Corporate Tax Return Due Date Form 2016

What is the Corporate Tax Return Due Date Form

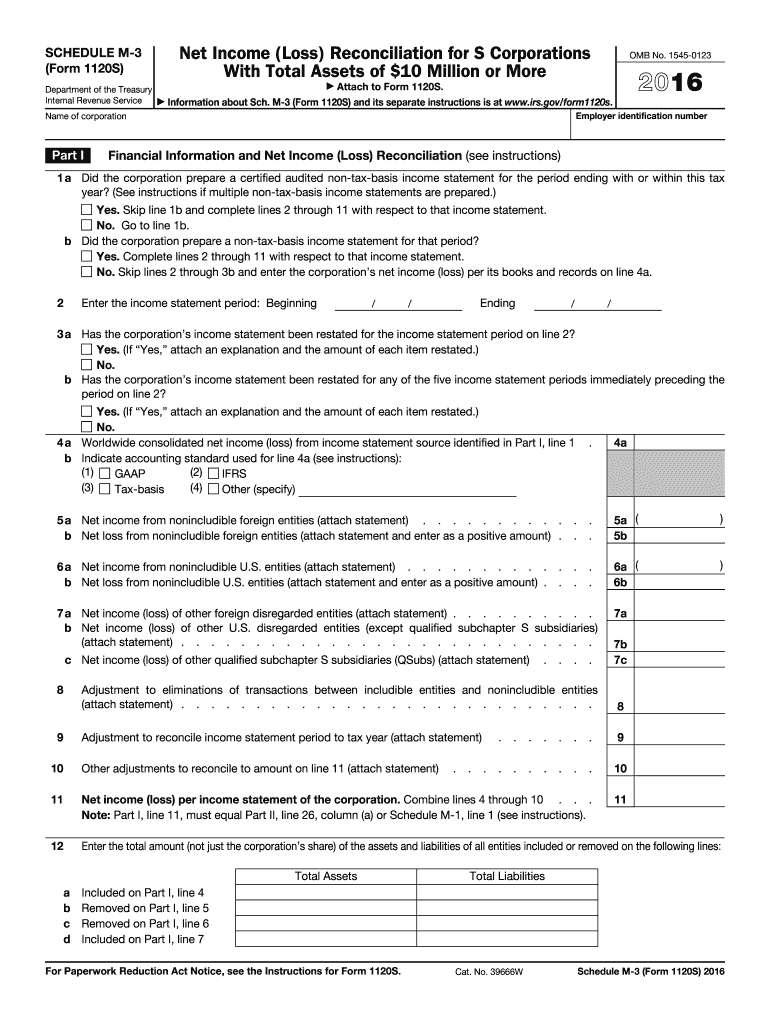

The Corporate Tax Return Due Date Form is a crucial document that corporations in the United States must complete to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for compliance with federal tax regulations and helps ensure that businesses meet their tax obligations accurately and on time. The form typically includes information about the corporation's financial performance over the tax year, including revenue, expenses, and tax liability.

How to use the Corporate Tax Return Due Date Form

Using the Corporate Tax Return Due Date Form involves several steps. First, gather all necessary financial documentation, including income statements, balance sheets, and records of deductions. Next, accurately fill out the form with the required information, ensuring that all figures are correct and reflect the corporation's financial status. After completing the form, review it thoroughly for any errors before submission. Depending on the filing method chosen, you may need to eSign the document to validate it before sending it to the IRS.

Steps to complete the Corporate Tax Return Due Date Form

Completing the Corporate Tax Return Due Date Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including profit and loss statements and tax records.

- Fill in the corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report all income earned during the tax year, including sales and investment income.

- List all allowable deductions, ensuring to include supporting documentation for each.

- Calculate the total tax liability based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form by the due date to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Corporate Tax Return Due Date Form is essential for compliance. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For most corporations operating on a calendar year, this means the due date is April fifteenth. It is important to note that extensions may be available, but they must be requested before the original due date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Corporate Tax Return Due Date Form. These methods include:

- Online: Many businesses choose to file electronically through approved software or tax preparation services, which can streamline the process and reduce errors.

- Mail: Corporations can also print and mail their completed forms to the IRS. Ensure that the form is sent to the correct address based on the corporation's location.

- In-Person: While less common, some corporations may opt to deliver their forms in person to local IRS offices.

Penalties for Non-Compliance

Failing to file the Corporate Tax Return Due Date Form on time can result in significant penalties. The IRS imposes fines based on the size of the corporation and the length of the delay. Additionally, late payments may incur interest charges. It is crucial for businesses to be aware of these penalties and to take proactive measures to ensure timely filing and payment to avoid unnecessary financial burdens.

Quick guide on how to complete corporate tax return due date 2016 form

Discover the simplest method to complete and endorse your Corporate Tax Return Due Date Form

Are you still wasting valuable time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior solution for completing and endorsing your Corporate Tax Return Due Date Form and related forms for public services. Our intelligent eSignature service equips you with everything necessary to handle paperwork swiftly and in line with official standards - robust PDF editing, managing, securing, signing, and sharing functionalities all readily available within an intuitive interface.

Only a few steps are needed to finish filling out and signing your Corporate Tax Return Due Date Form:

- Upload the editable template to the editor by clicking the Get Form button.

- Review the information you need to input in your Corporate Tax Return Due Date Form.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Conceal fields that are no longer relevant.

- Click on Sign to create a legally binding eSignature using your preferred method.

- Add the Date beside your signature and finish your task with the Done button.

Store your completed Corporate Tax Return Due Date Form in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers versatile file sharing options. There’s no necessity to print your forms when you need to submit them to the appropriate public office - do so via email, fax, or by requesting USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct corporate tax return due date 2016 form

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How can the original income tax return for AY 17-18 be filled after the due date is revised?

There was an amendment in the budget which now allows you to file revised returns even after they are filed after due date. The said amendment is effective from AY 17–18.CA. Bhavesh Savlawww.cabks.in

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

Create this form in 5 minutes!

How to create an eSignature for the corporate tax return due date 2016 form

How to create an eSignature for the Corporate Tax Return Due Date 2016 Form in the online mode

How to generate an electronic signature for the Corporate Tax Return Due Date 2016 Form in Google Chrome

How to generate an electronic signature for signing the Corporate Tax Return Due Date 2016 Form in Gmail

How to make an electronic signature for the Corporate Tax Return Due Date 2016 Form right from your smart phone

How to make an eSignature for the Corporate Tax Return Due Date 2016 Form on iOS

How to make an eSignature for the Corporate Tax Return Due Date 2016 Form on Android

People also ask

-

What is the Corporate Tax Return Due Date Form and why is it important?

The Corporate Tax Return Due Date Form is a crucial document that outlines the deadlines for filing corporate tax returns. Understanding these due dates helps businesses avoid penalties and ensure compliance with tax regulations. By using the Corporate Tax Return Due Date Form, companies can effectively manage their tax obligations.

-

How can airSlate SignNow help with the Corporate Tax Return Due Date Form?

airSlate SignNow provides a seamless way to send and eSign your Corporate Tax Return Due Date Form, ensuring that your documents are handled quickly and securely. With its user-friendly interface, you can easily manage deadlines and keep track of your filings. This streamlined process reduces the hassle of paperwork, allowing you to focus on your business.

-

What features does airSlate SignNow offer for managing corporate tax documents?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking for managing your Corporate Tax Return Due Date Form. These tools enhance efficiency and ensure that you never miss a deadline. With airSlate SignNow, you can also collaborate with team members in real-time, making tax document management easier.

-

Is airSlate SignNow cost-effective for small businesses handling tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises managing the Corporate Tax Return Due Date Form. Our pricing plans are flexible and cater to various business needs, ensuring you get great value while streamlining your document processes. This affordability helps small businesses stay compliant without breaking the bank.

-

Can I integrate airSlate SignNow with other software to manage corporate taxes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Corporate Tax Return Due Date Form alongside your financial documents. This integration allows for a more cohesive workflow, ensuring that all your tax-related information is in one place, reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for corporate tax management?

Using airSlate SignNow for managing your Corporate Tax Return Due Date Form offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. The platform's electronic signature capabilities ensure that documents are signed quickly, while automated reminders help you stay on top of important deadlines. These features ultimately save time and minimize stress during tax season.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your Corporate Tax Return Due Date Form and any sensitive information. Additionally, we comply with industry standards to ensure that your documents are safe from unauthorized access.

Get more for Corporate Tax Return Due Date Form

- I understand that my exposure to patients at hca healthcare facilities with the following vaccine preventable form

- Work schedule agreement template form

- Inland empire 66ers donation request form

- Medical certificate for work form

- Abt 6009 form

- Assured shorthold tenancy agreement docx form

- 1213 print form ez individual income tax return 801101381000 amended this form is for a single person with no dependents having

- Ny pt 350 fill in form

Find out other Corporate Tax Return Due Date Form

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast