Scroll Down to Complete Form it 370 PF Tax NY Gov 2023

Understanding Form IT 370 PF

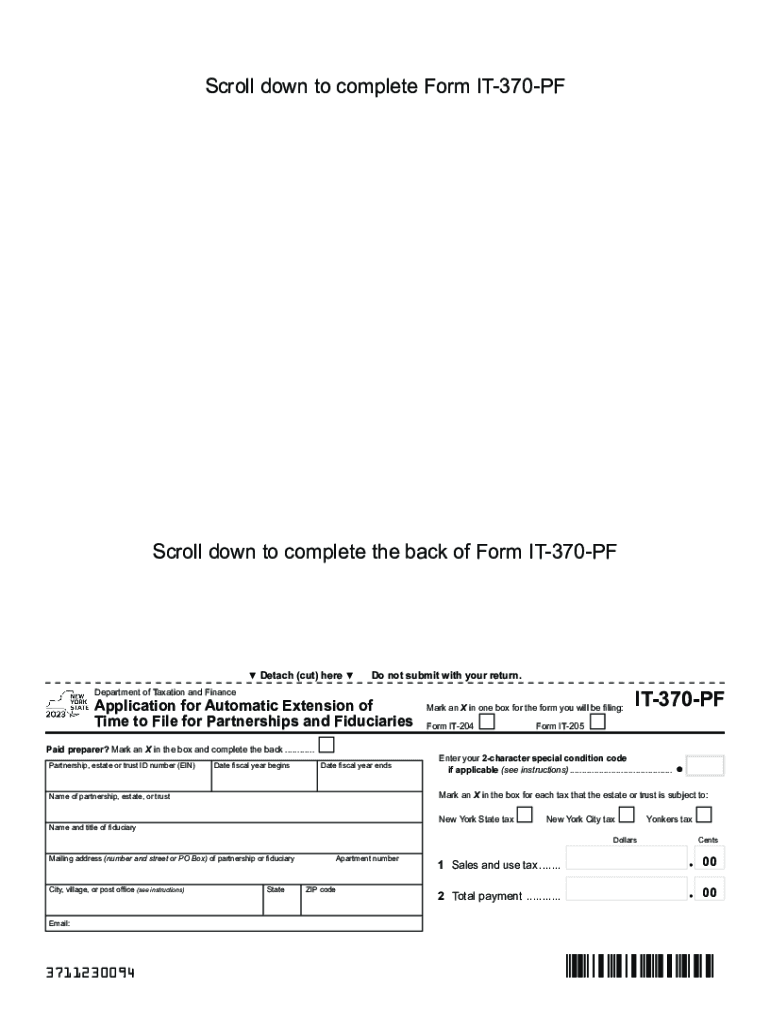

The IT 370 PF form is a tax document used in New York State for specific tax purposes. This form is primarily designed for taxpayers who are seeking a refund of their New York State personal income tax. It is essential for individuals who have overpaid their taxes or are eligible for certain tax credits. Understanding the purpose and requirements of this form can help ensure that taxpayers accurately complete it and receive their entitled refunds.

Steps to Complete Form IT 370 PF

Completing the IT 370 PF form involves several key steps:

- Gather necessary documents, including your tax return and any supporting documents related to your income and deductions.

- Fill out the personal information section, ensuring that your name, address, and Social Security number are accurate.

- Complete the tax calculation sections, where you will report your income, deductions, and credits.

- Review your entries for accuracy and completeness before signing and dating the form.

Filing Deadlines for Form IT 370 PF

It is crucial to be aware of the filing deadlines associated with the IT 370 PF form. Typically, the form must be submitted by the deadline for filing your New York State personal income tax return. This deadline usually aligns with the federal tax filing deadline, which is April 15. However, if you are requesting a refund for a prior year, ensure that you submit the form within the appropriate timeframe to avoid any issues.

Required Documents for Form IT 370 PF

When completing the IT 370 PF form, you will need to provide several documents to support your claim:

- Your New York State personal income tax return for the relevant year.

- Any W-2 forms or 1099 forms that report your income.

- Documentation for any deductions or credits you are claiming.

- Proof of payments made, if applicable.

Form Submission Methods for IT 370 PF

You can submit the IT 370 PF form through various methods. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate address provided in the form instructions.

- In-person submission at designated tax offices, if available.

Eligibility Criteria for Form IT 370 PF

To qualify for using the IT 370 PF form, you must meet specific eligibility criteria. Generally, this includes:

- Having filed a New York State personal income tax return for the year in question.

- Being eligible for a refund due to overpayment or qualifying credits.

- Meeting any additional requirements outlined by the New York State Department of Taxation and Finance.

Quick guide on how to complete scroll down to complete form it 370 pf tax ny gov

Complete Scroll Down To Complete Form IT 370 PF Tax NY gov effortlessly on any device

Managing documents online has gained popularity among corporations and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Scroll Down To Complete Form IT 370 PF Tax NY gov on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Scroll Down To Complete Form IT 370 PF Tax NY gov with ease

- Find Scroll Down To Complete Form IT 370 PF Tax NY gov and click on Get Form to start.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Scroll Down To Complete Form IT 370 PF Tax NY gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct scroll down to complete form it 370 pf tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the scroll down to complete form it 370 pf tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the it 370 pf?

The it 370 pf offers robust features for document management, including eSignature capabilities, customizable templates, and real-time collaboration tools. With its intuitive interface, users can streamline their workflows efficiently. Businesses will find that the it 370 pf enhances productivity while maintaining document security.

-

How does the pricing structure work for the it 370 pf?

The pricing for the it 370 pf is designed to be affordable for businesses of all sizes, with various subscription tiers to meet different needs. Each plan offers a range of features that provide excellent value, ensuring that users pay for only what they need. Additionally, there may be discounts for annual subscriptions.

-

What benefits does the it 370 pf provide to businesses?

The it 370 pf empowers businesses to save time and resources by simplifying the document signing process. It enhances communication and transparency by allowing multiple parties to collaborate on documents in real time. As a result, businesses can close deals faster and improve their overall efficiency.

-

Can the it 370 pf integrate with other software?

Yes, the it 370 pf seamlessly integrates with various applications, such as Salesforce, Google Drive, and Microsoft Office. This integration capability enhances its functionality and makes it easier for users to manage documents across different platforms. By utilizing these integrations, businesses can streamline their workflows even further.

-

Is the it 370 pf suitable for small businesses?

Absolutely! The it 370 pf is tailored for businesses of all sizes, including small enterprises. Its cost-effective pricing and user-friendly features make it particularly attractive for small businesses looking to improve their document management processes without breaking the bank.

-

What security measures are in place for the it 370 pf?

The it 370 pf prioritizes security with advanced encryption and compliance with industry standards such as GDPR and HIPAA. This ensures that sensitive information is kept safe during the signing process. Businesses can trust that their documents are secure while using the it 370 pf.

-

How can I get started with the it 370 pf?

Getting started with the it 370 pf is simple! You can sign up for a free trial on the airSlate SignNow website, which allows you to explore its features before committing to a subscription. After signing up, you’ll have immediate access to the platform and its various tools.

Get more for Scroll Down To Complete Form IT 370 PF Tax NY gov

Find out other Scroll Down To Complete Form IT 370 PF Tax NY gov

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later