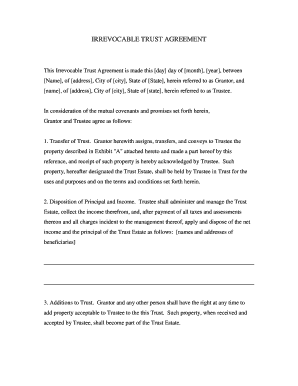

IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms 2009

Understanding the irrevocable trust agreement

An irrevocable trust agreement is a legal document that establishes a trust which cannot be modified or terminated without the permission of the beneficiaries. This type of trust is used to manage assets, protect them from creditors, and reduce estate taxes. Once assets are transferred into an irrevocable trust, the grantor relinquishes control over them, which can provide significant tax benefits and asset protection. It is essential to understand the implications of creating such a trust, as it involves a permanent decision regarding the management and distribution of your assets.

Steps to complete the irrevocable trust agreement

Filling out the irrevocable trust form involves several key steps to ensure it is legally binding and accurately reflects your intentions. Begin by gathering necessary information, including details about the grantor, trustee, and beneficiaries. Next, clearly outline the terms of the trust, including how assets will be managed and distributed. It is advisable to consult with a legal professional to ensure that all legal requirements are met and that the document adheres to state-specific laws. Once the form is completed, all parties must sign it in the presence of a notary public to validate the agreement.

Key elements of the irrevocable trust agreement

Several critical components must be included in an irrevocable trust agreement to ensure its effectiveness. These elements typically consist of:

- Grantor Information: The individual creating the trust.

- Trustee Information: The person or entity responsible for managing the trust.

- Beneficiary Designation: Individuals or entities that will receive the trust assets.

- Asset Description: A detailed list of the assets being transferred into the trust.

- Terms of Distribution: Guidelines on how and when the assets will be distributed to beneficiaries.

- Governing Law: The state law that will govern the trust.

Legal use of the irrevocable trust agreement

The irrevocable trust agreement serves various legal purposes, including asset protection and tax planning. By placing assets in an irrevocable trust, the grantor can shield them from creditors and legal judgments. Additionally, this type of trust can help reduce estate taxes, as assets transferred into the trust are no longer considered part of the grantor's taxable estate. It is crucial to ensure that the trust complies with relevant state laws and federal regulations to maintain its legal standing and benefits.

State-specific rules for the irrevocable trust agreement

Each state in the U.S. has its own rules and regulations governing irrevocable trusts. These can include specific requirements for the formation, execution, and administration of the trust. It is essential to research the laws in your state to ensure compliance. For example, some states may have unique requirements regarding the witnessing of signatures or the types of assets that can be placed in an irrevocable trust. Consulting with a legal expert familiar with your state's laws can help navigate these complexities.

Examples of using the irrevocable trust agreement

Irrevocable trusts can be used in various scenarios to achieve specific financial and estate planning goals. Common examples include:

- Medicaid Planning: Protecting assets from being counted for Medicaid eligibility.

- Charitable Giving: Establishing a trust to benefit a charity while providing tax deductions.

- Wealth Transfer: Transferring wealth to heirs while minimizing estate taxes.

These examples illustrate how irrevocable trusts can be tailored to meet individual needs and objectives, providing both financial security and peace of mind.

Quick guide on how to complete irrevocable trust agreement legal forms legalforms

Accomplish IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms effortlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers a flawless eco-conscious substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to design, modify, and electronically sign your documents swiftly without any hold-ups. Handle IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms on any gadget using the airSlate SignNow applications for Android or iOS and enhance any document-based task today.

The optimal way to modify and electronically sign IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms without breaking a sweat

- Find IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you choose. Modify and electronically sign IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irrevocable trust agreement legal forms legalforms

Create this form in 5 minutes!

How to create an eSignature for the irrevocable trust agreement legal forms legalforms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are irrevocable trust forms?

Irrevocable trust forms are legal documents that establish an irrevocable trust, meaning the trust cannot be altered or revoked once created. These forms outline the terms and conditions of the trust, including the assets involved and the rights of the beneficiaries. Using these forms can help in effective estate planning and asset protection.

-

How can airSlate SignNow help with irrevocable trust forms?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing and signing irrevocable trust forms. Users can easily fill out the forms online, ensuring all necessary information is accurately captured. Additionally, our solution allows for secure e-signatures, making the document execution process convenient and efficient.

-

Are there any costs associated with using airSlate SignNow for irrevocable trust forms?

Yes, there are several pricing plans available for using airSlate SignNow, which accommodate different usage levels based on your needs. These plans provide access to features that streamline the management of irrevocable trust forms, making it a cost-effective solution for businesses and individuals alike. Check our pricing page for more details.

-

What features does airSlate SignNow offer for managing irrevocable trust forms?

airSlate SignNow offers a range of features tailored for managing irrevocable trust forms, including customizable templates, secure e-signature capabilities, and document tracking. Users can easily collaborate with attorneys or advisors and ensure that all parties involved have access to the necessary forms. This enhances the overall efficiency of the trust creation process.

-

Can I store my irrevocable trust forms securely using airSlate SignNow?

Absolutely! airSlate SignNow offers secure cloud storage for all your documents, including irrevocable trust forms. Our platform employs advanced security measures to protect your sensitive information, providing peace of mind as you manage important legal documents. You can easily access and retrieve your stored forms whenever needed.

-

Is airSlate SignNow compliant with legal standards for irrevocable trust forms?

Yes, airSlate SignNow complies with various legal standards to ensure that your irrevocable trust forms are valid and recognized. We follow best practices in electronic signing and document management, helping you maintain compliance with state laws regarding trust documents. Our commitment to legal standards ensures the integrity of your documents.

-

Can I integrate airSlate SignNow with other software for managing irrevocable trust forms?

Yes, airSlate SignNow provides integration options with various software applications that can enhance your workflow for managing irrevocable trust forms. We support integrations with popular platforms to streamline your document management processes. This allows for seamless collaboration and improved efficiency in managing trust documentation.

Get more for IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms

- Revised consent disclose simcoe holistic health form

- Askari bank pay order form pdf

- Review exercise form

- Philcongenmilan form

- Member advance notice form for the involvement of a nonparticipating provider

- Form rp 425613application for school tax town of ramapo ramapo

- Standard form 76 federal post card application fpca

- Student progress report universiti selangor cgs unisel edu form

Find out other IRREVOCABLE TRUST AGREEMENT Legal Forms Legalforms

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure