Form 1120 S 2017

What is the Form 1120 S

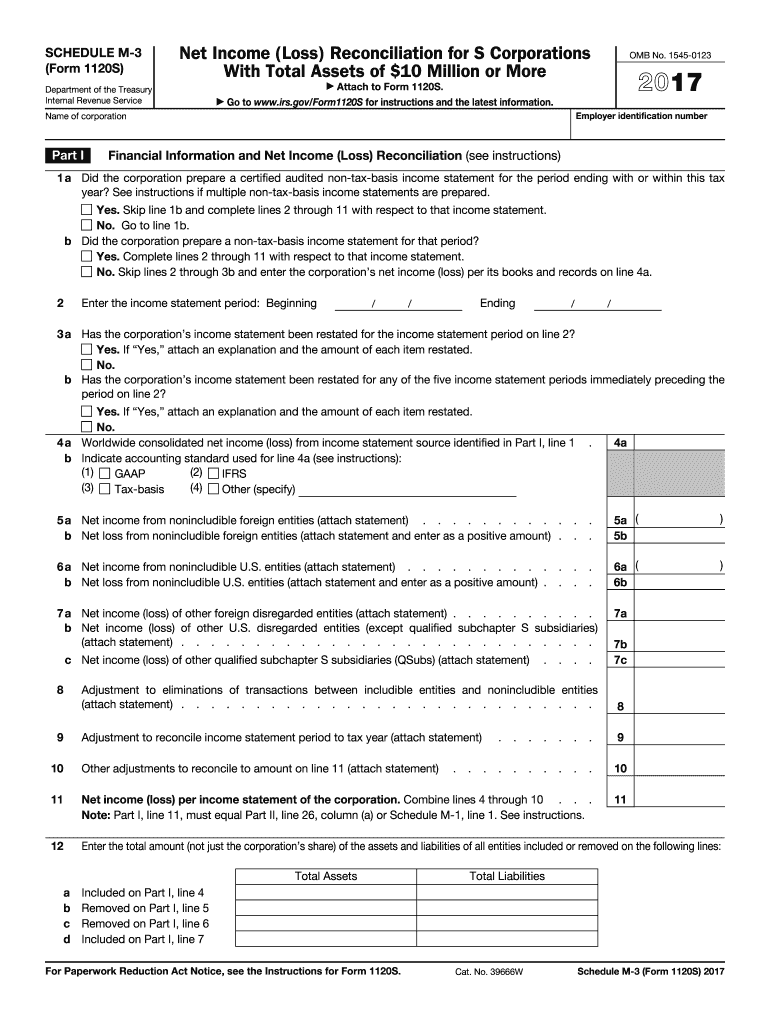

The Form 1120 S is a tax document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). S corporations are special tax entities that allow income to pass through to shareholders, avoiding double taxation at the corporate level. This form is essential for ensuring compliance with federal tax regulations and accurately reflecting the financial activities of the business for the tax year.

How to use the Form 1120 S

To use the Form 1120 S, businesses must first determine their eligibility as an S corporation. Once confirmed, they should gather all necessary financial information, including income, expenses, and any applicable deductions. The form requires details on shareholder information, including the number of shares owned and the distribution of profits. After completing the form, it must be filed with the IRS, typically by the fifteenth day of the third month following the end of the corporation's tax year.

Steps to complete the Form 1120 S

Completing the Form 1120 S involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income and deductions on the appropriate lines, ensuring accuracy and completeness.

- Detail shareholder information, including each shareholder's percentage of ownership and any distributions made during the year.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 S is typically the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is important for corporations to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Form 1120 S, several documents are required, including:

- Financial statements, such as income statements and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Documentation of any shareholder distributions or loans.

- Previous year’s tax return, if applicable, for reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 S can be submitted to the IRS in several ways. Corporations can file electronically using approved e-filing software, which can expedite processing times and reduce errors. Alternatively, the form can be printed and mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not accepted, making electronic and mail options the primary methods for filing.

Quick guide on how to complete form 1120 s 2017

Uncover the easiest method to complete and endorse your Form 1120 S

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior way to complete and endorse your Form 1120 S and comparable forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage paperwork swiftly and according to official standards - powerful PDF editing, organizing, securing, endorsing, and sharing tools all at your fingertips within an intuitive interface.

There are just a few steps needed to complete and endorse your Form 1120 S:

- Upload the fillable template to the editor using the Get Form button.

- Identify what details you need to enter in your Form 1120 S.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the sections with your information.

- Revise the content with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Obscure areas that are no longer relevant.

- Press Sign to create a legally binding eSignature using any method of your choice.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finished Form 1120 S in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our solution also provides adaptable form sharing. There’s no requirement to print your forms when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct form 1120 s 2017

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form 1120 s 2017

How to generate an electronic signature for the Form 1120 S 2017 in the online mode

How to generate an electronic signature for your Form 1120 S 2017 in Google Chrome

How to generate an electronic signature for putting it on the Form 1120 S 2017 in Gmail

How to make an electronic signature for the Form 1120 S 2017 straight from your smart phone

How to make an electronic signature for the Form 1120 S 2017 on iOS

How to generate an electronic signature for the Form 1120 S 2017 on Android devices

People also ask

-

What is Form 1120 S and why is it important?

Form 1120 S is a tax form used by S corporations to report income, deductions, and credits. It's crucial for S corporations as it helps in determining tax liabilities and ensures compliance with IRS regulations. Understanding how to complete and submit Form 1120 S is essential for maintaining good standing and avoiding penalties.

-

How can airSlate SignNow help with the Form 1120 S process?

airSlate SignNow streamlines the preparation and submission of Form 1120 S by allowing users to easily eSign and send documents securely. This simplifies collaboration with tax professionals and ensures that all necessary signatures are captured efficiently. With features that enhance organization, airSlate SignNow makes tax season less stressful for S corporations.

-

What integrations does airSlate SignNow offer for Form 1120 S preparation?

airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage Form 1120 S. These integrations help users import data directly into their tax forms, reducing the risk of errors and saving time. This functionality ensures a smooth workflow during tax season.

-

What are the pricing options for using airSlate SignNow for Form 1120 S?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing Form 1120 S. Users can choose from various plans that scale based on features and usage frequency. This allows S corporations of all sizes to access the tools they need without overspending.

-

Is airSlate SignNow secure for handling Form 1120 S documents?

Yes, airSlate SignNow provides robust security measures to protect sensitive data associated with Form 1120 S. With encryption and secure cloud storage, users can be confident that their tax-related documents are safeguarded against unauthorized access. This ensures peace of mind while managing crucial tax documents.

-

Can I track the status of my Form 1120 S documents with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow users to monitor the status of their Form 1120 S documents in real-time. You will receive notifications when documents are viewed, signed, or completed, keeping you informed throughout the process and ensuring timely submissions.

-

What are the benefits of using airSlate SignNow for S Corporations focusing on Form 1120 S?

Using airSlate SignNow provides numerous benefits for S Corporations preparing Form 1120 S, including increased efficiency and reduced paperwork. The platform simplifies eSigning and document sharing, signNowly speeding up the filing process. Additionally, it enhances collaboration between team members and tax professionals, leading to better accuracy.

Get more for Form 1120 S

- Judct form

- Rd1 supercard form

- Cor 364 form

- Child stress disorders checklist screening form

- Certification of correction of violations form

- Machtiging standaard europees incasso sepa bp plus tankpas form

- Revert to landlord agreement sceampg form

- Extended mass layoffs after a comparison of new york and the nation extended mass layoffs after a comparison of new york and form

Find out other Form 1120 S

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple