Form 1120 S Schedule M 3 Net Income Loss Reconciliation for S Corporations with Total Assets of $10 Million or More 2013

Understanding Form 1120 S Schedule M-3 Net Income Loss Reconciliation

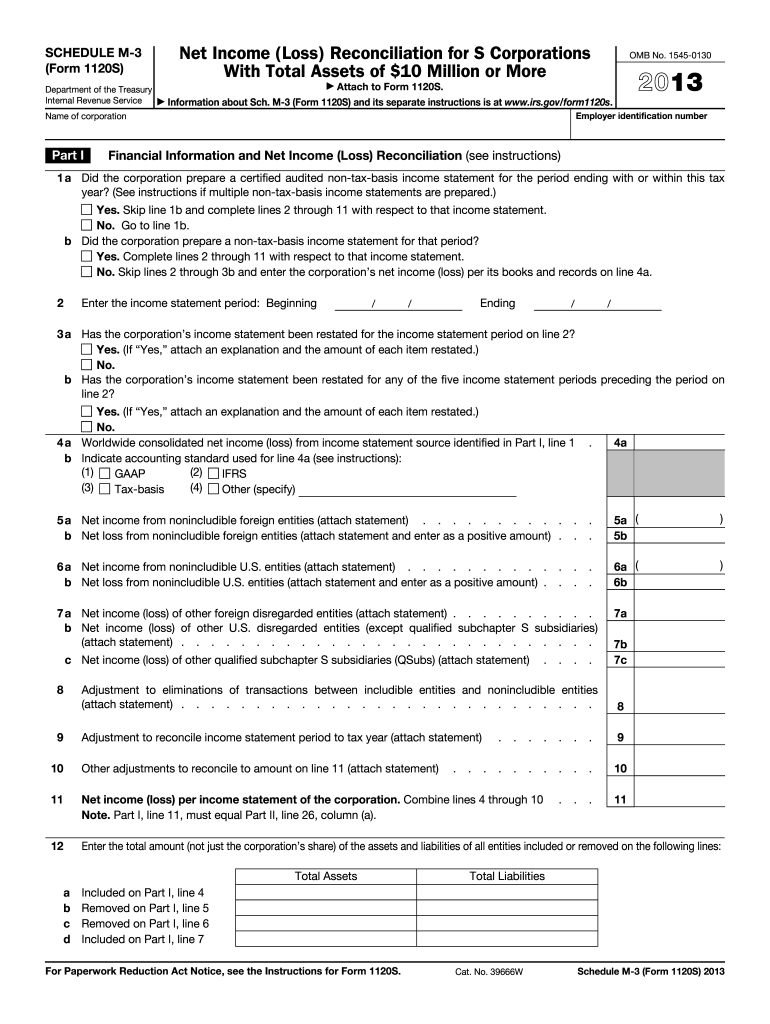

The Form 1120 S Schedule M-3 is a crucial document for S corporations with total assets of ten million dollars or more. This form serves as a reconciliation of net income or loss, providing detailed information about the corporation's financial status. The Schedule M-3 is designed to enhance transparency and ensure compliance with IRS regulations, enabling the IRS to better understand the differences between financial accounting and tax reporting. It requires corporations to disclose specific financial data, including income, deductions, and other adjustments, which can impact the overall tax liability.

Steps to Complete Form 1120 S Schedule M-3

Completing the Form 1120 S Schedule M-3 involves several key steps:

- Gather necessary financial statements, including balance sheets and income statements.

- Review the instructions provided by the IRS to ensure compliance with all requirements.

- Fill out the form accurately, ensuring that all figures are supported by your financial records.

- Double-check all entries for accuracy, particularly the reconciliation of net income or loss.

- Submit the completed form along with your tax return by the designated deadline.

Legal Use of Form 1120 S Schedule M-3

The legal validity of Form 1120 S Schedule M-3 is grounded in its compliance with IRS regulations. When filled out correctly, this form serves as a legally binding document that reflects the financial position of the S corporation. It is essential for corporations to ensure that all information provided is accurate and complete, as discrepancies can lead to audits or penalties. The electronic submission of this form is permissible under the ESIGN Act, provided that the electronic signature meets all legal standards.

Filing Deadlines for Form 1120 S Schedule M-3

Timely filing of Form 1120 S Schedule M-3 is critical to avoid penalties. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this typically means a deadline of March 15. Extensions may be available, but it is important to file for an extension before the original deadline to avoid late penalties.

Key Elements of Form 1120 S Schedule M-3

Form 1120 S Schedule M-3 comprises several important sections, including:

- Part I: Provides a summary of the corporation's income and deductions.

- Part II: Details the reconciliation of net income or loss.

- Part III: Requires disclosures regarding specific financial transactions.

Each section is designed to capture essential information that reflects the corporation's financial activities, ensuring comprehensive reporting to the IRS.

Obtaining Form 1120 S Schedule M-3

Form 1120 S Schedule M-3 can be obtained directly from the IRS website. It is available in a downloadable PDF format, which can be printed and filled out manually, or it can be completed electronically using compatible tax software. It is advisable to always use the most current version of the form to ensure compliance with any recent changes in tax laws.

Quick guide on how to complete 2013 form 1120 s schedule m 3net income loss reconciliation for s corporations with total assets of 10 million or more

Complete Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the correct form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More without hassle

- Locate Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or disorganized files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your needs in document management in just a few clicks from any device of your choice. Alter and eSign Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1120 s schedule m 3net income loss reconciliation for s corporations with total assets of 10 million or more

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1120 s schedule m 3net income loss reconciliation for s corporations with total assets of 10 million or more

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More?

Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More is a tax form used by S corporations to reconcile their financial statements with their tax returns. This form helps ensure accurate reporting of income and losses, which is critical for compliance. Proper completion of this form is essential for S corporations that meet the asset threshold.

-

How can airSlate SignNow assist with Form 1120 S Schedule M 3?

airSlate SignNow provides a streamlined process for preparing and signing Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More. Our platform simplifies document management, ensuring that you can easily gather signatures and maintain an organized workflow. This improves both efficiency and accuracy in your filing process.

-

What pricing options does airSlate SignNow offer for businesses preparing Form 1120 S Schedule M 3?

airSlate SignNow offers flexible pricing plans tailored to the needs of various businesses preparing Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More. Our pricing is competitive and designed to provide value through affordable electronic signature services. You can choose a plan based on your specific usage and requirements.

-

What features does airSlate SignNow provide for S Corporations?

airSlate SignNow includes features designed to facilitate the filing of Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More. Key features include document templates, customizable workflows, and secure e-signatures that enhance productivity. These tools help ensure compliance and prevent common errors.

-

Can airSlate SignNow integrate with accounting software for Form 1120 S Schedule M 3?

Yes, airSlate SignNow easily integrates with popular accounting software, making it simpler to handle Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More. This integration streamlines data sharing, reducing the risk of errors and accelerating your filing process. You'll enjoy a seamless experience when managing your financial documents.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, such as Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More, offers several benefits. It increases efficiency, ensures compliance, and enhances document security through encrypted e-signatures. Our platform is user-friendly and designed to make your tax season smoother.

-

How secure is airSlate SignNow for handling sensitive tax forms?

airSlate SignNow prioritizes the security of your documents, including Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More. Our platform utilizes advanced encryption and complies with industry standards to protect your confidential information. You can confidently manage sensitive tax forms with our secure system.

Get more for Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More

- Interrogatories to plaintiff for motor vehicle occurrence iowa form

- Interrogatories to defendant for motor vehicle accident iowa form

- Llc notices resolutions and other operations forms package iowa

- Notice of dishonored check civil keywords bad check bounced check iowa form

- Iowa certificate of trust by individual iowa form

- Ia trust form

- Mutual wills containing last will and testaments for unmarried persons living together with no children iowa form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children iowa form

Find out other Form 1120 S Schedule M 3 Net Income Loss Reconciliation For S Corporations With Total Assets Of $10 Million Or More

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online