Oregon Tax Forms Printable State Form or 40 and

What is the Oregon Tax Forms Printable State Form OR-40?

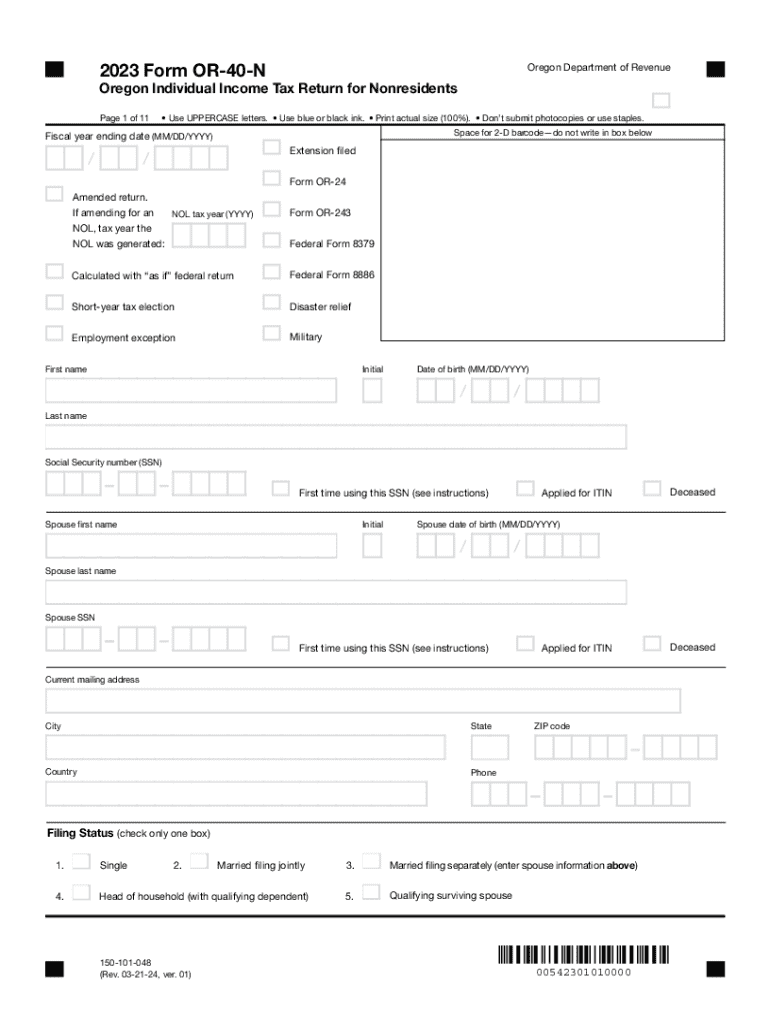

The Oregon Tax Forms Printable State Form OR-40 is a crucial document for residents who need to report their income and calculate their state tax liability. This form is specifically designed for individual taxpayers who are filing their state income tax returns in Oregon. It includes sections for reporting various types of income, deductions, and credits applicable under Oregon tax law. Understanding this form is essential for ensuring compliance with state tax regulations and for accurately calculating any taxes owed or refunds due.

How to Use the Oregon Tax Forms Printable State Form OR-40

Using the Oregon Tax Forms Printable State Form OR-40 involves several steps. First, gather all necessary documentation, such as W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, including your Social Security number and address. Then, report your income, deductions, and credits as required. Be sure to double-check your calculations to avoid errors. Finally, sign and date the form before submitting it to the Oregon Revenue Department, either electronically or by mail.

Steps to Complete the Oregon Tax Forms Printable State Form OR-40

Completing the Oregon Tax Forms Printable State Form OR-40 can be streamlined by following these steps:

- Collect all relevant income documents, including W-2s and 1099s.

- Enter your personal information accurately at the top of the form.

- Report your total income in the designated section.

- Include any deductions you qualify for, such as standard or itemized deductions.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form to certify that the information is correct.

- Submit the completed form to the Oregon Revenue Department by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Tax Forms Printable State Form OR-40 are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines, especially for extensions or specific circumstances that may apply to your tax situation.

Required Documents

When preparing to file the Oregon Tax Forms Printable State Form OR-40, certain documents are essential to ensure accurate reporting. These include:

- W-2 forms from employers showing wages earned.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Previous year’s tax return for reference.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the Oregon Tax Forms Printable State Form OR-40 can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for continued non-compliance. It is crucial to file your return accurately and on time to avoid these consequences. If you anticipate challenges in meeting the deadline, consider seeking assistance or filing for an extension to mitigate penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon tax forms printable state form or 40 and 757727598

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Oregon Revenue Department provide?

The Oregon Revenue Department offers a variety of services including tax collection, tax compliance assistance, and revenue forecasting. They help businesses understand their tax obligations and provide resources for filing and payment. Utilizing airSlate SignNow can streamline document management related to these services.

-

How can airSlate SignNow help with Oregon Revenue Department forms?

airSlate SignNow simplifies the process of filling out and submitting forms required by the Oregon Revenue Department. With our eSignature capabilities, you can easily sign and send documents electronically, ensuring compliance and reducing processing time. This efficiency is crucial for meeting deadlines set by the Oregon Revenue Department.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective, making it easier for businesses to manage their documentation related to the Oregon Revenue Department. You can choose a plan that fits your budget while still accessing essential features.

-

Is airSlate SignNow secure for handling sensitive documents related to the Oregon Revenue Department?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including those related to the Oregon Revenue Department, are protected. We utilize advanced encryption and secure storage solutions to safeguard your information. This commitment to security helps you confidently manage sensitive tax documents.

-

Can I integrate airSlate SignNow with other tools for Oregon Revenue Department tasks?

Absolutely! airSlate SignNow integrates seamlessly with various applications that can assist with tasks related to the Oregon Revenue Department. This includes accounting software and document management systems, allowing for a more streamlined workflow and better organization of your tax-related documents.

-

What are the benefits of using airSlate SignNow for Oregon Revenue Department documentation?

Using airSlate SignNow for your Oregon Revenue Department documentation offers numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. Our platform allows for easy collaboration and tracking of documents, ensuring that you stay compliant with state regulations. This can signNowly enhance your overall productivity.

-

How does airSlate SignNow ensure compliance with Oregon Revenue Department regulations?

airSlate SignNow is designed to help businesses maintain compliance with various regulations, including those set by the Oregon Revenue Department. Our platform provides templates and guidance for completing necessary forms accurately. Additionally, our audit trails ensure that all actions taken on documents are recorded for compliance purposes.

Get more for Oregon Tax Forms Printable State Form OR 40 And

Find out other Oregon Tax Forms Printable State Form OR 40 And

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now