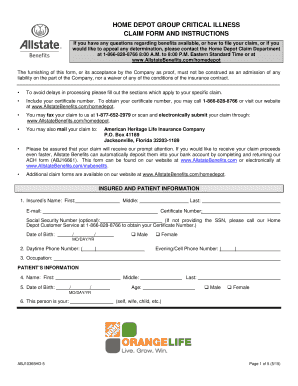

HOME DEPOT GROUP CRITICAL ILLNESS Form

What is critical illness insurance?

Critical illness insurance provides financial protection by offering a lump sum payment if the insured is diagnosed with a specified serious illness. This type of insurance typically covers conditions such as heart attacks, strokes, cancer, and other life-threatening diseases. The payment can be used to cover medical expenses, lost income, or any other financial needs during recovery. Understanding the specific illnesses covered by a policy is crucial, as this can vary significantly between insurance providers.

How to obtain critical illness insurance

Obtaining critical illness insurance involves several straightforward steps. First, assess your personal health needs and financial situation to determine the level of coverage required. Next, research various insurance providers to compare policies, premiums, and coverage options. After selecting a provider, fill out an application form, which may require health information and possibly a medical examination. Once approved, you will receive your policy documents, detailing the coverage and terms of your insurance.

Key elements of critical illness insurance

Several key elements define critical illness insurance policies. These include:

- Coverage Amount: The total sum payable upon diagnosis of a covered illness.

- Waiting Period: The time frame after the policy starts during which no claims can be made.

- Renewability: Conditions under which the policy can be renewed or extended.

- Exclusions: Specific conditions or circumstances that are not covered by the policy.

Understanding these elements helps in making informed decisions when choosing a policy.

Eligibility criteria for critical illness insurance

Eligibility for critical illness insurance typically depends on several factors, including age, health status, and lifestyle choices. Most insurers require applicants to be within a certain age range, often between eighteen and sixty-five years old. Additionally, individuals with pre-existing conditions may face restrictions or higher premiums. It is essential to provide accurate health information during the application process, as this can impact eligibility and coverage options.

Steps to complete the critical illness insurance application

Completing the application for critical illness insurance involves a series of methodical steps:

- Gather necessary personal and health information.

- Choose the appropriate coverage amount based on your needs.

- Fill out the application form, ensuring all information is accurate.

- Submit the application along with any required documentation, such as medical records.

- Await approval from the insurance provider, which may involve a medical examination.

Following these steps carefully can help streamline the application process and increase the likelihood of approval.

Legal use of critical illness insurance

Critical illness insurance is governed by various state and federal regulations. It is essential to ensure that the policy complies with the legal standards set forth by the state in which it is issued. This includes adherence to consumer protection laws and proper disclosure of policy terms. Understanding these legal aspects helps policyholders protect their rights and ensures they receive the benefits outlined in their insurance contract.

Quick guide on how to complete home depot group critical illness

Complete HOME DEPOT GROUP CRITICAL ILLNESS effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle HOME DEPOT GROUP CRITICAL ILLNESS on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based task today.

How to edit and eSign HOME DEPOT GROUP CRITICAL ILLNESS seamlessly

- Locate HOME DEPOT GROUP CRITICAL ILLNESS and click on Get Form to begin.

- Use the tools we provide to fill in your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign HOME DEPOT GROUP CRITICAL ILLNESS and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home depot group critical illness

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is critical illness insurance?

Critical illness insurance is a financial product that provides a lump sum payment when you're diagnosed with a covered serious illness. This type of insurance helps alleviate financial stress during tough times by covering medical expenses or lost income, ensuring peace of mind for you and your loved ones.

-

What illnesses are typically covered by critical illness insurance?

Most critical illness insurance policies cover serious conditions such as heart attack, stroke, cancer, and advanced stages of other diseases. It's essential to review the specific terms of your policy as coverage can vary. Understanding what's included is key to ensuring you're adequately protected.

-

How much does critical illness insurance cost?

The cost of critical illness insurance varies based on factors such as age, health status, and coverage amount. Typically, premiums are affordable and designed to fit within your budget while providing essential protection. It's advisable to compare different plans to find the best value that meets your needs.

-

What are the main benefits of critical illness insurance?

Critical illness insurance offers financial security by providing you with a tax-free lump sum payment upon diagnosis of a covered illness. This benefit can be used freely to cover medical expenses, pay off debts, or maintain your family's living standards during recovery. It acts as a financial cushion in uncertain times.

-

Can critical illness insurance be integrated with other insurance plans?

Yes, critical illness insurance can be integrated with other types of insurance, including life and health insurance. Many providers offer bundled packages, which can create a comprehensive coverage plan tailored to your needs. Integration can enhance your overall financial protection strategy.

-

How do I choose the right critical illness insurance policy?

To choose the right critical illness insurance, consider your health history, financial obligations, and the specific issues covered by the policy. It’s also wise to research insurers and read customer reviews. Consulting with a financial advisor can help you identify the best options available.

-

Is there a waiting period for critical illness insurance?

Many critical illness insurance policies do impose a waiting period before coverage begins, which typically lasts from 30 to 90 days. This period ensures that the insured is not undergoing treatment for a pre-existing condition at the time of enrollment. Always review the specific terms of your policy.

Get more for HOME DEPOT GROUP CRITICAL ILLNESS

- Form 77 omega psi phi

- Sports physical form illinois

- Us tax forms schedule e

- Adult family home business toolkit dhs division of daas ar form

- How to fill out eform 0990 v1

- Heap application checklist north coast energy services form

- Form 8582 cr rev december passive activity credit limitations

- Potential third party liability notification dhcs 6168 781528775 form

Find out other HOME DEPOT GROUP CRITICAL ILLNESS

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document