Copy of TX17 Rhode Island Employer Tax Home Page RI Gov Uitax Ri Form

What is the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

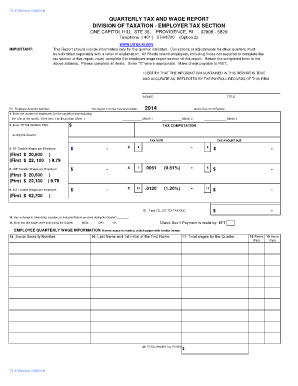

The Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri is an essential document for employers in Rhode Island. It serves as a guide for employers to understand their tax obligations and responsibilities to the state. This form provides detailed information regarding the employer tax rates, filing requirements, and deadlines. It is crucial for businesses to familiarize themselves with this form to ensure compliance with state tax laws.

How to use the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

Utilizing the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri involves several steps. Employers should first access the form through the official state website. Once obtained, they must review the instructions carefully to understand the information required. The form includes sections for reporting employee wages, tax withholdings, and other relevant data. Accurate completion is vital to avoid penalties and ensure timely processing.

Steps to complete the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

Completing the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri requires attention to detail. Follow these steps:

- Access the form from the official Rhode Island government website.

- Gather necessary information, including employee details and wage data.

- Fill out each section of the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the provided instructions, either online or via mail.

Legal use of the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

The legal use of the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri is governed by state tax laws. This form must be filled out correctly to ensure compliance with Rhode Island's tax regulations. Employers are legally obligated to submit this form to report their tax liabilities accurately. Failure to do so can result in penalties, including fines or additional tax assessments.

Key elements of the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

Key elements of the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri include:

- Employer identification information.

- Details of employee wages and withholdings.

- Tax rates applicable to the employer.

- Filing deadlines and submission methods.

Filing Deadlines / Important Dates

Filing deadlines for the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri are critical for compliance. Employers must be aware of specific dates for quarterly and annual filings. Missing these deadlines can lead to penalties and interest on unpaid taxes. It is advisable for employers to mark these dates on their calendars to ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri can be submitted through various methods. Employers have the option to file online via the state’s tax portal, which is often the fastest method. Alternatively, forms can be mailed to the appropriate tax office or submitted in person. Each method has its own processing times and requirements, so employers should choose the one that best suits their needs.

Quick guide on how to complete copy of tx17 rhode island employer tax home page ri gov uitax ri

Effortlessly Complete Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Easiest Way to Edit and eSign Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri with Ease

- Obtain Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or black out sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the copy of tx17 rhode island employer tax home page ri gov uitax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri?

The Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri is an official document required for businesses in Rhode Island to manage their employer tax obligations. It provides essential information needed to ensure compliance with state regulations. Utilizing airSlate SignNow can streamline the process of obtaining and submitting this document electronically.

-

How can airSlate SignNow help with the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri?

AirSlate SignNow simplifies the process of sending and signing documents, including the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri. Our platform allows businesses to securely eSign and share documents, reducing the time and effort spent on paperwork. You can easily track the status of your document to ensure timely submissions.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for handling tax documents like the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri offers several advantages, including increased efficiency and reduced paperwork. Our electronic signature solution helps ensure compliance and a faster turnaround time for document handling. This means businesses can focus more on what they do best instead of getting tangled in paperwork.

-

Is airSlate SignNow cost-effective for small businesses managing the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri?

Absolutely! AirSlate SignNow offers competitive pricing plans tailored for small businesses, making it an affordable solution for managing documents like the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri. By reducing the costs associated with printing and mailing, businesses can save money while ensuring compliance and timely submissions.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow provides features such as templates, automated workflows, and secure cloud storage to ensure efficient document management. These tools enable businesses to manage the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri and other essential documents with ease. Additionally, our platform supports multiple file formats, making it versatile for various business needs.

-

Can airSlate SignNow integrate with other software I use for tax management?

Yes, airSlate SignNow offers integrations with various software applications commonly used by businesses for tax management. Connecting our eSignature platform with your existing tools will enhance your operational efficiency while handling documents like the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri. Our APIs allow for seamless collaboration between systems.

-

Is it secure to eSign the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that any documents signed, including the Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri, are protected. We use advanced encryption technology and offer audit trails for your peace of mind. This ensures that all data remains confidential and secure during the signing process.

Get more for Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

- Hawaii tax form bb1x

- Sample medication reconciliation form

- Form ct 945 2012

- Ccle form 14 supreme court of ohio commission on supremecourt ohio

- Workers compensation disputed claim for compensation form

- Cd 7617 form

- Oau post utme past questions and answers access for form

- Interest form template 556114071

Find out other Copy Of TX17 Rhode Island Employer Tax Home Page RI gov Uitax Ri

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy