Form 3903 2013

What is the Form 3903

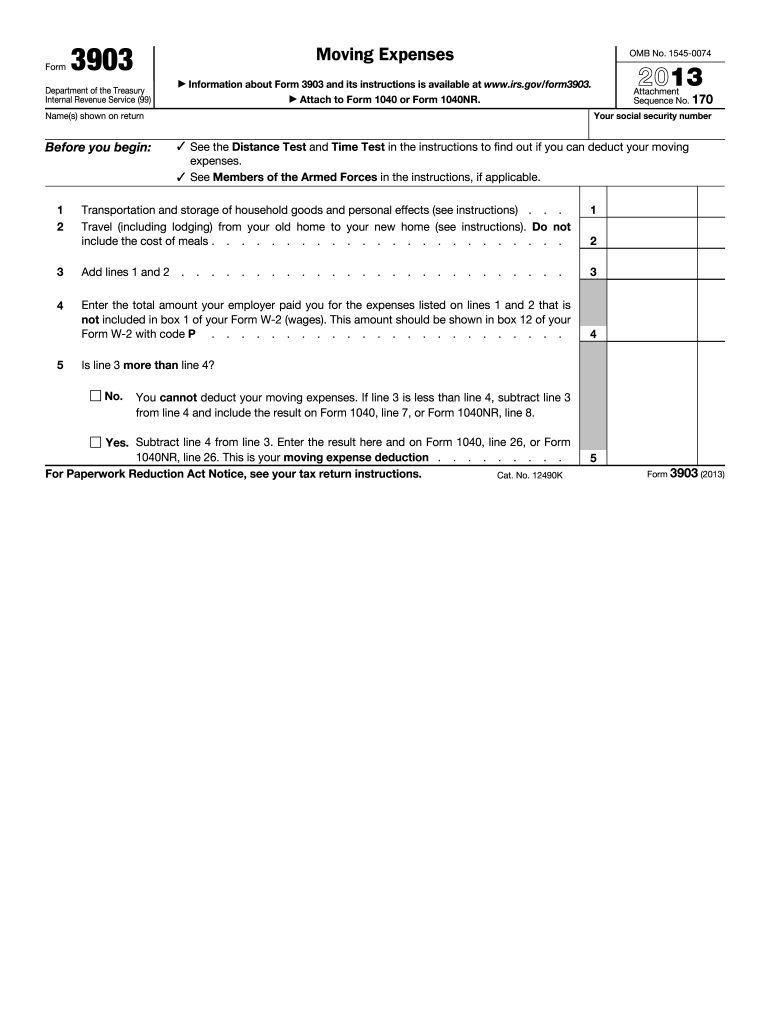

The Form 3903 is a tax form used by individuals to claim a deduction for moving expenses incurred during a job-related move. This form is particularly relevant for taxpayers who have relocated for work purposes and meet specific criteria set by the IRS. It allows eligible taxpayers to report their moving expenses and potentially reduce their taxable income, making it an essential document for those who qualify.

How to use the Form 3903

Using the Form 3903 involves several steps to ensure accurate reporting of moving expenses. Taxpayers should first gather all relevant documentation related to their move, including receipts for transportation and storage costs. Once the necessary information is collected, individuals can fill out the form by providing details such as the new job location, the date of the move, and the total moving expenses incurred. After completing the form, it should be attached to the taxpayer's federal income tax return for the applicable tax year.

Steps to complete the Form 3903

Completing the Form 3903 requires careful attention to detail. Here are the steps to follow:

- Gather all receipts and documentation related to your moving expenses.

- Indicate your old and new addresses, along with the date of your move.

- List the qualifying moving expenses, such as transportation and storage costs.

- Calculate the total amount of moving expenses you are claiming.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 3903

The Form 3903 must be used in compliance with IRS regulations to ensure that the claimed deductions are valid. To be eligible, the move must be closely related to the start of a new job, and the taxpayer must meet the distance and time tests outlined by the IRS. Failure to adhere to these requirements may result in the denial of the deduction and potential penalties.

Key elements of the Form 3903

Several key elements are essential for accurately completing the Form 3903. These include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Old and New Addresses: Details of the locations before and after the move.

- Moving Expenses: A breakdown of all qualifying expenses, including transportation and storage.

- Distance and Time Tests: Confirmation that the move meets IRS criteria for job-related relocations.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines associated with the Form 3903. Typically, the form must be submitted alongside your federal income tax return, which is due on April 15 of the following tax year. If additional time is needed, taxpayers may file for an extension, but they must ensure that the Form 3903 is included in their tax return by the extended deadline.

Quick guide on how to complete 2013 form 3903

Complete Form 3903 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Form 3903 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Form 3903 seamlessly

- Obtain Form 3903 and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize key sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 3903 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 3903

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 3903

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 3903 and how can airSlate SignNow help me with it?

Form 3903 is used for claiming moving expenses for tax purposes. airSlate SignNow simplifies the process of filling out and signing Form 3903 by providing an intuitive platform where you can easily upload, edit, and eSign documents securely.

-

Is there a cost associated with using airSlate SignNow for Form 3903?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can efficiently manage your Form 3903 and other documents without breaking the bank, as our solutions are cost-effective and designed for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for managing Form 3903?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing your ability to manage Form 3903 alongside your other workflows. This integration allows for a more streamlined process and improved efficiency.

-

What features does airSlate SignNow offer for filling out Form 3903?

airSlate SignNow offers a variety of features that facilitate the completion of Form 3903, including templates, easy document sharing, and eSignature capabilities. These features ensure that your forms are completed quickly and accurately, saving you time and effort.

-

How secure is airSlate SignNow when handling Form 3903?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and compliance measures to protect your Form 3903 and other sensitive documents, ensuring that your information remains confidential and secure.

-

Can I use airSlate SignNow on mobile devices for Form 3903?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to fill out and eSign Form 3903 from anywhere at any time. This flexibility ensures you can manage your documents on the go, making it convenient for busy professionals.

-

Does airSlate SignNow provide support for users completing Form 3903?

Yes, airSlate SignNow offers excellent customer support to assist users with any questions related to Form 3903. Our team is dedicated to helping you navigate the platform and ensure a smooth experience.

Get more for Form 3903

- 388 e form

- Bpcc immunization form

- Alicare 1199 form

- Reimbursement support services form

- Wcmc department of dermatology pediatric patient follow up intake form

- Electronic funds transfer enrollment form electronic funds transfer enrollment form

- Ibm shap 100945861 form

- Hudson surety agency application form

Find out other Form 3903

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors