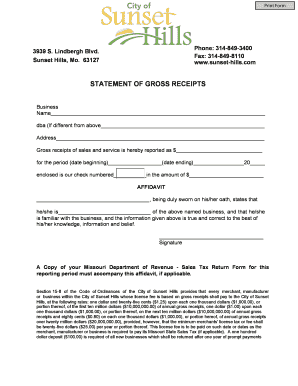

Declaration of Gross Receipts Form

What is the declaration of gross receipts?

The declaration of gross receipts is a formal document used by businesses to report their total revenue generated during a specific period. This declaration is crucial for various purposes, including tax filings, compliance with state regulations, and eligibility for certain programs. Gross receipts encompass all income received by a business, regardless of the source, and are essential for understanding a company's financial health. Businesses must ensure accuracy in reporting to avoid potential legal issues or penalties.

How to use the declaration of gross receipts

Using the declaration of gross receipts involves several steps to ensure compliance and accuracy. First, gather all relevant financial records, including sales receipts, invoices, and any other documentation that reflects income. Next, accurately calculate the total gross receipts for the reporting period, ensuring that all sources of income are included. Once the total is determined, fill out the declaration form, providing all required information clearly and accurately. Finally, submit the completed form to the appropriate authority, whether it be a state agency or the IRS, depending on the specific requirements for your business.

Steps to complete the declaration of gross receipts

Completing the declaration of gross receipts involves a systematic approach to ensure all necessary information is captured. Follow these steps:

- Gather financial documents, including sales records and invoices.

- Calculate total gross receipts by summing all income sources.

- Fill out the declaration form with accurate figures and details.

- Review the form for any errors or omissions.

- Submit the form according to the specified guidelines, either online or via mail.

Key elements of the declaration of gross receipts

Several key elements must be included in the declaration of gross receipts to ensure it meets legal and regulatory standards. These elements typically include:

- The business name and address.

- The reporting period for which gross receipts are being declared.

- A detailed breakdown of all income sources.

- The total amount of gross receipts.

- Signature of the authorized representative of the business.

IRS guidelines

The IRS provides specific guidelines regarding the declaration of gross receipts, particularly for tax reporting purposes. Businesses must adhere to these guidelines to ensure compliance and avoid penalties. Key aspects include:

- Understanding what constitutes gross receipts for tax purposes.

- Accurate reporting of all income, including cash, credit, and barter transactions.

- Filing the declaration in conjunction with the appropriate tax forms, such as the Schedule C for sole proprietors.

Filing deadlines / important dates

Filing deadlines for the declaration of gross receipts can vary depending on the type of business entity and the reporting period. Generally, businesses should be aware of the following important dates:

- Annual tax return deadlines, typically April 15 for individual taxpayers.

- Quarterly estimated tax payment deadlines, which may require interim declarations of gross receipts.

- State-specific deadlines that may differ from federal requirements.

Quick guide on how to complete declaration of gross receipts

Effortlessly Prepare Declaration Of Gross Receipts on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Handle Declaration Of Gross Receipts on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Declaration Of Gross Receipts with Ease

- Locate Declaration Of Gross Receipts and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering the form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Declaration Of Gross Receipts to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration of gross receipts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are gross receipts in the context of airSlate SignNow?

Gross receipts refer to the total income a business receives from its operations, including sales and services before any deductions. With airSlate SignNow, you can streamline your document signing processes to ensure that your records of gross receipts are accurately maintained and easily accessible.

-

How can airSlate SignNow help me manage my gross receipts?

Using airSlate SignNow allows you to eSign and send documents related to your gross receipts quickly and securely. This not only reduces paper clutter but also ensures that important financial documents are organized and stored properly for easy retrieval and record-keeping.

-

Is airSlate SignNow a cost-effective solution for tracking gross receipts?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage their gross receipts efficiently. With its competitive pricing plans, you can save on operational costs related to paper and printing while taking advantage of the software’s automation features.

-

What features of airSlate SignNow are useful for handling gross receipts?

AirSlate SignNow includes features such as customizable templates, automated reminders, and cloud storage that can enhance your management of gross receipts. These features ensure that your documentation process is streamlined, helping you keep track of all incoming and outgoing financial records effortlessly.

-

Does airSlate SignNow integrate with accounting software for gross receipts?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to track your gross receipts alongside other financial data. This integration facilitates real-time data updates and accurate financial reporting, making it easier to manage your business finances.

-

Can I access my gross receipts documentation from multiple devices?

Absolutely! AirSlate SignNow is a cloud-based platform that allows you to access your gross receipts documentation from any device with internet connectivity. This flexibility ensures that you can manage your documents on-the-go and have important information at your fingertips whenever you need it.

-

How secure is airSlate SignNow for handling sensitive financial documents like gross receipts?

AirSlate SignNow prioritizes security, employing advanced encryption technology to protect your sensitive financial documents, including gross receipts. The platform also provides user authentication features and regular backups to ensure that your data remains safe and secure at all times.

Get more for Declaration Of Gross Receipts

Find out other Declaration Of Gross Receipts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors