Www Irs Govpubirs Pdf2022 Form 1040 ES Internal Revenue Service 2022

Understanding the IRS Form 1040-ES

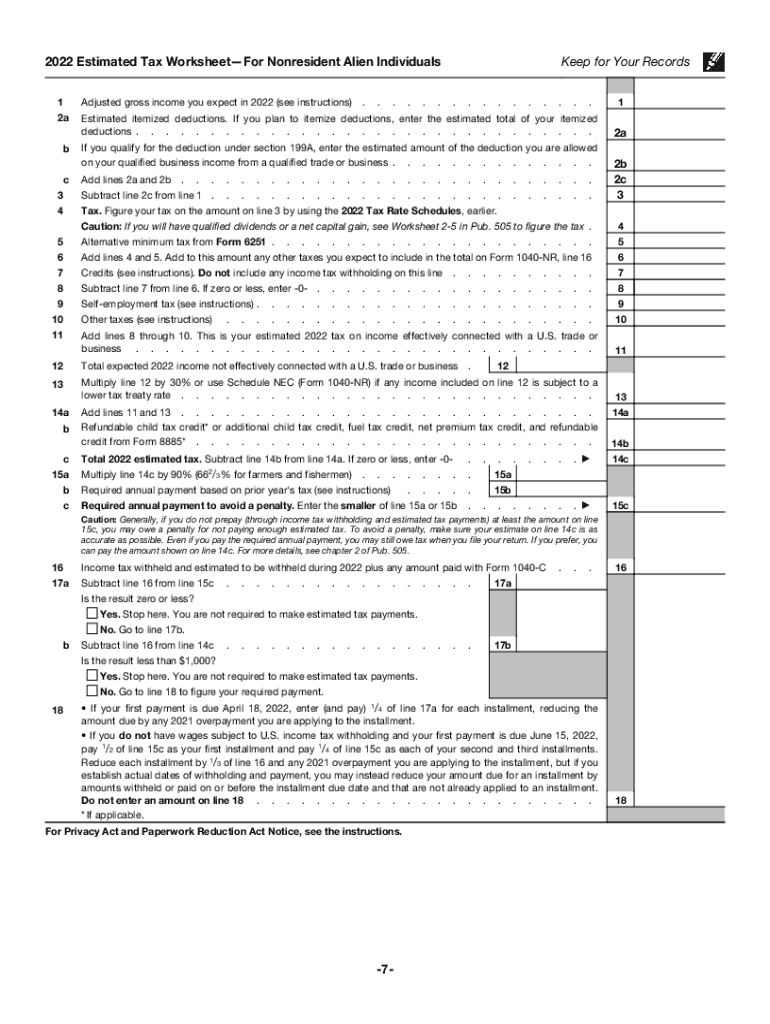

The IRS Form 1040-ES is used by taxpayers to calculate and pay estimated tax payments. This form is essential for individuals who expect to owe tax of $1,000 or more when they file their return. It is particularly relevant for self-employed individuals, freelancers, and those with significant income not subject to withholding. The form includes four payment vouchers that can be submitted quarterly to ensure timely compliance with tax obligations.

Steps to Complete the IRS Form 1040-ES

Completing the IRS Form 1040-ES involves several key steps:

- Gather your financial information, including income sources and deductions.

- Use the federal income tax calculator to estimate your tax liability for the year.

- Fill out the form, ensuring that you provide accurate information for each quarter.

- Calculate the estimated tax payment amount for each quarter based on your total estimated tax liability.

- Submit the completed form along with your payment by the due dates.

Form Submission Methods for IRS Form 1040-ES

Taxpayers have multiple options for submitting their IRS Form 1040-ES:

- Online: You can pay estimated taxes online through the IRS website using the Electronic Federal Tax Payment System (EFTPS).

- Mail: Send your completed Form 1040-ES and payment voucher to the address specified in the form instructions.

- In-Person: Payments can also be made in person at certain financial institutions or IRS offices, depending on your location.

Filing Deadlines for Estimated Tax Payments

It is crucial to adhere to the filing deadlines for estimated tax payments to avoid penalties. Generally, the due dates for quarterly payments are:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Penalties for Non-Compliance with Estimated Tax Payments

Failing to pay estimated taxes on time can result in penalties from the IRS. If you do not pay enough tax throughout the year, you may incur a penalty for underpayment. This penalty is calculated based on the amount owed and the time it remains unpaid. It is advisable to ensure that your estimated tax payments are accurate and submitted on time to avoid these additional costs.

IRS Guidelines for Estimated Tax Payments

The IRS provides specific guidelines regarding who must make estimated tax payments, how to calculate them, and when to pay. Taxpayers should refer to the IRS website or the instructions included with Form 1040-ES for detailed guidance. Understanding these guidelines helps ensure compliance and avoids potential tax issues.

Quick guide on how to complete wwwirsgovpubirs pdf2022 form 1040 es internal revenue service

Effortlessly Prepare Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service on Any Device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service effortlessly

- Locate Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools offered by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or mismanaged files, tiresome document searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document needs within a few clicks from any device you choose. Modify and eSign Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service and guarantee excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2022 form 1040 es internal revenue service

Create this form in 5 minutes!

People also ask

-

Where do I send my estimated tax payment for online transactions?

When using airSlate SignNow for your online transactions, you can send your estimated tax payment directly through the platform. Simply create a document that outlines your payment details and send it for eSignature. This ensures that all parties have a clear record of the transaction.

-

How can airSlate SignNow help me track my estimated tax payments?

airSlate SignNow allows you to create a structured workflow that lets you track all your estimated tax payments. With our document management features, you can save and revisit sent documents easily. This helps in maintaining a clear overview of where do I send my estimated tax payment at each due date.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. Each plan includes features that streamline sending documents and managing payments, including estimated tax payments. For specific inquiries about where do I send my estimated tax payment, we recommend reviewing our pricing page.

-

Are there integrations available for managing tax payments?

Yes, airSlate SignNow integrates with several accounting and tax software solutions that can help you manage where do I send my estimated tax payment. These integrations allow seamless data exchange and automation of payment reminders, making your tax processes more efficient.

-

Does airSlate SignNow support international estimated tax payments?

AirSlate SignNow is designed to cater to users across multiple countries, allowing you to send estimated tax payments internationally. Depending on your location, our platform helps identify where do I send my estimated tax payment by providing specific guidelines based on your country's regulations.

-

Can I use airSlate SignNow on mobile devices for tax payments?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to send your estimated tax payments on the go. Whether you're at home or in the office, you can easily access your documents and see where do I send my estimated tax payment using your smartphone or tablet.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow includes robust features for tax document management such as templates, reminders, and e-signatures. These tools simplify the process of preparing where do I send my estimated tax payment documentation. You'll find that managing tax-related documents is much easier with our intuitive platform.

Get more for Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service

- Ohio release form

- Quitclaim deed from individual to llc ohio form

- Ohio llc 497322235 form

- Ohio limited 497322236 form

- Request lien form 497322238

- Ohio quitclaim deed 497322239 form

- General warranty deed from husband and wife to corporation ohio form

- Limited warranty deed from husband and wife to corporation ohio form

Find out other Www irs govpubirs pdf2022 Form 1040 ES Internal Revenue Service

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document