Form M 3 2014

What is the Form M 3

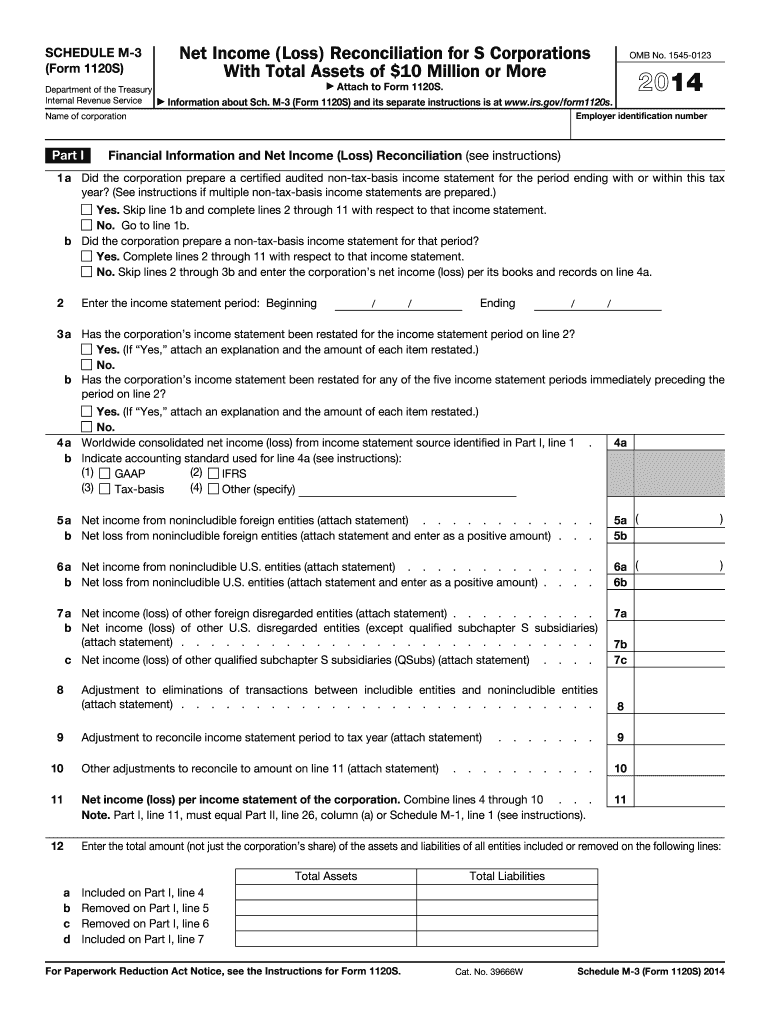

The Form M 3 is a specific tax document used in the United States, primarily by businesses to report certain financial information. This form is typically required for specific types of entities and serves as a means to comply with federal tax regulations. Understanding the purpose of the Form M 3 is essential for ensuring accurate reporting and compliance with the Internal Revenue Service (IRS) requirements.

How to use the Form M 3

Using the Form M 3 involves several steps to ensure that all necessary information is accurately reported. First, determine if your business entity is required to file this form based on its structure and income levels. Next, gather all relevant financial documents, including income statements and balance sheets. Complete the form by entering the required information in the designated fields, ensuring that all figures are accurate and reflect your business's financial status. Finally, review the completed form for any errors before submission.

Steps to complete the Form M 3

Completing the Form M 3 requires careful attention to detail. Follow these steps:

- Identify the correct version of the Form M 3 for your filing year.

- Gather necessary financial documents, such as profit and loss statements.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check all calculations and entries for errors.

- Sign and date the form before submission.

Legal use of the Form M 3

The legal use of the Form M 3 is governed by IRS regulations. It is essential to ensure that the form is completed in accordance with these regulations to avoid penalties. The information provided on the form must be truthful and accurate, as any discrepancies can lead to legal consequences. Businesses must also retain copies of submitted forms for their records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form M 3 vary depending on the type of business entity and the tax year. Generally, the form must be submitted by the due date of the business's tax return. It is crucial to stay informed about these deadlines to avoid late filing penalties. Businesses should also consider any extensions that may be available if they need additional time to complete the form.

Form Submission Methods (Online / Mail / In-Person)

The Form M 3 can typically be submitted through various methods, including online filing, mailing, or in-person submission at designated IRS offices. Online submission is often the most efficient option, allowing for quicker processing and confirmation of receipt. When mailing the form, ensure it is sent to the correct address specified by the IRS for your business type. In-person submissions may be appropriate for urgent matters or specific inquiries.

Quick guide on how to complete 2014 form m 3

Complete Form M 3 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without setbacks. Handle Form M 3 on any device with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to alter and eSign Form M 3 effortlessly

- Obtain Form M 3 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize crucial parts of the documents or conceal sensitive details with tools specially designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form M 3 and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form m 3

Create this form in 5 minutes!

How to create an eSignature for the 2014 form m 3

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form M 3 and how does it work with airSlate SignNow?

Form M 3 is a critical document used in various business processes for compliance and record-keeping. With airSlate SignNow, you can easily create, send, and eSign Form M 3, ensuring secure and efficient handling of your documents. Our platform simplifies the signing process, making it accessible from any device.

-

How can I integrate Form M 3 into my existing workflows?

Integrating Form M 3 into your workflows is seamless with airSlate SignNow. Our platform offers various integrations with popular applications, allowing you to automate the sending and signing of Form M 3 without disrupting your existing processes. You can easily connect your tools and improve overall efficiency.

-

Is there a cost associated with using airSlate SignNow for Form M 3?

Yes, airSlate SignNow offers competitive pricing options tailored to your business needs for using Form M 3. You can choose from different plans based on the number of users and features required, ensuring you get the best value for your document signing needs.

-

What features does airSlate SignNow provide for managing Form M 3?

airSlate SignNow offers a variety of features specifically designed for managing Form M 3. These include templates for easy document creation, bulk sending options, and advanced tracking capabilities that allow you to monitor the status of your Form M 3 in real-time.

-

Can I customize Form M 3 in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize Form M 3 to meet your specific business requirements. You can add fields, adjust layout, and incorporate branding elements to ensure that your Form M 3 aligns with your company’s identity.

-

What are the benefits of using airSlate SignNow for Form M 3?

Using airSlate SignNow for Form M 3 offers numerous benefits, including enhanced security, time-saving automation, and improved accuracy in document handling. By digitizing your signing process, you ensure compliance and streamline operations, reducing the likelihood of errors.

-

How does airSlate SignNow ensure the security of my Form M 3 documents?

Security is a top priority at airSlate SignNow. We employ robust encryption protocols, user authentication, and compliance with industry regulations to protect your Form M 3 documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form M 3

- To complete this form electronically life threatening

- Client personal history form associated clinic of psychology

- Subjects middle name form

- Dhs 3876 eng form

- Girl health history annual permission f 57 girl scouts of form

- Part i illness and injuries check all that apply form

- Buckeye provider adjustment request form

- Columbus orthopaedic clinic medication log form

Find out other Form M 3

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online