Bbva Compass Ira Form

What is the Bbva Compass Ira

The Bbva Compass IRA is an individual retirement account offered by BBVA, designed to help individuals save for retirement while enjoying potential tax benefits. This account allows contributions to grow tax-deferred until withdrawal, making it an attractive option for long-term savings. Investors can choose between traditional and Roth IRA options, each with distinct tax implications and withdrawal rules. Understanding these differences is essential for making informed financial decisions regarding retirement planning.

How to obtain the Bbva Compass Ira

To obtain a Bbva Compass IRA, individuals typically need to follow a straightforward process. First, potential account holders should visit a BBVA branch or the bank's website to gather information about the available IRA options. After selecting the appropriate type of IRA, applicants must complete the necessary paperwork, which may include providing personal identification and financial information. It is advisable to consult with a BBVA representative to ensure all requirements are met and to discuss any questions regarding the account setup.

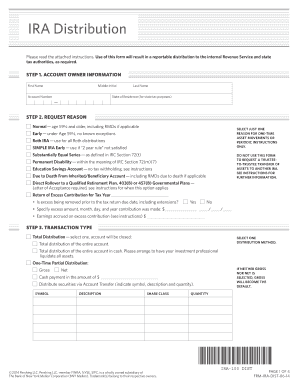

Steps to complete the Bbva Compass Ira

Completing the Bbva Compass IRA involves several key steps:

- Choose the type of IRA: Decide between a traditional IRA or a Roth IRA based on your financial goals.

- Gather necessary documentation: Prepare personal identification, Social Security number, and financial information.

- Fill out the application: Complete the required forms either online or in person at a BBVA branch.

- Fund your account: Make an initial contribution to activate your IRA, adhering to IRS contribution limits.

- Review account details: Confirm that all information is accurate and understand the terms and conditions of your IRA.

Legal use of the Bbva Compass Ira

The legal use of the Bbva Compass IRA is governed by IRS regulations, which outline contribution limits, withdrawal rules, and tax implications. To maintain compliance, account holders must adhere to annual contribution limits and ensure that funds are used for qualified expenses. Additionally, understanding the penalties associated with early withdrawals or non-compliance with IRS rules is crucial for protecting retirement savings. Consulting with a financial advisor can provide clarity on legal obligations and help avoid potential issues.

Key elements of the Bbva Compass Ira

Several key elements define the Bbva Compass IRA, including:

- Contribution Limits: Annual contributions are subject to IRS limits, which may vary based on age and account type.

- Tax Advantages: Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement.

- Investment Options: Account holders can typically choose from a range of investment vehicles, including stocks, bonds, and mutual funds.

- Withdrawal Rules: Understanding the rules for withdrawals, including penalties for early access, is essential for effective retirement planning.

IRS Guidelines

IRS guidelines play a critical role in the management of the Bbva Compass IRA. These guidelines specify contribution limits, eligibility criteria, and tax treatment of distributions. For example, individuals under the age of fifty can contribute a maximum amount each year, while those fifty and older may qualify for catch-up contributions. Additionally, the IRS outlines the rules for required minimum distributions (RMDs) that must begin at a certain age. Familiarity with these guidelines ensures compliance and maximizes the benefits of the IRA.

Quick guide on how to complete bbva compass ira

Complete Bbva Compass Ira effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Bbva Compass Ira on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The simplest way to modify and eSign Bbva Compass Ira with ease

- Find Bbva Compass Ira and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Choose your preferred method to send your form via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Bbva Compass Ira and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bbva compass ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BBVA Compass IRA and how does it work?

A BBVA Compass IRA is an individual retirement account offered by BBVA Compass that helps you save for retirement in a tax-advantaged way. It works by allowing you to deposit funds that can grow tax-deferred until you withdraw them during retirement. With various investment options available, it's designed to meet your specific retirement goals.

-

What types of BBVA Compass IRA accounts are available?

BBVA Compass offers several types of IRAs, including Traditional IRAs, Roth IRAs, and SEP IRAs. Each type has its own tax implications and benefits, catering to different financial situations and retirement plans. By understanding these options, you can choose the BBVA Compass IRA that best suits your needs.

-

What are the fees associated with a BBVA Compass IRA?

The fees for a BBVA Compass IRA may vary depending on the account type and the investments you choose. Generally, there may be annual maintenance fees and transaction costs associated with certain investments. It’s essential to review the account details carefully to understand all applicable charges related to your BBVA Compass IRA.

-

What are the benefits of opening a BBVA Compass IRA?

Opening a BBVA Compass IRA allows you to benefit from tax advantages while saving for retirement. Additionally, you gain access to a range of investment options and expert financial guidance from BBVA. This can signNowly enhance your retirement savings strategy compared to traditional savings accounts.

-

Can I transfer funds from another IRA to a BBVA Compass IRA?

Yes, you can easily transfer funds from another IRA to a BBVA Compass IRA without incurring tax penalties. This process is commonly known as a 'rollover' and allows you to consolidate your retirement savings into one account. It's a smart way to streamline your investments and potentially lower fees.

-

What investment options are available through a BBVA Compass IRA?

A BBVA Compass IRA offers a variety of investment options, including stocks, bonds, mutual funds, and ETFs. This diverse range allows you to create a tailored portfolio that aligns with your risk tolerance and retirement goals. Reviewing these options with a financial advisor can help maximize your investment potential.

-

How can I manage my BBVA Compass IRA account online?

Managing your BBVA Compass IRA account online is convenient and user-friendly. You can log in to their online banking platform to view your balance, track investments, and make transactions at any time. This online access ensures that you remain informed about your retirement savings effortlessly.

Get more for Bbva Compass Ira

Find out other Bbva Compass Ira

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document