Estimated Tax Forms 2016

What is the Estimated Tax Forms

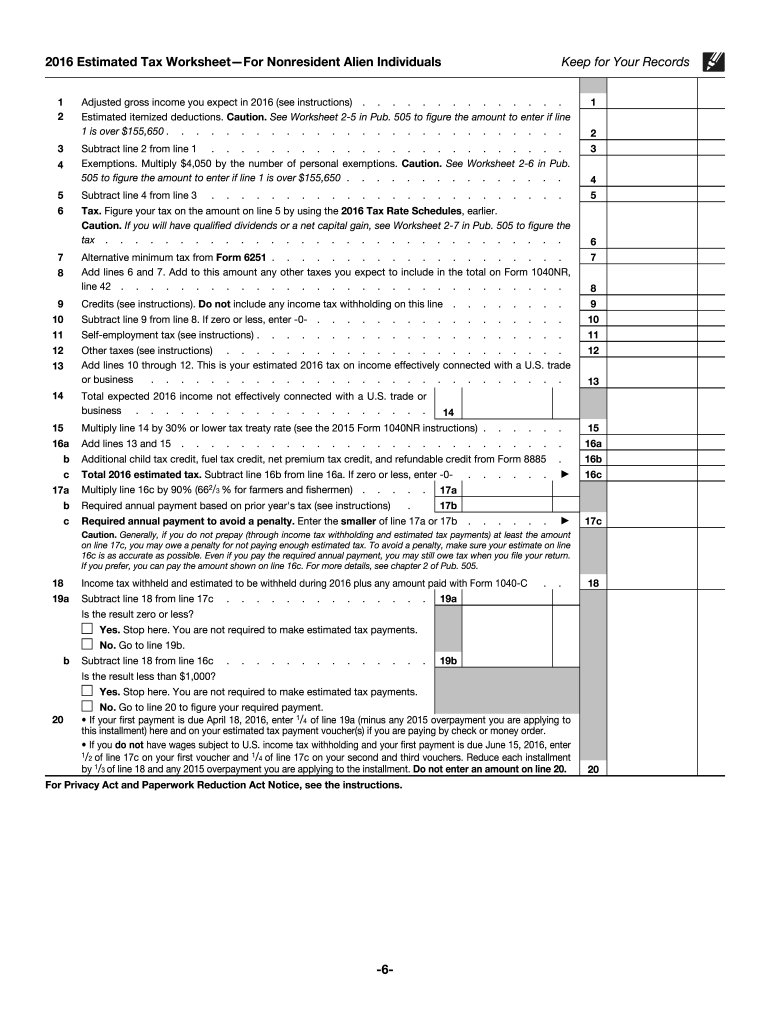

The Estimated Tax Forms are documents used by individuals and businesses to report and pay estimated taxes to the Internal Revenue Service (IRS). These forms are essential for taxpayers who expect to owe tax of one thousand dollars or more when they file their annual tax return. The estimated tax is typically calculated based on the income expected for the year, including wages, dividends, and capital gains. The most common forms used for this purpose are Form 1040-ES for individuals and Form 1120-W for corporations.

How to use the Estimated Tax Forms

Using the Estimated Tax Forms involves several steps. First, taxpayers must determine their expected income and tax liability for the year. This calculation will guide them in estimating their quarterly payments. Once the expected tax amount is established, taxpayers can fill out the appropriate form, ensuring they include all necessary information, such as income sources and deductions. After completing the forms, they can submit them to the IRS along with their payment. It is important to keep copies of the submitted forms for personal records and future reference.

Steps to complete the Estimated Tax Forms

Completing the Estimated Tax Forms requires a systematic approach:

- Gather financial documents, including income statements and previous tax returns.

- Calculate your expected income and deductions for the current tax year.

- Use the IRS tax tables to estimate your tax liability based on your calculated income.

- Fill out the appropriate form, such as Form 1040-ES or Form 1120-W, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form along with your estimated tax payment by the due date.

Filing Deadlines / Important Dates

Filing deadlines for Estimated Tax Forms are crucial for compliance. Generally, estimated tax payments are due quarterly, with the following schedule:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Taxpayers should be aware that if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Legal use of the Estimated Tax Forms

The legal use of Estimated Tax Forms is governed by IRS regulations. Taxpayers are required to file these forms to avoid penalties for underpayment of taxes. The IRS allows for estimated payments to be made online, by mail, or in person, depending on the taxpayer's preference. It is essential to use the most current version of the forms to ensure compliance with tax laws. Failing to submit these forms or making insufficient payments can result in penalties and interest charges.

Who Issues the Form

The Estimated Tax Forms are issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Taxpayers can obtain these forms directly from the IRS website or through various tax preparation software programs. It is important to ensure that the correct version of the form is used, as updates may occur annually.

Quick guide on how to complete 2016 estimated tax forms

Discover the easiest method to complete and endorse your Estimated Tax Forms

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow offers a superior approach to fill in and endorse your Estimated Tax Forms and similar forms for public services. Our intelligent electronic signature solution equips you with everything required to handle documentation swiftly and in compliance with official standards - comprehensive PDF editing, organizing, safeguarding, endorsing, and sharing tools all available within a user-friendly interface.

Only a few simple steps are needed to complete and endorse your Estimated Tax Forms:

- Insert the fillable template into the editor by clicking the Get Form button.

- Review what information you need to enter in your Estimated Tax Forms.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the spaces with your details.

- Modify the content using Text boxes or Images from the top menu.

- Highlight what is important or Blackout sections that are irrelevant.

- Click on Sign to create a legally binding electronic signature using any method you choose.

- Add the Date alongside your signature and finalize your task with the Done button.

Store your completed Estimated Tax Forms in the Documents folder within your account, download it, or transfer it to your preferred cloud service. Our platform also facilitates versatile form sharing. There’s no need to print your forms when you must submit them to the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 estimated tax forms

FAQs

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

Do 1099 workers have to pay estimated taxes?

Yes, you are supposed to pay estimated taxes if you expect to owe more than $1,000 in tax. This is a very rough estimate and shouldn’t be taken as fact, but $1K in tax roughly equates to $7,000 in net earnings over the course of a year (excluding any type of W-2 income from a normal job).Estimated taxes are due four times per year; payments are not exactly quarterly though. The IRS’ website has the due dates of each payment. To file, you’ll need to fill out Form 1040-ES: https://www.irs.gov/pub/irs-pdf/.... The form has instructions on how to pay.Another useful resource is this freelancer tax calculator: Freelancer Income Tax Calculator 2016.

-

What is your view on Subramanian Swamy’s statement of abolishing income tax?

Q : What's your take on Subramanian Swamy calling for the abolition of IT?A : Even if the message is right, it has to be shared at at the right time and at a right place. I do not think the present time is right to abolish Income Tax. Income Tax is direct tax which the tax payer has to pay from his pocket while GST is indirect tax which is included in the price of the product itself. Needless to mention that all the people whether poor or rich pay GST whereas only those who have their income above taxable limit pay income tax. Therefore, in a way GST is compulsory while while paying Income Tax the businessman do resort to certain accounting jugglery to evade tax.Ideally the direct taxes should get more revenue to government treasury than indirect taxes so that the burden of taxes goes on shoulder of the rich than the poor. However in India whose population is around 132+ crore not even 10 crore people pay income tax. Although the gross revenue figure out of income tax has increased by around 84% since 2014, it it still less. The tax base needs to be enhanced to include more and more people. This is still not the case in India.Many film actors like the Bachchans and the Kapoors are agriculturists who club their unaccounted income as agricultural income and evade the tax. These are really rich people who should be paying 30% income tax, however, because of the prevailing legal provisions these people legalize their black money without paying any tax. Therefore, for abolishing income tax, I don’t think this is the right time. Let at least 25% of middle aged Indians start paying some income tax and more specifically the some tax be levied on agriculture. After this move the threshold income tax rates can be lowered and basic exemption limits can be enhanced.However, the income tax cannot be abolished.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the 2016 estimated tax forms

How to generate an eSignature for your 2016 Estimated Tax Forms online

How to make an electronic signature for the 2016 Estimated Tax Forms in Google Chrome

How to generate an eSignature for signing the 2016 Estimated Tax Forms in Gmail

How to create an eSignature for the 2016 Estimated Tax Forms right from your mobile device

How to generate an electronic signature for the 2016 Estimated Tax Forms on iOS

How to generate an electronic signature for the 2016 Estimated Tax Forms on Android OS

People also ask

-

What are Estimated Tax Forms and why are they important?

Estimated Tax Forms are documents that taxpayers use to report and pay income taxes on income not subject to withholding. They are crucial for self-employed individuals and businesses to avoid penalties and ensure compliance with tax regulations. Using airSlate SignNow, you can easily create, send, and eSign these forms, streamlining your tax preparation process.

-

How can airSlate SignNow help me manage my Estimated Tax Forms?

airSlate SignNow offers a user-friendly platform that allows you to efficiently create and manage your Estimated Tax Forms. With our eSigning feature, you can quickly send these forms for signatures, ensuring timely submissions. Our solution helps you stay organized and compliant, making the tax season less stressful.

-

Is there a pricing plan for businesses that frequently handle Estimated Tax Forms?

Yes, airSlate SignNow provides flexible pricing plans tailored to different business needs, including those who frequently manage Estimated Tax Forms. Our cost-effective solutions are designed to fit various budgets while offering all the essential features you need to handle your documents efficiently. You can choose from monthly or annual subscriptions, depending on your requirements.

-

Can I integrate airSlate SignNow with my accounting software for Estimated Tax Forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, making it easy to manage your Estimated Tax Forms alongside your financial data. These integrations help streamline your workflow by allowing automatic data transfer, reducing manual entry, and ensuring accuracy in your tax submissions.

-

What features does airSlate SignNow offer for handling Estimated Tax Forms?

airSlate SignNow provides a range of features specifically designed for managing Estimated Tax Forms, including customizable templates, eSignature capabilities, and document storage. Our platform also offers tracking and notifications, so you can easily monitor the status of your forms. With these features, you can enhance efficiency and ensure timely compliance.

-

How secure is the airSlate SignNow platform for managing Estimated Tax Forms?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and security protocols to protect your Estimated Tax Forms and sensitive information. You can trust that your documents are safe while being easily accessible for your business needs.

-

Can I access my Estimated Tax Forms on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage your Estimated Tax Forms on the go. Our mobile app ensures that you can create, send, and eSign documents from anywhere, making it convenient for busy professionals and businesses.

Get more for Estimated Tax Forms

Find out other Estimated Tax Forms

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online