Residential Homestead Exemption Travis Form

What is the Residential Homestead Exemption Travis Form

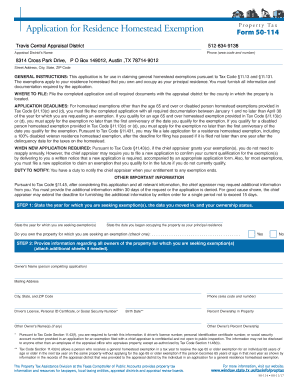

The Residential Homestead Exemption Travis Form is a legal document used in Travis County, Texas, to apply for a property tax exemption on a primary residence. This exemption reduces the taxable value of the property, resulting in lower property taxes for homeowners. It is designed to provide financial relief to residents by acknowledging their primary home and offering tax benefits. Understanding this form is essential for homeowners looking to take advantage of available tax savings.

How to use the Residential Homestead Exemption Travis Form

Using the Residential Homestead Exemption Travis Form involves several key steps. First, ensure you meet the eligibility criteria, which typically include being the owner of the property and using it as your primary residence. Next, obtain the form, which can usually be found on the Travis County Appraisal District website or through local government offices. Complete the form by providing necessary information about your property and ownership. Finally, submit the form to the appropriate local authority by the specified deadline.

Steps to complete the Residential Homestead Exemption Travis Form

Completing the Residential Homestead Exemption Travis Form requires careful attention to detail. Start by gathering required documents, such as proof of ownership and identification. Fill out the form accurately, ensuring all information is current and complete. Key sections typically include property details, owner information, and any additional documentation required for the exemption. After filling out the form, review it for accuracy before submission to avoid delays or rejections.

Eligibility Criteria

To qualify for the Residential Homestead Exemption Travis Form, applicants must meet specific eligibility criteria. Generally, the applicant must be the owner of the property and occupy it as their principal residence. Additionally, the property must not be used for commercial purposes. Homeowners may also need to provide proof of identity and residency, such as a driver's license or utility bill, to verify eligibility. Understanding these criteria is crucial to ensure a successful application.

Required Documents

When applying for the Residential Homestead Exemption Travis Form, several documents are typically required to support your application. These may include a copy of your driver's license or state ID, proof of ownership such as a deed or title, and any other documentation that verifies your residency at the property. Ensuring that all required documents are included with your application can help expedite the review process and increase the likelihood of approval.

Form Submission Methods

The Residential Homestead Exemption Travis Form can be submitted through various methods, depending on local regulations. Common submission methods include online submission via the Travis County Appraisal District website, mailing the completed form to the appropriate office, or delivering it in person. Each method has its own advantages, such as convenience for online submissions or direct interaction when submitting in person. Be sure to choose the method that best fits your needs and complies with local guidelines.

Quick guide on how to complete residential homestead exemption travis form

Complete Residential Homestead Exemption Travis Form seamlessly on any device

Web-based document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without interruptions. Manage Residential Homestead Exemption Travis Form on any device through airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Residential Homestead Exemption Travis Form without effort

- Locate Residential Homestead Exemption Travis Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or redact sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your updates.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Residential Homestead Exemption Travis Form and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residential homestead exemption travis form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Residential Homestead Exemption Travis Form?

The Residential Homestead Exemption Travis Form is a document used to apply for property tax exemptions on residential properties in Travis County. This form helps homeowners reduce their taxable value, providing signNow savings on their property taxes. By submitting the Residential Homestead Exemption Travis Form, you can ensure you are taking advantage of all available tax benefits.

-

How do I complete the Residential Homestead Exemption Travis Form?

Completing the Residential Homestead Exemption Travis Form requires basic information about your property, including its location and ownership details. You must also provide proof of residency as it’s essential for claiming the exemption. Accessing the form online through local government websites can streamline the submission process.

-

Are there any fees associated with filing the Residential Homestead Exemption Travis Form?

No, there are no fees to file the Residential Homestead Exemption Travis Form in Travis County. It is important to submit the form by the deadline to ensure you receive your exemption. Filing is a straightforward process, making it accessible for all residents seeking tax relief.

-

What are the benefits of filing the Residential Homestead Exemption Travis Form?

Filing the Residential Homestead Exemption Travis Form offers substantial financial savings through property tax reductions. Homeowners can benefit from a lowered taxable value and potentially lower monthly mortgage payments. Additionally, this exemption can enhance overall community well-being by making housing more affordable.

-

What is the deadline for submitting the Residential Homestead Exemption Travis Form?

The deadline for submitting the Residential Homestead Exemption Travis Form in Travis County is typically January 1st through April 30th of the tax year. It is crucial to submit your form within this timeframe to qualify for the current year's exemption. Late submissions may lead to missed tax savings.

-

Can I eFile the Residential Homestead Exemption Travis Form with airSlate SignNow?

Yes, you can easily eFile the Residential Homestead Exemption Travis Form using airSlate SignNow. This platform allows users to complete and electronically sign their forms securely and efficiently. Utilizing airSlate SignNow simplifies the process, ensuring you stay compliant and organized.

-

What documents do I need to submit along with the Residential Homestead Exemption Travis Form?

When submitting the Residential Homestead Exemption Travis Form, you typically need to include proof of residence such as a utility bill or your driver's license. It’s important to check local guidelines for any additional required documents. Providing complete documentation helps expedite the approval process.

Get more for Residential Homestead Exemption Travis Form

Find out other Residential Homestead Exemption Travis Form

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease