Schedule B Form 1040 Interest and Ordinary Dividends 2024-2026

What is the Schedule B Form 1040 Interest And Ordinary Dividends

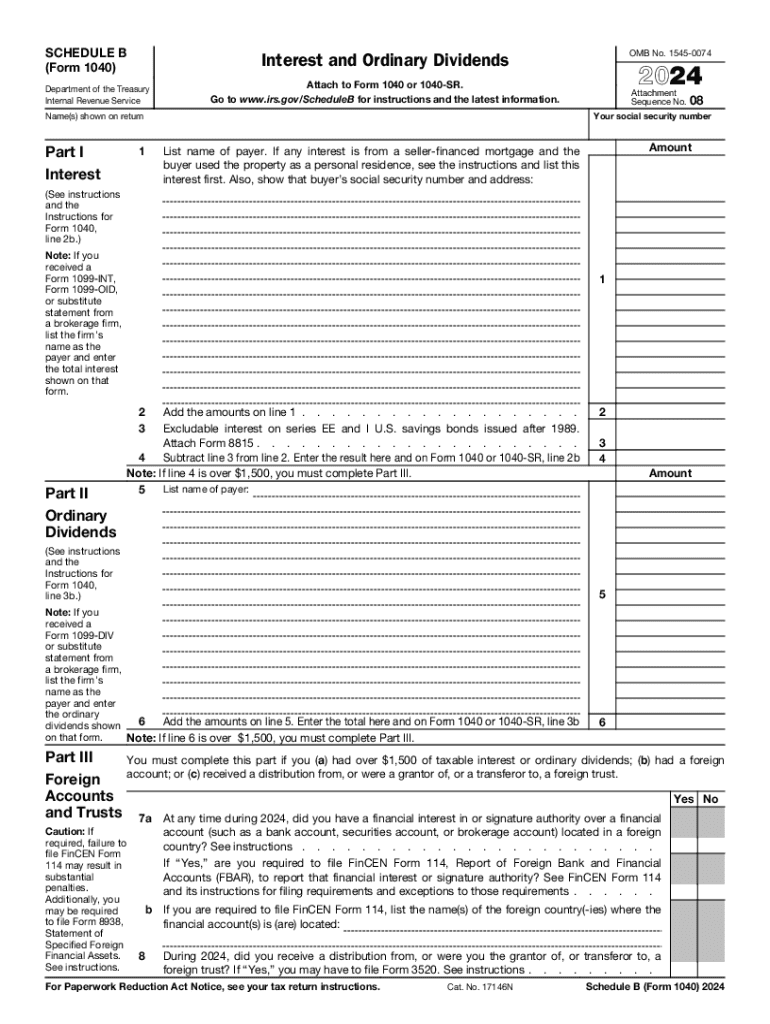

The Schedule B form is a crucial part of the U.S. tax filing process, specifically for reporting interest and ordinary dividends. It is used by taxpayers to disclose income earned from various sources, including bank accounts, bonds, and stock dividends. This form is typically attached to the Form 1040, which is the standard individual income tax return. The information provided on Schedule B helps the IRS ensure that taxpayers are accurately reporting their income and paying the appropriate amount of tax.

How to Use the Schedule B Form 1040 Interest And Ordinary Dividends

Using the Schedule B form involves several steps to accurately report your interest and dividend income. First, gather all relevant documents, such as Form 1099-INT for interest income and Form 1099-DIV for dividends. Next, fill out the form by listing each source of income, including the payer's name, amount received, and any foreign accounts if applicable. It is important to ensure that the totals from Schedule B match the amounts reported on your Form 1040 to avoid discrepancies. Finally, attach the completed Schedule B to your Form 1040 when filing your federal tax return.

Steps to Complete the Schedule B Form 1040 Interest And Ordinary Dividends

Completing the Schedule B form can be straightforward if you follow these steps:

- Gather all necessary documents, including Forms 1099-INT and 1099-DIV.

- Begin by filling in your personal information at the top of the form.

- List each source of interest income in Part I, including the name of the payer and the amount received.

- In Part II, report any ordinary dividends received, again including the payer's name and amount.

- If applicable, answer the questions regarding foreign accounts and sign the form.

- Double-check all entries for accuracy before attaching it to your Form 1040.

IRS Guidelines for Schedule B Form 1040 Interest And Ordinary Dividends

The IRS provides specific guidelines for completing the Schedule B form. Taxpayers must report all interest and dividend income, regardless of the amount. If you have foreign bank accounts, additional disclosures may be required. The IRS also emphasizes the importance of keeping accurate records of all income sources to support your claims. Following these guidelines helps ensure compliance and reduces the risk of audits or penalties.

Filing Deadlines for Schedule B Form 1040 Interest And Ordinary Dividends

The filing deadline for the Schedule B form aligns with the due date for the Form 1040, which is typically April 15th each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be mindful of any changes to deadlines, especially if they are filing for extensions. Ensuring timely submission of the Schedule B helps avoid penalties and interest on unpaid taxes.

Required Documents for Schedule B Form 1040 Interest And Ordinary Dividends

To accurately complete the Schedule B form, taxpayers should have the following documents on hand:

- Form 1099-INT for reporting interest income.

- Form 1099-DIV for reporting dividend income.

- Bank statements or brokerage statements that detail interest and dividends received.

- Any records of foreign accounts if applicable.

Handy tips for filling out Schedule B Form 1040 Interest And Ordinary Dividends online

Quick steps to complete and e-sign Schedule B Form 1040 Interest And Ordinary Dividends online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant solution for maximum straightforwardness. Use signNow to e-sign and share Schedule B Form 1040 Interest And Ordinary Dividends for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct schedule b form 1040 interest and ordinary dividends

Create this form in 5 minutes!

How to create an eSignature for the schedule b form 1040 interest and ordinary dividends

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule B and how does it relate to airSlate SignNow?

A Schedule B is a form used to report the sale of certain types of securities and other financial transactions. With airSlate SignNow, you can easily create, send, and eSign your Schedule B documents, ensuring compliance and accuracy in your financial reporting.

-

How can airSlate SignNow help me manage my Schedule B documents?

airSlate SignNow provides a user-friendly platform that allows you to manage your Schedule B documents efficiently. You can create templates, track changes, and securely store your documents, making it easier to handle your financial paperwork.

-

Is airSlate SignNow cost-effective for handling Schedule B forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Schedule B forms. With flexible pricing plans, you can choose the option that best fits your business needs while ensuring you have the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for Schedule B eSigning?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning for Schedule B documents. These features streamline the signing process, making it faster and more efficient for you and your clients.

-

Can I integrate airSlate SignNow with other software for Schedule B management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Schedule B documents alongside your existing tools. This integration enhances your workflow and ensures that all your financial data is synchronized.

-

What are the benefits of using airSlate SignNow for Schedule B documentation?

Using airSlate SignNow for your Schedule B documentation offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform simplifies the eSigning process, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow for handling sensitive Schedule B information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive Schedule B information. You can trust that your documents are safe and secure throughout the signing process.

Get more for Schedule B Form 1040 Interest And Ordinary Dividends

Find out other Schedule B Form 1040 Interest And Ordinary Dividends

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment