Form CT 3 a General Business Corporation Combined Franchise Tax Return Tax Year 2024-2026

What is the Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

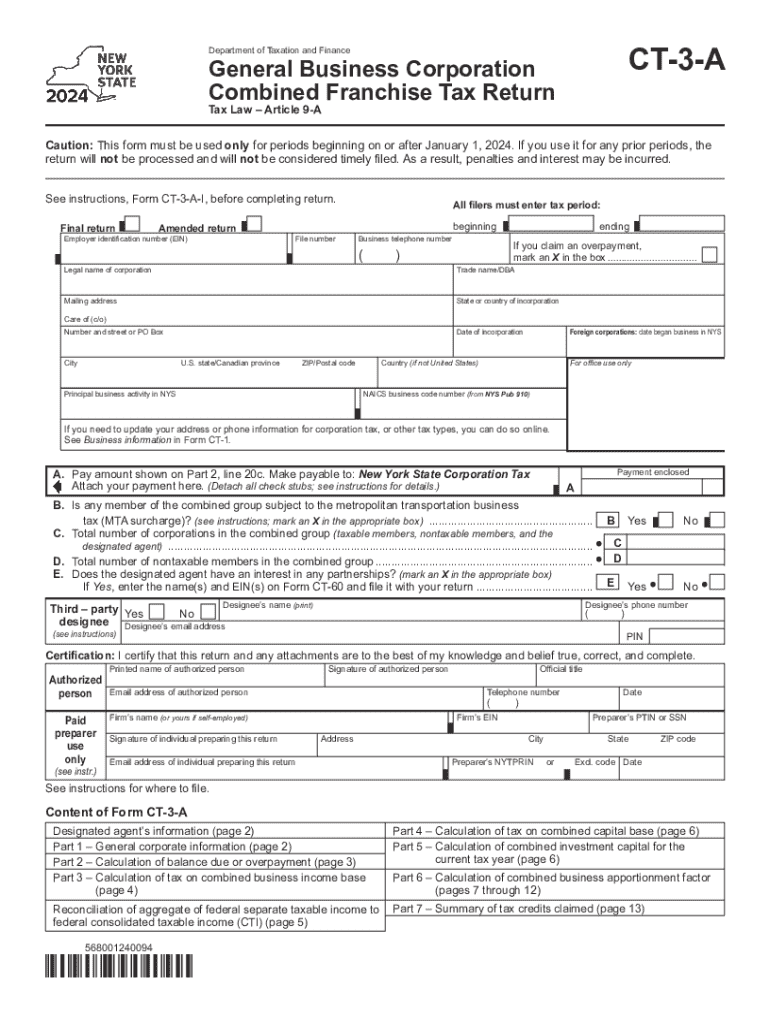

The Form CT 3 A is a tax return specifically designed for general business corporations in New York. It serves as the Combined Franchise Tax Return for the tax year 2024. This form allows corporations to report their income, calculate their tax liability, and fulfill their obligations under New York State tax law. It is essential for corporations that are part of a combined group to file this form, ensuring compliance with state regulations while accurately reflecting their financial activities.

How to use the Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

Using the Form CT 3 A involves several steps, starting with gathering the necessary financial information for the tax year. Corporations must compile data regarding their income, deductions, and credits. Once the information is collected, the form can be filled out, ensuring that all sections are completed accurately. It is crucial to review the form for any errors before submission, as inaccuracies can lead to penalties or delays in processing.

Steps to complete the Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

Completing the Form CT 3 A requires a systematic approach. Begin by entering the corporation's identifying information, including the name and Employer Identification Number (EIN). Next, report the total income and allowable deductions. Calculate the taxable income and apply the appropriate tax rates. Ensure that all relevant schedules and attachments are included, such as any necessary documentation for credits claimed. Finally, review the entire form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

For the tax year 2024, the filing deadline for the Form CT 3 A is typically the fifteenth day of the fourth month following the end of the corporation's fiscal year. Corporations should be aware of any extensions that may apply, as well as specific deadlines for estimated tax payments. Staying informed about these dates is crucial to avoid late filing penalties and interest charges.

Penalties for Non-Compliance

Failure to file the Form CT 3 A on time or inaccuracies in the submitted information can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits by the New York State Department of Taxation and Finance. It is important for corporations to understand these consequences and ensure timely and accurate submissions to maintain compliance with state tax laws.

Who Issues the Form

The Form CT 3 A is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance among corporations operating within the state. Corporations can obtain the form directly from the department's official website or through authorized distribution channels.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 a general business corporation combined franchise tax return tax year 772083707

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 a general business corporation combined franchise tax return tax year 772083707

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 ct 3a and how does it benefit my business?

The 2024 ct 3a is a comprehensive eSignature solution that streamlines document management for businesses. By utilizing airSlate SignNow, you can easily send, sign, and manage documents, enhancing efficiency and reducing turnaround times. This tool is designed to meet the needs of modern businesses looking for a cost-effective way to handle their documentation.

-

How much does the 2024 ct 3a cost?

The pricing for the 2024 ct 3a varies based on the plan you choose, with options suitable for businesses of all sizes. airSlate SignNow offers competitive pricing that ensures you get the best value for your investment. You can explore different plans on our website to find one that fits your budget and needs.

-

What features are included in the 2024 ct 3a?

The 2024 ct 3a includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document workflow and ensure that you can manage your eSignatures efficiently. With airSlate SignNow, you can also integrate with other tools to further streamline your processes.

-

Can I integrate the 2024 ct 3a with other software?

Yes, the 2024 ct 3a can be easily integrated with various software applications, including CRM systems and project management tools. This integration capability allows you to enhance your workflow and improve productivity. airSlate SignNow supports numerous integrations to ensure a seamless experience for users.

-

Is the 2024 ct 3a secure for my documents?

Absolutely, the 2024 ct 3a prioritizes security with advanced encryption and compliance with industry standards. airSlate SignNow ensures that your documents are protected throughout the signing process, giving you peace of mind. You can trust that your sensitive information is safe and secure.

-

How does the 2024 ct 3a improve document turnaround times?

The 2024 ct 3a signNowly improves document turnaround times by allowing users to send and sign documents electronically. This eliminates the delays associated with traditional paper-based processes. With airSlate SignNow, you can expect faster approvals and quicker access to completed documents.

-

What types of businesses can benefit from the 2024 ct 3a?

The 2024 ct 3a is suitable for a wide range of businesses, from small startups to large enterprises. Any organization that requires efficient document management and eSigning can benefit from airSlate SignNow. Its versatility makes it an ideal solution for various industries, including real estate, finance, and healthcare.

Get more for Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

Find out other Form CT 3 A General Business Corporation Combined Franchise Tax Return Tax Year

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile