Nj Division of Revenue C113 Form

What is the Nj Division Of Revenue C113 Form

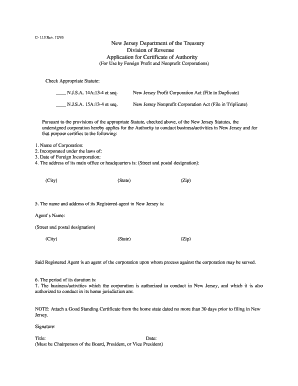

The Nj Division Of Revenue C113 Form is a crucial document used in New Jersey for various tax-related purposes. This form is primarily designed for businesses to report and remit their state taxes. It serves as a declaration of the business's financial activities and ensures compliance with state tax obligations. Understanding the purpose of the C113 Form is essential for any business operating in New Jersey, as it helps maintain transparency and accountability in financial reporting.

How to use the Nj Division Of Revenue C113 Form

Using the Nj Division Of Revenue C113 Form involves several steps to ensure accurate completion and submission. First, businesses must gather all necessary financial information, including income, expenses, and any applicable deductions. Next, the form should be filled out carefully, ensuring that all required fields are completed. Once the form is filled, it can be submitted electronically or via mail, depending on the preferred method of submission. Utilizing electronic signature solutions can streamline this process, making it easier to sign and send the form securely.

Steps to complete the Nj Division Of Revenue C113 Form

Completing the Nj Division Of Revenue C113 Form requires attention to detail. Here are the essential steps:

- Gather all relevant financial documents, including income statements and expense records.

- Access the C113 Form from the official New Jersey Division of Revenue website.

- Fill out the form accurately, ensuring all required information is provided.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mailing it to the appropriate state office.

Legal use of the Nj Division Of Revenue C113 Form

The legal use of the Nj Division Of Revenue C113 Form is vital for compliance with New Jersey tax laws. This form must be completed accurately to avoid penalties or legal repercussions. It serves as a formal declaration to the state regarding a business's tax obligations. Ensuring that the form is submitted on time and in accordance with state regulations is essential for maintaining good standing with the New Jersey Division of Revenue.

Key elements of the Nj Division Of Revenue C113 Form

Understanding the key elements of the Nj Division Of Revenue C113 Form is essential for accurate completion. The form typically includes sections for:

- Business identification details, such as name and address.

- Financial information, including income and expenses.

- Tax calculation sections to determine the amount owed.

- Signature lines for authorized representatives.

Each section must be filled out with precise information to ensure compliance and avoid potential issues with the state.

Form Submission Methods

The Nj Division Of Revenue C113 Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the New Jersey Division of Revenue's electronic filing system.

- Mailing a physical copy of the completed form to the designated state office.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can help expedite processing and ensure timely compliance with state tax requirements.

Quick guide on how to complete nj division of revenue c113 form

Complete Nj Division Of Revenue C113 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without holdups. Manage Nj Division Of Revenue C113 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Nj Division Of Revenue C113 Form with ease

- Locate Nj Division Of Revenue C113 Form and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight key sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and has the same legal standing as a traditional signed document.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your document, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nj Division Of Revenue C113 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj division of revenue c113 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nj Division Of Revenue C113 Form?

The Nj Division Of Revenue C113 Form is a document used for business registration and tax purposes in New Jersey. This form is essential for entities looking to operate legally in the state, as it provides necessary information about your business structure and ownership.

-

How can airSlate SignNow help with the Nj Division Of Revenue C113 Form?

airSlate SignNow simplifies the process of completing and eSigning the Nj Division Of Revenue C113 Form. Our platform allows you to easily fill in the required details and securely send it for signature, ensuring compliance and efficiency in your business operations.

-

Is there a cost associated with using airSlate SignNow for the Nj Division Of Revenue C113 Form?

airSlate SignNow offers various pricing plans that cater to different business needs, all while providing cost-effective solutions. While there may be fees associated with our plans, using SignNow to handle the Nj Division Of Revenue C113 Form can save you time and reduce errors.

-

What features does airSlate SignNow offer for the Nj Division Of Revenue C113 Form?

With airSlate SignNow, you get features like customizable templates, real-time collaboration, and secure document storage, all tailored for the Nj Division Of Revenue C113 Form. These tools help streamline the completion and approval process, making tax filing easier for businesses.

-

Can I integrate airSlate SignNow with other applications for managing the Nj Division Of Revenue C113 Form?

Yes, airSlate SignNow seamlessly integrates with many applications, allowing you to manage the Nj Division Of Revenue C113 Form alongside other business functions. These integrations enhance productivity by automating workflows and ensuring that all your documents are in one place.

-

What benefits does airSlate SignNow provide for businesses filing the Nj Division Of Revenue C113 Form?

Using airSlate SignNow for the Nj Division Of Revenue C113 Form provides businesses with improved efficiency, enhanced security, and reduced paper clutter. Our platform helps ensure that your documents are processed quickly and securely, contributing to smoother business operations.

-

How secure is airSlate SignNow when handling the Nj Division Of Revenue C113 Form?

AirSlate SignNow takes security seriously, implementing robust encryption measures to protect your documents, including the Nj Division Of Revenue C113 Form. We adhere to industry standards to ensure your sensitive business information remains confidential and secure.

Get more for Nj Division Of Revenue C113 Form

- 2021 form 1098 mortgage interest statement

- Instructions for form 1098 2021internal revenue service

- Dorwagovget form or publicationforms subjectreal estate excise tax formswashington department of revenue

- Mail to washington state department of revenue jandec form

- Payers name street address city or irs tax forms

- How to write an incident report templates venngagehow to write an incident report templates venngageemployer incident form

- Fillable online revenue procedure 2002 53 reprinted from form

- 2021 schedule f form 990 statement of activities outside the united states

Find out other Nj Division Of Revenue C113 Form

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure