Connecticut Higher Education Trust CHET Gift Deposit Form

What is the Connecticut Higher Education Trust CHET Gift Deposit Form

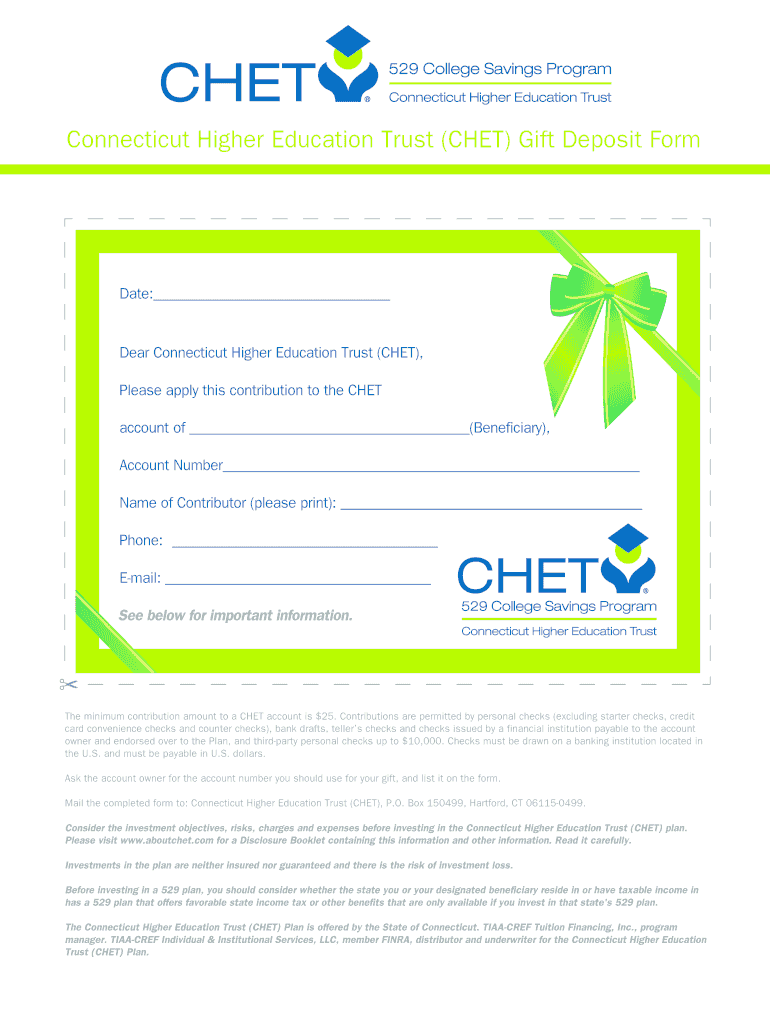

The Connecticut Higher Education Trust (CHET) Gift Deposit Form is a crucial document for individuals wishing to contribute to a CHET account. This form allows family and friends to make financial gifts toward a beneficiary's higher education savings. It is specifically designed to facilitate contributions to a Connecticut 529 college savings plan, ensuring that funds are allocated correctly for educational expenses. By using this form, contributors can easily track their donations and ensure compliance with state regulations regarding educational savings accounts.

How to use the Connecticut Higher Education Trust CHET Gift Deposit Form

Using the CHET Gift Deposit Form involves several straightforward steps. First, ensure that you have the correct form, which can be obtained from the Connecticut Higher Education Trust website or other authorized sources. Next, fill out the required fields, including the beneficiary's information and the amount of the gift. Once completed, the form can be submitted either online or via mail, depending on your preference. It is essential to keep a copy of the form for your records, as it serves as proof of the contribution for both the giver and the beneficiary.

Steps to complete the Connecticut Higher Education Trust CHET Gift Deposit Form

Completing the CHET Gift Deposit Form requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the CHET Gift Deposit Form from an official source.

- Fill in the beneficiary's name and CHET account number accurately.

- Enter the donor's information, including name and contact details.

- Specify the gift amount and any additional notes if necessary.

- Review the completed form for accuracy before submission.

- Submit the form online through the CHET portal or mail it to the designated address.

Legal use of the Connecticut Higher Education Trust CHET Gift Deposit Form

The legal use of the CHET Gift Deposit Form is governed by state regulations that ensure contributions are made in compliance with Connecticut's educational savings laws. To be considered valid, the form must be filled out completely and accurately. Electronic submissions are legally binding, provided they meet the requirements outlined by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). It is advisable to retain a copy of the submitted form for future reference and to confirm compliance with any applicable tax laws.

Key elements of the Connecticut Higher Education Trust CHET Gift Deposit Form

Several key elements are essential for the CHET Gift Deposit Form to be effective:

- Beneficiary Information: This includes the name and CHET account number of the individual receiving the gift.

- Donor Information: The form requires the donor's name, address, and contact details.

- Gift Amount: Clearly state the amount being contributed to the beneficiary's account.

- Signature: The donor's signature or electronic confirmation is necessary to validate the transaction.

- Date: The date of the gift must be included to ensure proper record-keeping.

Form Submission Methods

The CHET Gift Deposit Form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Use the Connecticut Higher Education Trust website to submit the form electronically.

- Mail Submission: Print the completed form and send it to the designated address for processing.

- In-Person Submission: Visit a local CHET office to deliver the form directly, if applicable.

Quick guide on how to complete connecticut higher education trust chet gift deposit form

Complete Connecticut Higher Education Trust CHET Gift Deposit Form effortlessly on any device

Digital document management has gained immense traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents swiftly without interruptions. Manage Connecticut Higher Education Trust CHET Gift Deposit Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Connecticut Higher Education Trust CHET Gift Deposit Form seamlessly

- Locate Connecticut Higher Education Trust CHET Gift Deposit Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your modifications.

- Select your preferred method to submit your form, whether by email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Alter and eSign Connecticut Higher Education Trust CHET Gift Deposit Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut higher education trust chet gift deposit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Connecticut Higher Education Trust?

The Connecticut Higher Education Trust (CHET) is a state-sponsored college savings program designed to help families save for higher education expenses. With tax advantages and flexible investment options, the Connecticut Higher Education Trust makes saving for college more accessible and efficient.

-

How does the Connecticut Higher Education Trust benefit families?

The Connecticut Higher Education Trust offers numerous benefits, including tax-free growth on investments and tax deductions for contributions. Families can save effectively for their children's futures while enjoying peace of mind knowing their funds are working towards higher education expenses.

-

What are the investment options available with the Connecticut Higher Education Trust?

The Connecticut Higher Education Trust provides a variety of investment options that cater to different risk tolerances and financial goals. Investors can choose from age-based portfolios or individual fund options, ensuring flexibility and personalization to best fit their higher education savings strategy.

-

What are the fees associated with the Connecticut Higher Education Trust?

The Connecticut Higher Education Trust has low annual maintenance fees and no account opening or contribution fees, making it a cost-effective solution for families. Understanding these costs helps families plan effectively and maximize their savings for higher education.

-

Can funds from the Connecticut Higher Education Trust be used for any educational institution?

Yes, the funds from the Connecticut Higher Education Trust can be used for qualified expenses at eligible colleges, universities, and vocational schools nationwide. This flexibility allows families to tailor their educational choices while effectively utilizing their higher education savings.

-

How do I apply for the Connecticut Higher Education Trust?

Applying for the Connecticut Higher Education Trust is a straightforward process that can be completed online. Interested families can visit the official CHET website, provide necessary personal information, and set up their saving plan in just a few simple steps.

-

What happens to the Connecticut Higher Education Trust if my child doesn't go to college?

If your child decides not to attend college, you have options with the Connecticut Higher Education Trust. You can change the beneficiary to another eligible family member or withdraw the funds, although taxes and penalties may apply depending on the circumstances.

Get more for Connecticut Higher Education Trust CHET Gift Deposit Form

Find out other Connecticut Higher Education Trust CHET Gift Deposit Form

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe