8752 Form 2014

What is the 8752 Form

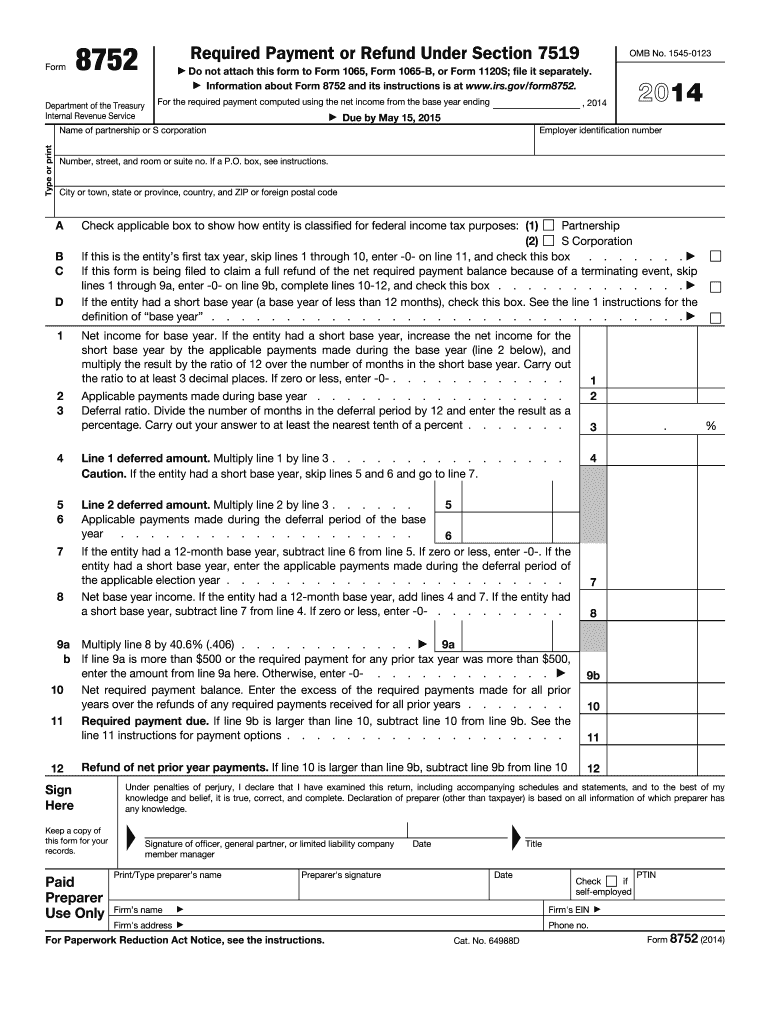

The 8752 Form is a tax-related document used by businesses and individuals in the United States. It is specifically designed for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required in various business scenarios. Understanding the purpose and requirements of the 8752 Form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the 8752 Form

Using the 8752 Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information required to fill out the form accurately. Next, follow the instructions provided on the form carefully, ensuring that each section is completed as required. Once the form is filled out, review it for any errors or omissions before submission. The completed form can then be submitted to the IRS either electronically or via traditional mail, depending on the specific requirements for your situation.

Steps to complete the 8752 Form

Completing the 8752 Form involves a systematic approach to ensure accuracy. Begin by entering your personal information, including your name, address, and taxpayer identification number. Next, provide the relevant financial data as prompted by the form. It is important to double-check all figures and calculations to prevent mistakes. After filling out all sections, sign and date the form. Finally, submit the form according to the guidelines provided by the IRS, ensuring that you meet any applicable deadlines.

Legal use of the 8752 Form

The 8752 Form must be used in accordance with IRS regulations to be considered valid. This includes ensuring that all information provided is accurate and complete. Legal use also requires adherence to submission deadlines and proper filing methods. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing a reliable eSignature platform can enhance the security and legality of the form submission process, ensuring that it meets all necessary legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the 8752 Form are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, which may vary depending on your business structure and tax situation. It is essential to stay informed about these deadlines to ensure timely submission. Marking your calendar with important dates related to the 8752 Form can help you maintain compliance and avoid unnecessary complications with the IRS.

Required Documents

To complete the 8752 Form accurately, certain documents are required. These may include financial statements, previous tax returns, and any supporting documentation relevant to the information being reported. Gathering these documents in advance can streamline the process and help ensure that the form is filled out correctly. It is advisable to keep all supporting documents organized and accessible for reference during the completion of the form.

Quick guide on how to complete 2014 8752 form

Effortlessly Prepare 8752 Form on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage 8752 Form on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related processes today.

How to Alter and eSign 8752 Form with Ease

- Locate 8752 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers for that specific purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and eSign 8752 Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 8752 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 8752 form

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 8752 Form and why is it necessary?

The 8752 Form is a tax form used by certain partnerships to elect to adjust the basis of their assets and is required for compliance with IRS regulations. Businesses that need to manage this form must ensure accurate representation in their tax filings to avoid penalties. Utilizing airSlate SignNow can simplify the signing process for this important document.

-

How does airSlate SignNow support the completion of the 8752 Form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the 8752 Form electronically. With step-by-step guidance and templates specifically designed for tax forms, it streamlines the process of preparing and submitting the 8752 Form. This feature ensures that businesses can meet their deadlines without the hassle of traditional paperwork.

-

Is airSlate SignNow cost-effective for businesses needing to manage the 8752 Form?

Yes, airSlate SignNow is a cost-effective solution for businesses that frequently handle documents such as the 8752 Form. With flexible pricing plans tailored to different business sizes, users can benefit from a range of features, including unlimited eSignatures and document storage. This affordability makes it accessible for companies looking to simplify their document management.

-

What are the key features of airSlate SignNow for filing the 8752 Form?

Key features of airSlate SignNow include easy document uploading, customizable templates for the 8752 Form, real-time collaboration, and secure eSignature capabilities. These features facilitate a seamless experience for users, ensuring that the 8752 Form is completed efficiently and securely. Additionally, the platform ensures compliance with industry standards.

-

Can I integrate airSlate SignNow with other software for the 8752 Form?

Absolutely, airSlate SignNow offers integration with a variety of software applications that businesses may use, such as CRM systems and accounting software. This means you can incorporate the 8752 Form seamlessly into your existing workflows. The integration capabilities enhance productivity and ensure that document handling is compatible with your business tools.

-

How secure is airSlate SignNow when handling the 8752 Form?

airSlate SignNow prioritizes security by using encryption and authentication protocols, safeguarding sensitive information in documents like the 8752 Form. This commitment to security ensures that your business data and electronic signatures are protected against unauthorized access. Businesses can confidently manage their forms without worrying about data bsignNowes.

-

What benefits can I expect from using airSlate SignNow for my 8752 Form needs?

Using airSlate SignNow for your 8752 Form needs offers numerous benefits, including reduced turnaround times, increased compliance accuracy, and improved collaboration among team members. It simplifies the eSignature process and allows for quick adjustments to the form, ensuring that submissions are processed efficiently. Overall, it enhances productivity for businesses.

Get more for 8752 Form

- Centers for pain management new patient history and form

- Medical office registration form rhinebeck equine

- Allergy associates ampamp lab allergy associates and asthma ltd form

- Congenital cardiac surgery fellowship match tsda form

- Pediatric specialist request vidant health form

- Allergy ampamp asthma center ca allergies in children adults form

- We ask that you fill in this form and return it to us prior to your childs appointment

- Rmhp prior authorization list effective october 1 2017 v5 revised form

Find out other 8752 Form

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template