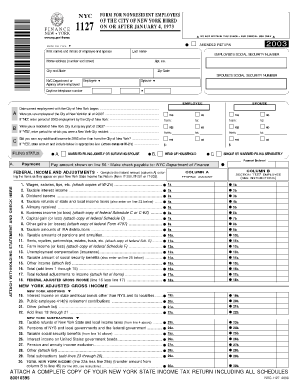

Nyc 1127 Form

What is the NYC 1127?

The NYC 1127 form is a tax document used by businesses and individuals in New York City to report specific financial information. This form is particularly relevant for those involved in real estate transactions, as it helps to ensure compliance with local tax regulations. The NYC 1127 serves as an essential tool for accurately documenting income and expenses, thereby facilitating proper tax calculations and submissions.

Steps to Complete the NYC 1127

Completing the NYC 1127 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, follow these steps:

- Fill in your personal and business information, including your name, address, and tax identification number.

- Detail your income sources and expenses in the designated sections of the form.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form to validate your submission.

Once completed, you can file the NYC 1127 form online or through traditional mail, depending on your preference.

Legal Use of the NYC 1127

The NYC 1127 form is legally binding when completed correctly and submitted in accordance with local regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. The form must be filed by the designated deadlines to maintain compliance with New York City tax laws. Additionally, using a reliable eSignature platform can enhance the legitimacy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 1127 form can vary based on the specific tax year and the nature of the income being reported. Typically, the form must be submitted by the end of the tax year or as specified by the New York City Department of Finance. It is advisable to stay informed about any changes in deadlines to avoid late penalties. Mark your calendar and set reminders to ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The NYC 1127 form can be submitted through various methods, offering flexibility for filers. You can choose to file online, which is often the quickest and most efficient option. Alternatively, you may opt to mail the completed form to the appropriate tax office or deliver it in person. Each method has specific guidelines, so it is important to follow the instructions carefully to ensure proper processing of your submission.

Required Documents

When preparing to file the NYC 1127 form, it is essential to gather all required documents to support your claims. Commonly needed documents include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns, if applicable.

- Any additional documentation requested by the New York City Department of Finance.

Having these documents ready will facilitate a smoother filing process and help ensure that your form is accurate and complete.

Quick guide on how to complete nyc 1127

Complete Nyc 1127 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Nyc 1127 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The simplest way to edit and eSign Nyc 1127 without hassle

- Find Nyc 1127 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Nyc 1127 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 1127

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC 1127 form?

The NYC 1127 form is a tax form used to report specific tax obligations for businesses in New York City. It is essential for compliance with local regulations and helps ensure that businesses meet their tax requirements efficiently. Using airSlate SignNow can simplify the eSigning process for this form.

-

How can airSlate SignNow help with the NYC 1127 form?

airSlate SignNow provides an easy-to-use platform for businesses to send, sign, and store the NYC 1127 form digitally. This saves time and reduces the risk of errors associated with physical documents. With our software, you can streamline your tax filing process securely and efficiently.

-

What are the pricing options for using airSlate SignNow to manage the NYC 1127 form?

airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose from essential to advanced packages, all of which include features that facilitate the management of the NYC 1127 form. Visit our pricing page to find the plan that works for you.

-

Are there any key features of airSlate SignNow specifically for the NYC 1127 form?

Yes, airSlate SignNow includes key features like document templates, automatic reminders, and secure cloud storage which enhance the management of the NYC 1127 form. These features help to ensure that your business remains compliant with tax regulations while saving time and reducing paperwork.

-

Can I integrate airSlate SignNow with other software for handling the NYC 1127 form?

Absolutely! airSlate SignNow supports various integrations with popular business software, including CRM systems and accounting applications. This makes it easy to manage the NYC 1127 form alongside other business processes, enhancing productivity and convenience.

-

What benefits does airSlate SignNow offer for eSigning the NYC 1127 form?

Using airSlate SignNow for eSigning the NYC 1127 form offers several benefits like quick turnaround times, enhanced security, and reduced paper waste. You can eSign documents from anywhere, which is especially convenient for busy business owners and tax professionals.

-

Is airSlate SignNow secure for handling sensitive information in the NYC 1127 form?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures to protect sensitive information in the NYC 1127 form. Our platform ensures that your documents and data are safe while complying with relevant regulations.

Get more for Nyc 1127

- Form r 1393 louisiana department of revenue

- Form pde 338 d 04 09 doc outlook calendar 200 wcupa

- Dog registration armadale form

- Topic estimating sums and differences horizontallyworksheet 1 form

- Payroll deposit form eckerd college

- Rocky mount police department ride along program rockymountnc form

- Form ct 3 a general business corporation combined franchise tax return tax year 772083707

- Film directors contract template form

Find out other Nyc 1127

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors