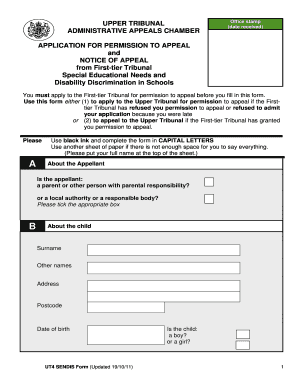

What is a Ut4 Form 2011

What is the What Is A Ut4 Form

The UT4 form is a tax document used in the United States, specifically for reporting and remitting certain types of taxes. It is primarily utilized by businesses to report withholding taxes on payments made to non-resident aliens or foreign entities. This form ensures that the correct amount of tax is withheld and reported to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the UT4 form is essential for compliance with U.S. tax laws.

How to use the What Is A Ut4 Form

Using the UT4 form involves several steps to ensure accurate reporting and compliance. First, businesses must gather necessary information about the payee, including their tax identification number and residency status. Next, the form must be completed accurately, detailing the payments made and the corresponding tax withheld. Once filled out, the form should be submitted to the IRS along with any required payments. It is crucial to keep a copy for your records to ensure proper documentation in case of an audit.

Steps to complete the What Is A Ut4 Form

Completing the UT4 form involves a systematic approach:

- Gather the required information about the payee, including their name, address, and taxpayer identification number.

- Determine the appropriate withholding tax rate based on the payee's residency status and the type of payment.

- Fill out the UT4 form accurately, ensuring all figures are correct and correspond to the payments made.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the IRS by the specified deadline, along with any tax payments owed.

Legal use of the What Is A Ut4 Form

The UT4 form is legally binding when completed and submitted according to IRS guidelines. It serves as a formal declaration of the taxes withheld and ensures compliance with federal tax laws. Failure to use the form correctly can lead to penalties and interest on unpaid taxes. Therefore, it is essential for businesses to understand the legal implications of the UT4 form and to use it appropriately to avoid potential legal issues.

Who Issues the Form

The UT4 form is issued by the Internal Revenue Service (IRS), the U.S. federal agency responsible for tax collection and enforcement of tax laws. Businesses must use the official form provided by the IRS to ensure compliance and accuracy in their tax reporting. It is important to obtain the most current version of the form directly from the IRS to avoid any discrepancies or outdated information.

Filing Deadlines / Important Dates

Filing deadlines for the UT4 form are critical for compliance. Typically, the form must be submitted by the end of the month following the close of the tax period in which the payments were made. For example, if payments were made in January, the UT4 form would generally be due by the end of February. It is important to stay updated on specific deadlines each tax year, as they may vary or change due to IRS regulations.

Quick guide on how to complete what is a ut4 form

Effortlessly Prepare What Is A Ut4 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage What Is A Ut4 Form on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign What Is A Ut4 Form with Ease

- Find What Is A Ut4 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require new printed document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign What Is A Ut4 Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is a ut4 form

Create this form in 5 minutes!

How to create an eSignature for the what is a ut4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UT4 form?

A UT4 form is a tax-related document used in Canada for reporting specific income tax withholdings. It is essential for businesses and freelancers to understand when dealing with government agencies. Knowing what a UT4 form is can streamline tax filing processes and ensure compliance.

-

How can airSlate SignNow help with UT4 forms?

AirSlate SignNow simplifies the management of UT4 forms by allowing users to create, send, and eSign these documents quickly and securely. By utilizing our platform, businesses can enhance their workflow and minimize errors associated with manual processing of UT4 forms.

-

Is airSlate SignNow cost-effective for managing UT4 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing UT4 forms and other document workflows. With competitive pricing plans tailored to various business needs, users can efficiently handle UT4 forms without incurring high costs. Our platform maximizes productivity while keeping expenses low.

-

What features of airSlate SignNow are useful for UT4 forms?

AirSlate SignNow includes several features that are particularly useful for handling UT4 forms, such as customizable templates, electronic signatures, and tracking capabilities. These features allow users to manage their UT4 forms seamlessly, ensuring that all necessary information is captured accurately and efficiently.

-

Can I integrate airSlate SignNow with other tools to manage UT4 forms?

Absolutely! AirSlate SignNow offers integrations with various business tools and applications, which can enhance how you manage UT4 forms. This interoperability allows you to streamline processes, connecting your accounting software or CRM to ensure all your document workflows, including UT4 forms, are synchronized.

-

What are the benefits of using airSlate SignNow for UT4 forms?

Using airSlate SignNow for UT4 forms provides numerous benefits, including time savings and operational efficiency. The platform helps reduce the chances of errors associated with manual input and accelerates the document review and approval process, ensuring your UT4 forms are processed quickly.

-

How secure is airSlate SignNow for handling UT4 forms?

AirSlate SignNow prioritizes security, offering robust measures to protect your UT4 forms and sensitive data. With encryption, secure access controls, and compliance with industry standards, users can trust that their UT4 forms and other documents are safe when managed through our platform.

Get more for What Is A Ut4 Form

- Intervention group data collection form tier iitier iii

- Online naturalisation application form

- 4555 14 medical excuse lsu hospitals lsuhospitals form

- Luton bus pass renewal form

- Registered chiropractic assistant application florida board form

- Port city neurosurgery ampampamp spine george a alsina md form

- M3132 rev 719place patient label reinform part a

- Dss 6189 state maternity fund residential care provider agreement info dhhs state nc form

Find out other What Is A Ut4 Form

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online