Forms North Dakota Office of State Tax Commissioner 2023

Understanding Oregon Form OR 41

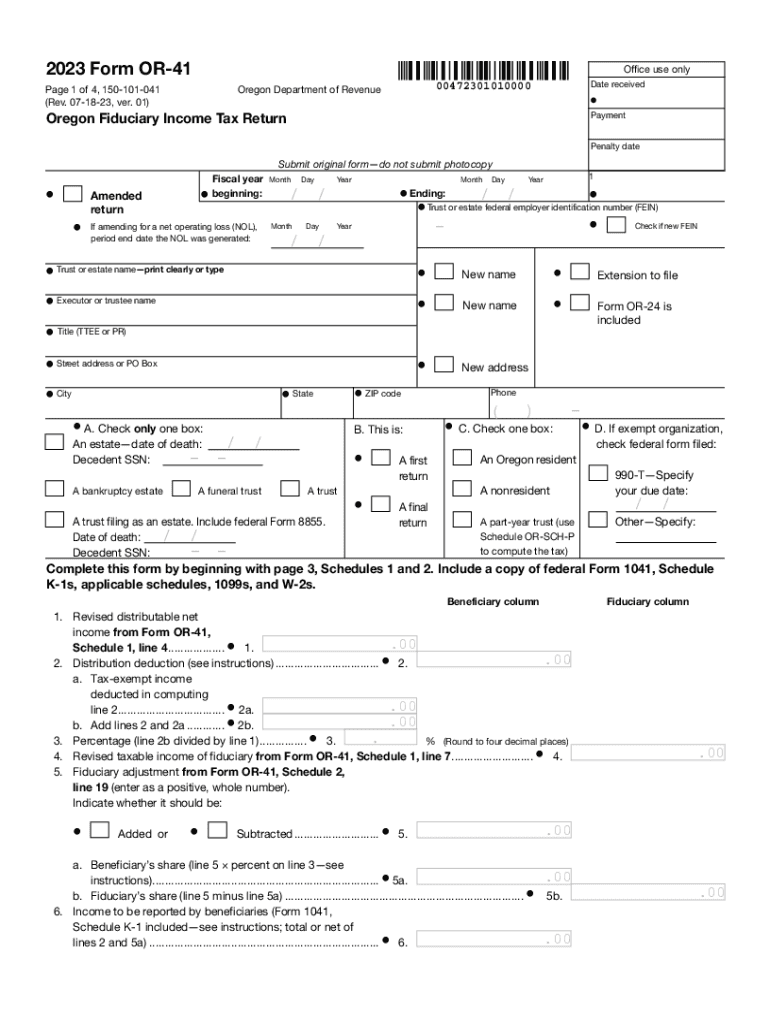

The Oregon Form OR 41 is a tax form used for reporting income for fiduciaries, such as estates and trusts. It is essential for ensuring that the income generated by these entities is reported accurately to the state. The form captures various types of income, deductions, and credits, allowing fiduciaries to fulfill their tax obligations. Understanding the specific requirements and instructions for this form is crucial for compliance and accurate reporting.

Steps to Complete Oregon Form OR 41

Completing the Oregon Form OR 41 involves several key steps:

- Gather necessary documentation, including income statements, deductions, and credits applicable to the estate or trust.

- Fill out the form, ensuring that all income sources are reported accurately. This includes wages, dividends, and interest.

- Calculate the total income and applicable deductions to determine the taxable amount.

- Review the form for accuracy before submission, as errors can lead to penalties.

- Submit the completed form by the designated deadline, either electronically or via mail.

Filing Deadlines for Oregon Form OR 41

It is important to be aware of the filing deadlines for the Oregon Form OR 41. Generally, the form is due on April 15 of the year following the tax year for which the income is reported. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Fiduciaries should also be aware of any extensions that may be available, which can provide additional time for filing.

Required Documents for Oregon Form OR 41

When preparing to file the Oregon Form OR 41, certain documents are necessary to ensure accurate reporting:

- Income statements, including W-2s and 1099s, detailing all sources of income.

- Records of any deductions or credits that may apply, such as expenses related to the administration of the estate or trust.

- Previous tax returns, if applicable, to provide context for the current filing.

Form Submission Methods for Oregon Form OR 41

The Oregon Form OR 41 can be submitted in various ways to accommodate different preferences:

- Online submission through the Oregon Department of Revenue's e-file system, which offers a quick and secure method.

- Mailing the completed form to the appropriate address provided in the filing instructions.

- In-person submission at designated tax offices, which may be suitable for those needing assistance or clarification.

Penalties for Non-Compliance with Oregon Form OR 41

Failure to comply with the filing requirements for the Oregon Form OR 41 can result in significant penalties. These may include:

- Late filing penalties, which can accrue if the form is submitted past the deadline.

- Interest on any unpaid taxes, which compounds over time until the balance is settled.

- Potential legal consequences for persistent non-compliance, which can affect the fiduciary's ability to manage the estate or trust.

Create this form in 5 minutes or less

Find and fill out the correct forms north dakota office of state tax commissioner

Create this form in 5 minutes!

How to create an eSignature for the forms north dakota office of state tax commissioner

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Oregon Form OR 41 instructions?

The Oregon Form OR 41 instructions provide detailed guidance on how to complete the Oregon tax return for partnerships and S corporations. These instructions include information on eligibility, required documentation, and filing deadlines to ensure compliance with state tax laws.

-

How can airSlate SignNow help with Oregon Form OR 41 instructions?

airSlate SignNow simplifies the process of completing and submitting Oregon Form OR 41 instructions by allowing users to eSign documents securely and efficiently. Our platform ensures that all necessary forms are filled out correctly, reducing the risk of errors and streamlining the filing process.

-

Is there a cost associated with using airSlate SignNow for Oregon Form OR 41 instructions?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our cost-effective solutions provide access to features that facilitate the completion of Oregon Form OR 41 instructions, making it a valuable investment for businesses looking to simplify their document management.

-

What features does airSlate SignNow offer for managing Oregon Form OR 41 instructions?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Oregon Form OR 41 instructions. These tools help users efficiently prepare and submit their tax documents while ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for Oregon Form OR 41 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with Oregon Form OR 41 instructions. This integration allows for easy data transfer and collaboration, making the document preparation process even more efficient.

-

What are the benefits of using airSlate SignNow for Oregon Form OR 41 instructions?

Using airSlate SignNow for Oregon Form OR 41 instructions offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your business while we take care of the documentation.

-

How secure is airSlate SignNow when handling Oregon Form OR 41 instructions?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including Oregon Form OR 41 instructions. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

Get more for Forms North Dakota Office Of State Tax Commissioner

Find out other Forms North Dakota Office Of State Tax Commissioner

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now