Uta Tax Exempt Form

What is the Uta Tax Exempt Form

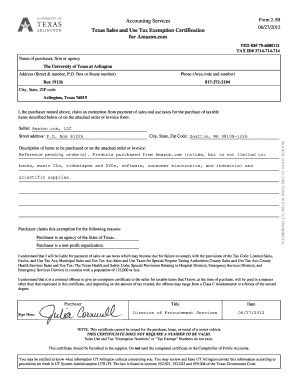

The Uta Tax Exempt Form is a specific document used by eligible individuals and organizations to claim tax-exempt status in the state of Utah. This form is crucial for those who qualify, as it allows them to avoid paying certain taxes, thereby reducing their financial burden. The form typically requires detailed information about the applicant, including their tax identification number, the nature of the exemption being claimed, and supporting documentation that verifies eligibility. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax regulations.

How to Use the Uta Tax Exempt Form

Using the Uta Tax Exempt Form involves several key steps. First, applicants must determine their eligibility for tax exemption based on state guidelines. Once eligibility is confirmed, the applicant should carefully fill out the form, ensuring all required fields are completed accurately. It is important to gather any necessary documentation that supports the claim for exemption, such as proof of nonprofit status or educational institution affiliation. After completing the form, it should be submitted to the appropriate state agency for processing.

Steps to Complete the Uta Tax Exempt Form

Completing the Uta Tax Exempt Form requires attention to detail. Here are the steps to follow:

- Review eligibility criteria to confirm that you qualify for tax exemption.

- Download the Uta Tax Exempt Form from the official state website or obtain a physical copy.

- Fill out the form, ensuring that all information is accurate and complete.

- Attach any required documentation that supports your claim.

- Double-check the form for any errors before submission.

- Submit the completed form to the designated state agency, either online or by mail.

Legal Use of the Uta Tax Exempt Form

The legal use of the Uta Tax Exempt Form is governed by state tax laws. It is important to ensure that the form is used only by eligible entities and individuals, as misuse can lead to penalties or denial of the exemption. The form must be completed in accordance with the guidelines provided by the state, and all claims for exemption should be supported by appropriate documentation. Compliance with these legal requirements is essential for maintaining tax-exempt status.

Key Elements of the Uta Tax Exempt Form

The Uta Tax Exempt Form includes several key elements that applicants must pay attention to. These elements typically include:

- Applicant Information: Name, address, and tax identification number of the applicant.

- Type of Exemption: A clear indication of the specific tax exemption being claimed.

- Supporting Documentation: Any required documents that verify eligibility for the exemption.

- Signature: The form must be signed by an authorized representative of the applicant.

Filing Deadlines / Important Dates

Filing deadlines for the Uta Tax Exempt Form can vary based on the type of exemption being claimed and the applicant's specific circumstances. It is crucial to be aware of these deadlines to ensure timely submission. Generally, applications should be submitted well in advance of the tax year for which the exemption is being claimed. Keeping track of important dates helps avoid penalties and ensures that the exemption is granted without delays.

Quick guide on how to complete uta tax exempt form

Complete Uta Tax Exempt Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can procure the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle Uta Tax Exempt Form on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to alter and eSign Uta Tax Exempt Form without any hassle

- Obtain Uta Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Uta Tax Exempt Form and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uta tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the uta 1098 t tax form?

The uta 1098 t tax form is a document that universities provide to students to report qualified tuition and related expenses to the IRS. This form is essential for students looking to claim education tax credits. Understanding how to interpret this form can benefit students during tax season.

-

How can airSlate SignNow help with the uta 1098 t tax form?

airSlate SignNow streamlines the process of signing and sending the uta 1098 t tax form electronically. With our platform, you can ensure that your tax form is securely signed and delivered without the hassles of traditional paperwork. This makes tax preparation much easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for the uta 1098 t tax form?

Yes, airSlate SignNow offers affordable pricing plans based on the features you need, making it accessible for both individuals and businesses. The cost-effectiveness of using our platform ensures that you can manage your documents, including the uta 1098 t tax form, without breaking the bank. Explore our plans to find the best fit for your needs.

-

What features does airSlate SignNow offer for managing the uta 1098 t tax form?

Our platform provides a variety of features including eSignature capabilities, document templates, and secure storage, all of which enhance the management of the uta 1098 t tax form. These tools help users efficiently create, sign, and store their tax documents, ensuring compliance and ease of access.

-

Can I integrate airSlate SignNow with other software for the uta 1098 t tax form?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your workflow for the uta 1098 t tax form. Connect with platforms like Salesforce, Google Workspace, or other financial software to centralize your document management process.

-

What are the benefits of using airSlate SignNow for the uta 1098 t tax form?

Using airSlate SignNow for the uta 1098 t tax form offers numerous benefits, such as increased efficiency, enhanced document security, and reduced processing time. Our user-friendly interface allows you to quickly prepare and send your tax forms. This ensures that you never miss important deadlines during tax season.

-

How secure is airSlate SignNow when handling the uta 1098 t tax form?

Security is a priority at airSlate SignNow. Our platform uses bank-grade encryption to safeguard your data while handling the uta 1098 t tax form. You can trust that your sensitive information is protected throughout the entire document signing and management process.

Get more for Uta Tax Exempt Form

- Conversion agreement form

- Security agreement regarding borrowing of funds and granting of security interest in assets form

- Computer agreement form

- Reciprocal license agreement form

- Software license agreement form

- Technology license agreement 497336858 form

- Sun community microsystems incorporation form

- Lease agreement between 497336860 form

Find out other Uta Tax Exempt Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document