Irs Form 5329 2014

What is the IRS Form 5329

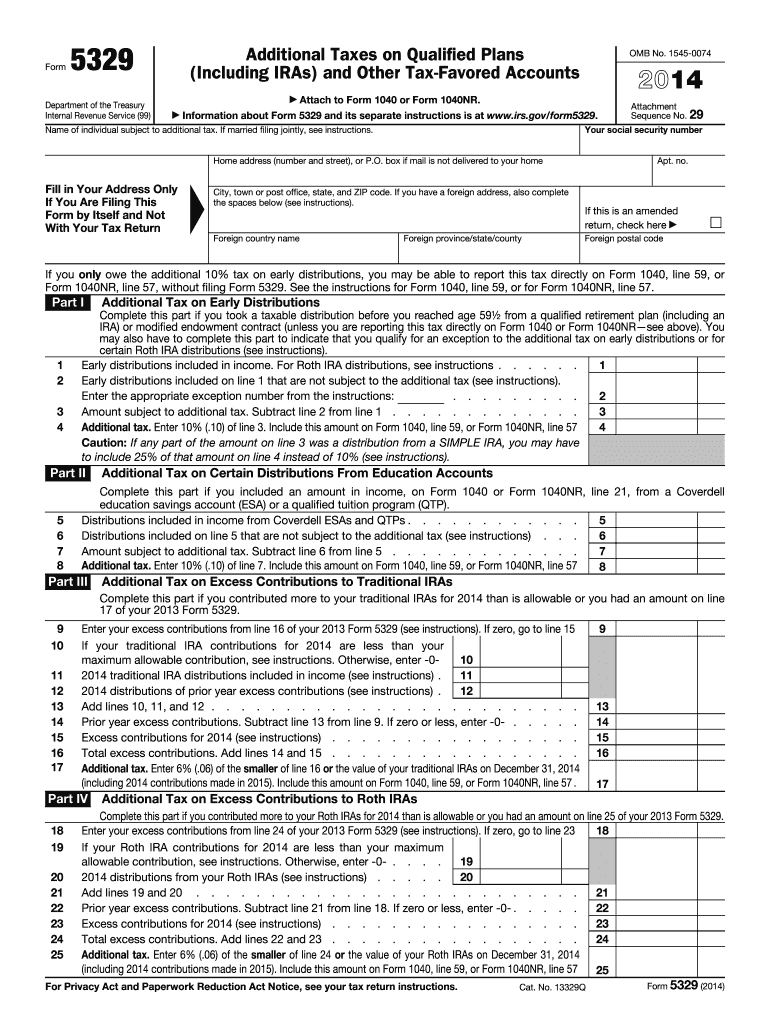

The IRS Form 5329 is a tax form used by individuals to report additional taxes on qualified retirement plans and other tax-favored accounts. This form is essential for taxpayers who have made excess contributions to their retirement accounts or who have failed to take required minimum distributions (RMDs). The IRS Form 5329 helps ensure compliance with tax regulations regarding retirement savings, allowing taxpayers to accurately calculate any additional taxes owed.

How to use the IRS Form 5329

Using the IRS Form 5329 involves several key steps. First, determine if you need to file this form based on your retirement account activities. If you have excess contributions or missed RMDs, you will need to complete the form. Next, gather relevant information about your retirement accounts, including contribution limits and distribution requirements. Finally, fill out the form accurately, ensuring that all calculations are correct, and submit it along with your tax return.

Steps to complete the IRS Form 5329

Completing the IRS Form 5329 requires careful attention to detail. Follow these steps:

- Identify the specific section of the form that applies to your situation, such as excess contributions or missed distributions.

- Accurately report the amounts related to your retirement accounts in the appropriate fields.

- Calculate any additional taxes owed based on the IRS guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Legal use of the IRS Form 5329

The IRS Form 5329 is legally binding when filled out correctly and submitted as part of your tax return. To ensure its legal standing, the form must comply with IRS regulations, including accurate reporting of contributions and distributions. It is essential to maintain records of your retirement account transactions, as these may be required for verification purposes by the IRS. Utilizing a reliable electronic signature solution can further enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5329 align with the overall tax filing deadlines. Generally, individual taxpayers must submit their tax returns, including Form 5329, by April 15 of each year. If you require additional time, you may file for an extension, which typically allows for an extension until October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failure to file the IRS Form 5329 when required can result in significant penalties. If you do not report excess contributions or missed distributions, you may face an additional tax of six percent on the excess contributions for each year they remain in the account. Additionally, failing to take required minimum distributions can incur a penalty of fifty percent on the amount that was not distributed. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete 2014 irs form 5329

Set Up Irs Form 5329 with Ease on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without interruptions. Manage Irs Form 5329 on any platform using airSlate SignNow's applications for Android or iOS and enhance any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Irs Form 5329 Effortlessly

- Find Irs Form 5329 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs Form 5329 and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 5329

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 5329

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is IRS Form 5329 and why do I need it?

IRS Form 5329 is used to report additional taxes on qualified retirement plans, including IRAs. If you have taken early distributions or have not met the required minimum distributions, you will need to file this form. Using airSlate SignNow can help streamline the process of completing and submitting IRS Form 5329 electronically, making it easier for you to meet your tax obligations.

-

How can airSlate SignNow assist with filling out IRS Form 5329?

airSlate SignNow provides an intuitive platform for filling out IRS Form 5329 digitally. With features like easy document editing and eSigning, you can complete your form accurately and efficiently. Our solution also ensures that your form is securely stored and easily accessible for your records.

-

Is airSlate SignNow compliant with IRS regulations for submitting IRS Form 5329?

Yes, airSlate SignNow is compliant with IRS regulations for electronic submissions of forms, including IRS Form 5329. We adhere to strict security protocols to protect your personal information while ensuring that your forms are submitted correctly and on time.

-

What pricing plans does airSlate SignNow offer for handling forms like IRS Form 5329?

airSlate SignNow offers flexible pricing plans tailored to the needs of individuals and businesses. Our plans provide access to essential features for completing forms like IRS Form 5329, with options for increased functionality as your needs grow. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for managing IRS Form 5329?

Absolutely! airSlate SignNow seamlessly integrates with various tools and applications, such as cloud storage services and accounting software. This allows you to manage IRS Form 5329 alongside your other financial documents, enhancing your workflow and efficiency.

-

What are the key benefits of using airSlate SignNow for IRS Form 5329?

Using airSlate SignNow for IRS Form 5329 offers numerous benefits, including time savings, reduced errors, and enhanced security. Our platform simplifies the process of filling out and submitting the form, ensuring that you can focus on your financial goals without the hassle of paperwork.

-

How secure is my information when using airSlate SignNow for IRS Form 5329?

Your information is highly secure when using airSlate SignNow for IRS Form 5329. We employ advanced encryption and security measures to protect your data, ensuring that your personal and financial information remains confidential throughout the process.

Get more for Irs Form 5329

- Pharmacy address phone number form

- Cv surgery patient guidebook cardiovascular thoracic surgery cv surgery patient guidebook form

- History form child adolescent

- How can i use files that are too large for wordpress to upload form

- Portability formcdr

- Bsa health form 2020

- Idi form

- Send completed applications to form

Find out other Irs Form 5329

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now