About Form 1040 ES, Estimated Tax for IndividualsInternal 2020

Understanding Form 1040 ES for Estimated Taxes

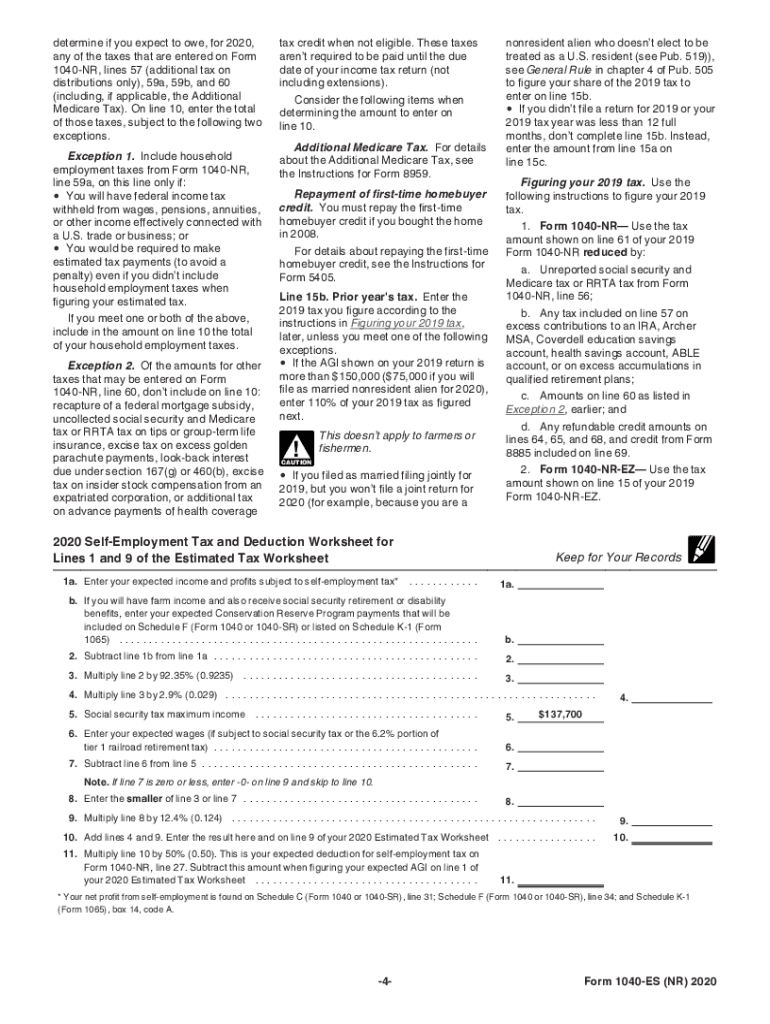

The Form 1040 ES is used by individuals to calculate and pay estimated taxes to the IRS. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It is particularly relevant for self-employed individuals, freelancers, and those with income not subject to withholding. Understanding how to use this form can help ensure compliance with tax obligations and avoid penalties.

Steps to Complete Form 1040 ES

Completing the Form 1040 ES involves several steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected adjusted gross income for the year.

- Determine your tax liability using the IRS tax tables or tax rate schedules.

- Subtract any tax credits you may be eligible for.

- Divide your total estimated tax by four to determine quarterly payments.

- Complete the form by filling in your personal information and payment amounts.

It is important to ensure accuracy in your calculations to avoid underpayment or overpayment of taxes.

Filing Deadlines for Form 1040 ES

Timely submission of your estimated tax payments is crucial. The deadlines for filing Form 1040 ES are typically as follows:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Missing these deadlines may result in penalties and interest on unpaid taxes.

Legal Use of Form 1040 ES

The Form 1040 ES is legally binding when completed correctly and submitted on time. It is important to retain copies of your submitted forms and any payment confirmations for your records. This documentation can be vital in case of an audit or dispute with the IRS.

Obtaining Form 1040 ES

Taxpayers can obtain Form 1040 ES directly from the IRS website or through various tax preparation software. It is advisable to ensure you are using the correct version for the tax year you are filing. The form can be printed and filled out manually or completed electronically, depending on your preference.

IRS Guidelines for Estimated Taxes

The IRS provides guidelines on who needs to pay estimated taxes and how to calculate the amount. Generally, if you expect to owe $1,000 or more in taxes after subtracting your withholding and refundable credits, you are required to make estimated tax payments. The IRS recommends reviewing your tax situation periodically throughout the year to adjust your payments as needed.

Quick guide on how to complete about form 1040 es estimated tax for individualsinternal

Complete About Form 1040 ES, Estimated Tax For IndividualsInternal effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents promptly without delays. Handle About Form 1040 ES, Estimated Tax For IndividualsInternal on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-focused workflow today.

How to modify and eSign About Form 1040 ES, Estimated Tax For IndividualsInternal effortlessly

- Find About Form 1040 ES, Estimated Tax For IndividualsInternal and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method for sending your form—via email, text message (SMS), invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign About Form 1040 ES, Estimated Tax For IndividualsInternal and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1040 es estimated tax for individualsinternal

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 es estimated tax for individualsinternal

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is a 2020 tax calculator and how does it work?

A 2020 tax calculator is an online tool designed to help individuals estimate their tax liabilities for the year 2020. By inputting relevant financial information, users can quickly calculate their expected refund or amount owed. This can help you better prepare for filing your taxes and make informed financial decisions.

-

Is the 2020 tax calculator free to use?

Yes, the 2020 tax calculator is typically free and accessible through various websites. This cost-effective solution enables you to compute your taxes without the need for expensive software or consultations, ensuring you have the resources needed to file accurately and efficiently.

-

What features should I look for in a 2020 tax calculator?

When choosing a 2020 tax calculator, look for user-friendly interfaces, accuracy in calculations, and the ability to handle various tax scenarios. Additional features like savings suggestions, filing reminders, and integration with e-signature tools can enhance your experience and ensure a smooth tax-filing process.

-

How can the 2020 tax calculator help me save money?

Using a 2020 tax calculator can help you identify deductions and credits you may qualify for, potentially maximizing your tax refund. By planning your finances ahead of time, you can strategically make adjustments that could lower your taxable income, ultimately saving you money.

-

Can I integrate the 2020 tax calculator with other financial tools?

Many 2020 tax calculators offer integrations with popular financial tools and accounting software. These integrations can streamline your data entry process and keep your financial information organized, ensuring you have a comprehensive view of your tax situation.

-

What are the benefits of using an online 2020 tax calculator?

Using an online 2020 tax calculator provides convenience and speed, allowing you to calculate your taxes from anywhere, at any time. Additionally, many calculators offer real-time updates based on tax law changes, ensuring you are always working with the most accurate information.

-

Are the results from the 2020 tax calculator guaranteed to be accurate?

While a 2020 tax calculator provides a good estimate based on the data you enter, the results should not be considered legally binding. To ensure accuracy, it's advisable to consult a tax professional for complex situations, particularly if your financial status has signNowly changed.

Get more for About Form 1040 ES, Estimated Tax For IndividualsInternal

- Form436

- Form it 204 ip i2018instructions for form it 204 ip new york partners schedule k 1it204ipi

- Fillable online form ct 3 a2018general business corporation

- Cdtfa 146 cc exemption certificate and statement of delivery in indian country form

- 2012 ia 1040es 2017 2019 form

- Form w 2 electronic filing requirements for tax year 2018

- California form 589 2019

- Deep sea fishing vesselswashington department of revenue form

Find out other About Form 1040 ES, Estimated Tax For IndividualsInternal

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors