the type of asset they are depreciating. Each asset class has a specific recovery period outlined in the tables. Once the asset class is determined, taxpayers can select the appropriate method of depreciation. For example, the straight-line method spreads the cost evenly over the asset's useful life, while the declining balance method allows for larger deductions in the earlier years. Accurate calculations are essential to ensure compliance with IRS regulations.

Key Elements of the IRS Depreciation Tables

Key elements of the IRS depreciation tables include the asset class, recovery period, and depreciation method. The asset class categorizes property types, such as residential rental property or commercial property. The recovery period indicates how many years the asset will be depreciated. Additionally, the tables specify the applicable depreciation methods, which can vary based on the asset's classification. Familiarity with these elements helps taxpayers make informed decisions regarding asset management and tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for tax returns that include depreciation calculations are critical for compliance. Typically, individual taxpayers must file their returns by April fifteenth, while businesses may have different deadlines based on their structure. It is important to keep track of these dates to avoid penalties and interest on unpaid taxes. Additionally, taxpayers should be aware of any changes in deadlines that may occur due to legislation or IRS announcements.

Required Documents

To accurately complete depreciation calculations using the IRS depreciation tables, several documents are required. Taxpayers should have purchase invoices, asset acquisition dates, and any prior depreciation records. These documents provide the necessary information to determine the asset's cost basis and useful life. Keeping organized records will facilitate the accurate reporting of depreciation on tax returns and support claims in case of an audit.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding depreciation can result in significant penalties. Taxpayers who incorrectly report depreciation may face fines, interest on unpaid taxes, or even audits. It is crucial to ensure that all calculations align with IRS guidelines to avoid these consequences. Understanding the importance of accurate reporting will help taxpayers maintain compliance and protect themselves from financial penalties.

Quick guide on how to complete irs depreciation tables

Prepare Irs Depreciation Tables effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Irs Depreciation Tables on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Irs Depreciation Tables with ease

- Obtain Irs Depreciation Tables and click Get Form to begin.

- Utilize our tools to complete your form.

- Highlight key sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Depreciation Tables to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs depreciation tables

Create this form in 5 minutes!

How to create an eSignature for the irs depreciation tables

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

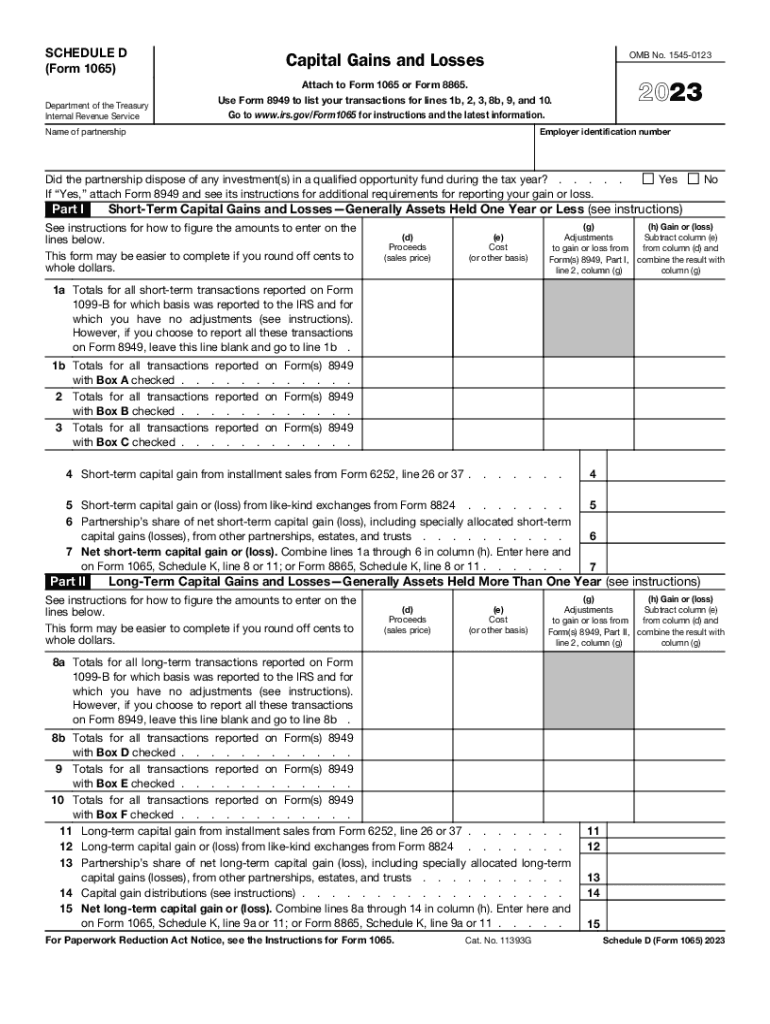

What is IRS Schedule D and why is it important for businesses?

IRS Schedule D is used to report capital gains and losses from the sale of assets. For businesses, accurately completing IRS Schedule D is crucial as it affects the overall tax liability. Understanding how to fill out this form correctly ensures compliance with tax regulations and avoids potential penalties.

-

How can airSlate SignNow assist with signing IRS Schedule D documents?

AirSlate SignNow facilitates the electronic signing process, making it easier for businesses to sign IRS Schedule D documents quickly and securely. With its user-friendly interface, you can invite multiple signers and track the signing process in real-time. This streamlines the preparation and submission of tax forms.

-

What features does airSlate SignNow offer for managing IRS Schedule D filings?

AirSlate SignNow offers features like document templates, customizable workflows, and automated reminders to help manage IRS Schedule D filings efficiently. These features ensure that all necessary signatures are obtained promptly and that the forms are filed on time. This reduces the risk of errors and enhances your tax filing process.

-

Is airSlate SignNow compatible with IRS Schedule D tax preparation software?

Yes, airSlate SignNow integrates seamlessly with popular tax preparation software, allowing for easy management of IRS Schedule D documents. This integration ensures that you can eSign documents directly from your tax software dashboard, optimizing your workflow and reducing the time spent on paperwork.

-

What are the pricing options for airSlate SignNow when dealing with IRS Schedule D documents?

AirSlate SignNow offers various pricing plans that cater to different business needs, making it cost-effective for managing IRS Schedule D documentation. You can choose from individual, team, or enterprise plans, depending on the number of users and features required. An affordable solution ensures you can manage your tax documents without breaking the bank.

-

Can airSlate SignNow help with IRS Schedule D audits?

Absolutely! AirSlate SignNow provides detailed audit trails and access to signed IRS Schedule D documents whenever needed. This feature is invaluable during audits, as it helps demonstrate compliance and provides proof that all necessary steps were properly followed in the document signing process.

-

How secure is airSlate SignNow when handling sensitive IRS Schedule D information?

AirSlate SignNow prioritizes security with advanced encryption and compliance with industry standards to protect sensitive IRS Schedule D information. Your documents are stored securely, ensuring that only authorized users have access. This level of security allows you to confidently manage your tax documents online.

Get more for Irs Depreciation Tables

Find out other Irs Depreciation Tables

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA