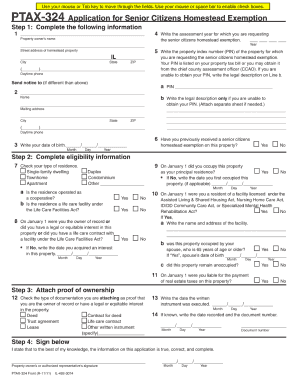

Ptax 324 Form

What is the Ptax 324 Form

The Ptax 324 Form is a property tax exemption application utilized in the United States. It is primarily designed for property owners seeking to apply for specific tax exemptions or reductions based on qualifying criteria. This form is essential for ensuring that eligible properties receive the appropriate tax benefits, which can significantly reduce the financial burden on homeowners and businesses alike.

How to use the Ptax 324 Form

Using the Ptax 324 Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including property details, ownership documentation, and any supporting materials required for the exemption. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors before submission. Finally, submit the form according to the instructions provided, which may include online submission, mailing, or in-person delivery to the relevant tax authority.

Steps to complete the Ptax 324 Form

Completing the Ptax 324 Form requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the Ptax 324 Form from the appropriate tax authority.

- Fill in your personal and property information, ensuring accuracy.

- Provide any required documentation that supports your claim for exemption.

- Review the form for completeness and correctness.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Ptax 324 Form

The Ptax 324 Form is legally binding when completed and submitted in accordance with state regulations. It is crucial to adhere to the specific guidelines outlined by the local tax authority to ensure that the form is recognized as valid. This includes providing accurate information and necessary documentation. Failure to comply with these legal requirements may result in denial of the exemption or other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 324 Form can vary by state and locality. It is essential to check with your local tax authority for specific dates that apply to your situation. Generally, forms must be submitted by a certain date each year to qualify for exemptions for the upcoming tax year. Missing these deadlines can result in the loss of potential tax savings.

Who Issues the Form

The Ptax 324 Form is typically issued by local tax authorities or county assessors. These entities are responsible for managing property tax assessments and exemptions. It is advisable to contact your local tax office to obtain the most current version of the form and to clarify any specific requirements related to its completion and submission.

Quick guide on how to complete ptax 324 form

Finish Ptax 324 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed papers, as you can access the right forms and securely save them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Ptax 324 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Ptax 324 Form without hassle

- Find Ptax 324 Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Ptax 324 Form and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 324 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ptax 324 Form?

The Ptax 324 Form is a tax-related document required for certain assessments in the state. This form is essential for businesses to accurately report their tax obligations, ensuring compliance with local regulations.

-

How can airSlate SignNow help with the Ptax 324 Form?

airSlate SignNow simplifies the process of filling out and signing the Ptax 324 Form. With its user-friendly interface, you can easily create, edit, and eSign your forms, making tax reporting more efficient for your business.

-

Is airSlate SignNow cost-effective for handling the Ptax 324 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Ptax 324 Form. With flexible pricing plans, businesses of all sizes can find a package that fits their budget while ensuring compliance with tax requirements.

-

What features does airSlate SignNow offer for the Ptax 324 Form?

airSlate SignNow provides features like document templates, eSignature capabilities, and secure cloud storage specifically for the Ptax 324 Form. These tools enhance efficiency and ensure that your documents are processed quickly and safely.

-

Are there integrations available for the Ptax 324 Form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Ptax 324 Form efficiently. These integrations facilitate smooth workflows between your existing software and our eSign solutions, automating document management.

-

What are the benefits of using airSlate SignNow for the Ptax 324 Form?

Using airSlate SignNow for the Ptax 324 Form enhances productivity by reducing the time spent on paperwork. The platform's electronic signature capability also minimizes errors and streamlines the submission process, making it easier to meet deadlines.

-

Is it safe to use airSlate SignNow for the Ptax 324 Form?

Absolutely. airSlate SignNow prioritizes security, employing encryption and compliance measures to protect your Ptax 324 Form and other documents. You can confidently manage sensitive tax information with our secure solution.

Get more for Ptax 324 Form

Find out other Ptax 324 Form

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement