Form 1040 ES NR Form 1040 ES NR, U S Estimated Tax for Nonresident Alien Individuals 2024

What is the Form 1040 ES NR

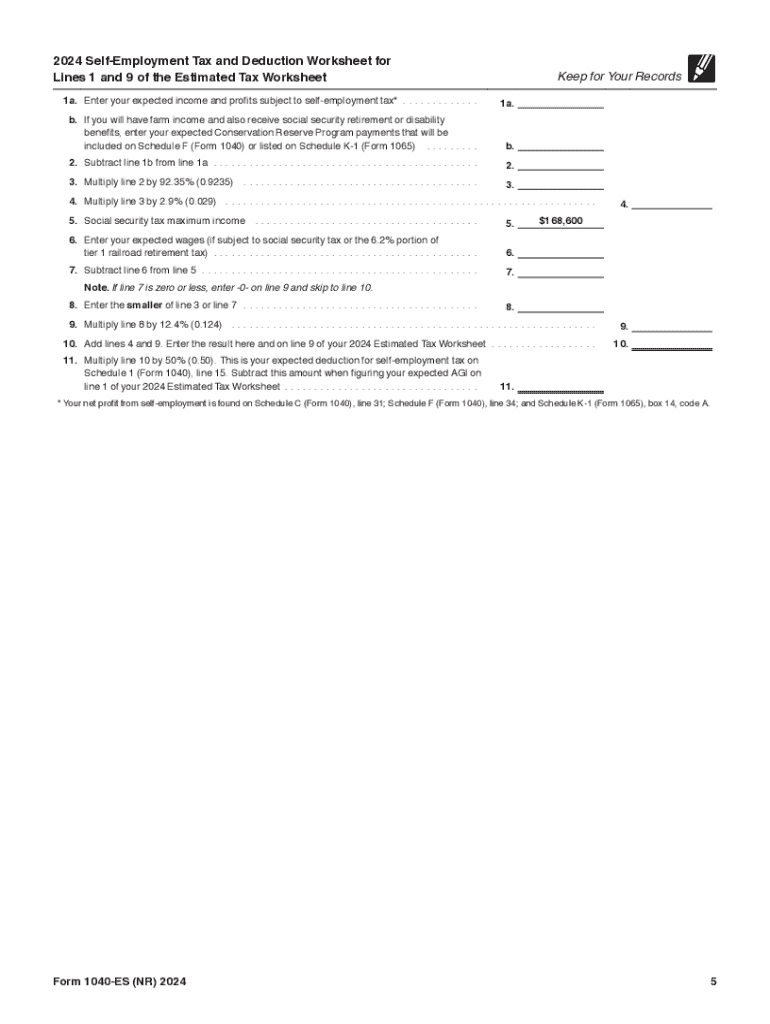

The Form 1040 ES NR is the U.S. Estimated Tax for Nonresident Alien Individuals. This form is specifically designed for nonresident aliens who are required to pay estimated taxes on income that is not subject to withholding. It allows individuals to calculate and pay their estimated tax liabilities throughout the year, ensuring compliance with U.S. tax laws.

How to use the Form 1040 ES NR

To use the Form 1040 ES NR, you must first determine your estimated tax liability for the year. This involves calculating your expected income, deductions, and credits. Once you have this information, you can fill out the form, which includes sections for entering your estimated income and tax amounts. It is important to keep accurate records of your income and any payments made to avoid underpayment penalties.

Steps to complete the Form 1040 ES NR

Completing the Form 1040 ES NR involves several key steps:

- Gather your financial documents, including income statements and records of any deductions.

- Calculate your total expected income for the year.

- Determine your deductions and credits to arrive at your taxable income.

- Use the IRS tax tables to find your estimated tax liability.

- Fill out the form with your calculated amounts and any necessary personal information.

- Submit the form by the appropriate deadlines to ensure timely payment.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form 1040 ES NR. Generally, estimated tax payments are due quarterly, with specific dates set by the IRS. For the 2024 tax year, the due dates are typically April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

When preparing to file the Form 1040 ES NR, you will need several documents:

- Income statements, such as W-2s or 1099s, reflecting your earnings.

- Records of any deductions you plan to claim, such as mortgage interest or student loan interest.

- Previous tax returns to help estimate your current year’s tax liability.

Penalties for Non-Compliance

Failure to comply with the estimated tax payment requirements can lead to significant penalties. The IRS may impose a penalty for underpayment if you do not pay enough tax throughout the year. Additionally, late payments can incur interest charges, further increasing your tax liability. It is essential to stay informed about your obligations to avoid these penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 es nr form 1040 es nr u s estimated tax for nonresident alien individuals

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es nr form 1040 es nr u s estimated tax for nonresident alien individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the total population of the world and how does it relate to document management?

The total population of the world is over 7.9 billion people, which highlights the vast number of businesses and individuals needing efficient document management solutions. airSlate SignNow caters to this demand by providing a user-friendly platform for eSigning and sending documents, ensuring that users can manage their paperwork effectively in a global market.

-

How does airSlate SignNow's pricing compare to other eSignature solutions?

airSlate SignNow offers competitive pricing that is designed to be cost-effective for businesses of all sizes. With plans tailored to different needs, users can choose a package that fits their budget while still benefiting from features that support the total population of the world in their document signing needs.

-

What features does airSlate SignNow offer to enhance document signing?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features are essential for managing documents efficiently, especially considering the total population of the world that relies on digital solutions for their business operations.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration capability is crucial for businesses looking to streamline their processes and cater to the total population of the world by enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for businesses?

Using airSlate SignNow allows businesses to save time and reduce costs associated with traditional document signing methods. By providing a fast and secure way to eSign documents, airSlate SignNow supports the needs of the total population of the world, ensuring that businesses can operate efficiently in a digital landscape.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be accessible for small businesses, offering affordable plans that do not compromise on features. This makes it an ideal choice for small enterprises looking to manage their documents effectively, especially in a world with a total population that demands quick and reliable solutions.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, utilizing encryption and compliance with industry standards. This level of security is essential for protecting sensitive information, especially when considering the total population of the world that relies on digital transactions.

Get more for Form 1040 ES NR Form 1040 ES NR, U S Estimated Tax For Nonresident Alien Individuals

Find out other Form 1040 ES NR Form 1040 ES NR, U S Estimated Tax For Nonresident Alien Individuals

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form