Schedule Irs Form 2013

What is the Schedule Irs Form

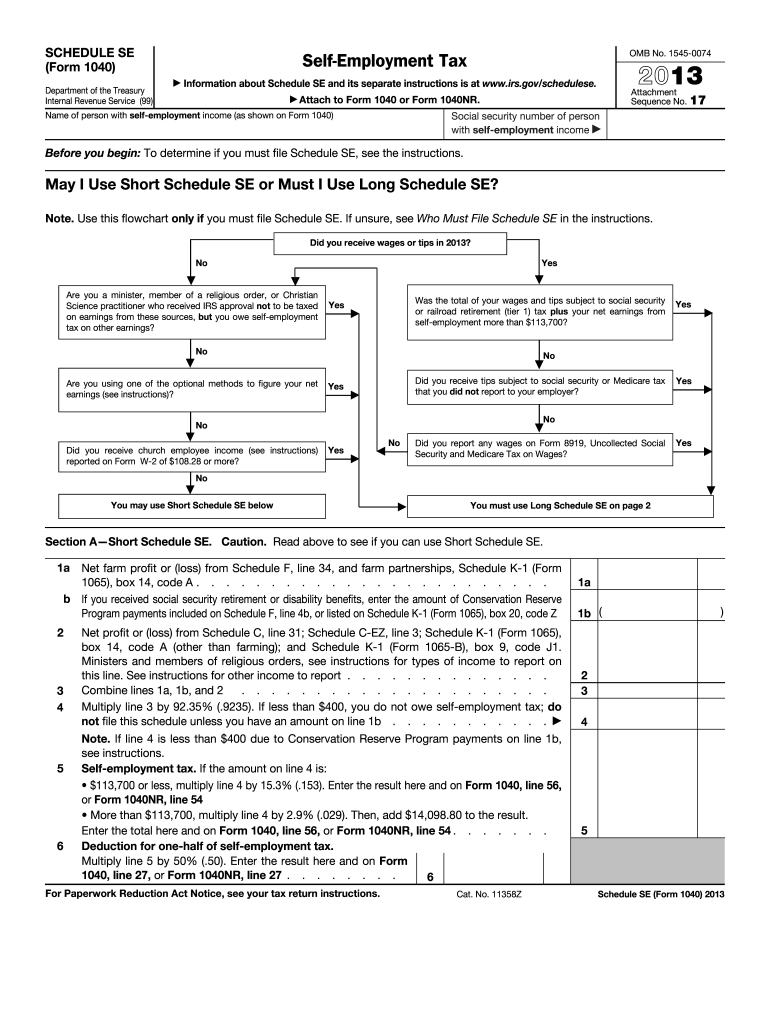

The Schedule IRS Form is a crucial document used by taxpayers in the United States to report specific types of income, deductions, and credits on their federal tax returns. It allows individuals and businesses to provide detailed information about their financial activities, ensuring compliance with IRS regulations. This form is essential for accurately calculating tax liabilities and determining eligibility for various tax benefits.

How to use the Schedule Irs Form

Using the Schedule IRS Form involves several steps. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax forms. Next, fill out the form by entering your financial information in the appropriate sections. It is important to follow the IRS guidelines to ensure accuracy. Finally, review the completed form for any errors before submitting it with your federal tax return.

Steps to complete the Schedule Irs Form

Completing the Schedule IRS Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, such as W-2s, 1099s, and receipts.

- Read the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your financial documents in the designated sections.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it with your tax return.

Legal use of the Schedule Irs Form

The Schedule IRS Form is legally binding when completed correctly and submitted to the IRS. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the IRS and provide accurate information. Any discrepancies or false information can lead to penalties or audits. Utilizing a reliable electronic signature solution can further enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule IRS Form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended. It is essential to stay informed about any changes to deadlines to avoid late filing penalties.

Required Documents

To complete the Schedule IRS Form accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any supporting documentation for tax credits claimed

Form Submission Methods (Online / Mail / In-Person)

The Schedule IRS Form can be submitted in several ways, depending on taxpayer preference and resources. Options include:

- Online filing through IRS-approved e-filing software

- Mailing a paper version of the form to the appropriate IRS address

- In-person submission at designated IRS offices or tax assistance centers

Quick guide on how to complete 2013 schedule irs form

Effortlessly Prepare Schedule Irs Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Manage Schedule Irs Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Edit and eSign Schedule Irs Form with Ease

- Obtain Schedule Irs Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule Irs Form to ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 schedule irs form

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule irs form

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the process to Schedule Irs Form using airSlate SignNow?

To Schedule Irs Form using airSlate SignNow, simply log in to your account, select the document you wish to sign, and use our intuitive interface to send it for eSignature. You can set reminders and deadlines to ensure timely completion. This streamlined process saves you time and helps manage your tax documents efficiently.

-

How does airSlate SignNow help in managing my Schedule Irs Form?

airSlate SignNow helps manage your Schedule Irs Form by allowing you to create, send, and track documents electronically. With our platform, you can easily collaborate with others, ensuring everyone involved in the process stays informed. This reduces the risk of errors and enhances the overall efficiency of your tax filing.

-

Is there a cost associated with using airSlate SignNow to Schedule Irs Form?

Yes, airSlate SignNow offers several pricing plans to accommodate different needs for those looking to Schedule Irs Form. Our plans are competitively priced and designed to deliver value, featuring unlimited eSignatures, document templates, and more. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow offer for Scheduling Irs Forms?

airSlate SignNow offers a range of features to effectively Schedule Irs Forms including customizable templates, advanced security options, and automated reminders. Our user-friendly dashboard allows you to keep track of the signing progress and deadlines, making it easier to manage your tax documents. These features enhance your productivity and simplify the eSigning process.

-

Can I integrate airSlate SignNow with other tools to Schedule Irs Form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools like Google Drive, Salesforce, and Dropbox, making it easy to Schedule Irs Form directly from your favorite platforms. This integration allows for a more streamlined workflow and helps you manage documents without switching between applications.

-

What are the benefits of using airSlate SignNow for Schedule Irs Form?

Using airSlate SignNow to Schedule Irs Form offers numerous benefits, including time-saving automation, enhanced accuracy, and improved compliance with IRS regulations. Our electronic signature solution ensures your forms are completed securely and quickly, reducing the hassle associated with traditional methods. This ultimately leads to a more efficient tax preparation process.

-

Is airSlate SignNow secure for handling my Schedule Irs Form?

Yes, airSlate SignNow takes security seriously and employs advanced encryption methods to protect your Schedule Irs Form and sensitive information. Our platform is compliant with major regulations such as GDPR and HIPAA, ensuring your data is safe during transmission and storage. You can trust us to keep your documents secure.

Get more for Schedule Irs Form

- Verification of practice hours for ccrn k renewal american aacn form

- Bridgton me 04009 0189 form

- No fault insurance department of financial services new form

- Generic soa form

- Appointment time agreement form appointment time agreement

- Broker sheet form

- Wwwbalexandriadermbbcomb form

- For internal promotional use only form

Find out other Schedule Irs Form

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online