928 Form

What is the 928 Form

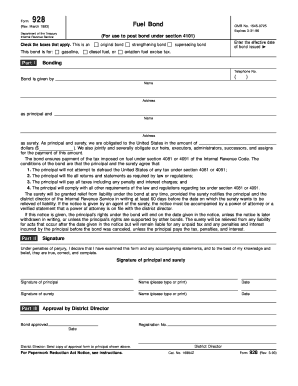

The IRS Form 928 is a tax document used primarily for reporting certain income and expenses. This form is essential for individuals and businesses who need to provide detailed information about their financial activities. It serves as a formal declaration to the Internal Revenue Service, ensuring compliance with tax regulations. Understanding the purpose of the 928 form is crucial for accurate tax reporting and to avoid potential penalties.

How to obtain the 928 Form

Obtaining the IRS Form 928 is a straightforward process. The form can be downloaded directly from the official IRS website. It is available in PDF format, allowing users to print and fill it out manually. Alternatively, individuals may also request a physical copy by contacting the IRS directly. Ensuring that you have the correct version of the form is vital for accurate reporting.

Steps to complete the 928 Form

Completing the IRS Form 928 involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

Following these steps will help ensure that the form is filled out correctly, reducing the risk of complications with the IRS.

Legal use of the 928 Form

The legal use of the IRS Form 928 is fundamental for maintaining compliance with tax laws. This form must be completed accurately and submitted by the designated deadlines to avoid penalties. The information provided on the form is subject to verification by the IRS, making it essential to ensure that all data is truthful and complete. Failure to comply with the legal requirements associated with this form can result in fines and other legal repercussions.

Form Submission Methods

The IRS Form 928 can be submitted through various methods, including:

- Online submission via the IRS e-file system, which allows for quicker processing.

- Mailing a completed paper form to the appropriate IRS address, which depends on the taxpayer's location.

- In-person submission at designated IRS offices, where assistance may be available.

Choosing the right submission method can impact the processing time and overall efficiency of your tax filing.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IRS Form 928. Typically, the form must be submitted by April fifteenth of the following tax year. However, extensions may be available under certain circumstances. Keeping track of these important dates helps ensure timely submission and compliance with IRS regulations.

Quick guide on how to complete 928 form

Effortlessly Prepare 928 Form on Any Device

Managing documents online has gained signNow traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to access the necessary format and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage 928 Form on any device through the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Steps to Modify and eSign 928 Form with Ease

- Obtain 928 Form and click on Get Form to begin.

- Utilize the tools available to submit your form.

- Highlight important sections of your documents or obscure sensitive details with the tools provided specifically for that reason by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and hit the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign 928 Form to maintain effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 928 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 928?

IRS Form 928 is used for reporting certain financial transactions related to partnerships and limited liability companies. Understanding its requirements is crucial for maintaining compliance with federal tax laws. Using airSlate SignNow can streamline the signing process for this form.

-

How does airSlate SignNow help with IRS Form 928?

airSlate SignNow simplifies the process of sending and signing IRS Form 928 by providing an intuitive platform. You can easily upload the form, send it for eSignature, and track its status all in one place. This efficiency can save you time and reduce the chances of errors.

-

Is there a cost associated with using airSlate SignNow for IRS Form 928?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including those needing to manage IRS Form 928. The plans are designed to be cost-effective and provide value through features such as unlimited document uploads and advanced signing workflows. You can choose a plan that fits your budget.

-

Can I integrate airSlate SignNow with other tools for IRS Form 928?

Absolutely! airSlate SignNow supports multiple integrations with popular applications such as Google Workspace and Salesforce. This allows you to send and manage IRS Form 928 seamlessly alongside your existing workflow tools, enhancing productivity.

-

What are the benefits of using airSlate SignNow for IRS Form 928?

Using airSlate SignNow for IRS Form 928 provides several benefits, including increased efficiency and reduced paperwork. The platform also enhances security with encrypted signatures and storage. This combination makes it easier to stay compliant and manage important tax forms.

-

How secure is the signing process for IRS Form 928 in airSlate SignNow?

The signing process for IRS Form 928 in airSlate SignNow is highly secure, utilizing encryption and advanced authentication measures. This ensures that your sensitive information and signed documents remain protected throughout the signing process. Trusting airSlate SignNow means peace of mind for your business.

-

Can I access IRS Form 928 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to create, send, and sign IRS Form 928 from your smartphone or tablet. This flexibility means you can manage your documents on the go, making it easier to stay on top of your tax obligations, no matter where you are.

Get more for 928 Form

- Open public records act request for north bergen nj form

- Checklist of labor law requirements form

- Form for a rule for 102 louisiana divorce

- Of 306 fillable form

- Cj d 301 form

- Solicitation application form

- Gerber life insurance application naaiporg form

- Non cash charitable contributions worksheet tax year form

Find out other 928 Form

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment